Tokenized stocks may be approaching a turning point as investors' demand for a surge in blockchain-based financial products could create and drive the adoption of traditional assets.

Tokenized stocks, part of the growing real-world assets (RWA) tokenization sector, had reached a market capitalization of $370 million by the end of July, according to a Binance Research Report shared with Cointelegraph.

Lion's share, $260 million, was attributed to Exodus Movement (Exod) shares issued through Securitize. Excluding this figure, the market capitalization of tokenized stocks rose to $53.6 million, indicating a 220% monthly increase since June.

Tokenized stocks are seeing the same pace of growth reminiscent of an early distributed financial (DEFI) boom when TVL rose from $1 billion to $100 billion in under two years, within two years, between 2020 and 2021.

“Although still small compared to the global equity market (valued at over US$100), the explosive growth in July suggests that tokenized stocks may be approaching a major inflection point for a broader transition to hybrid finance.”

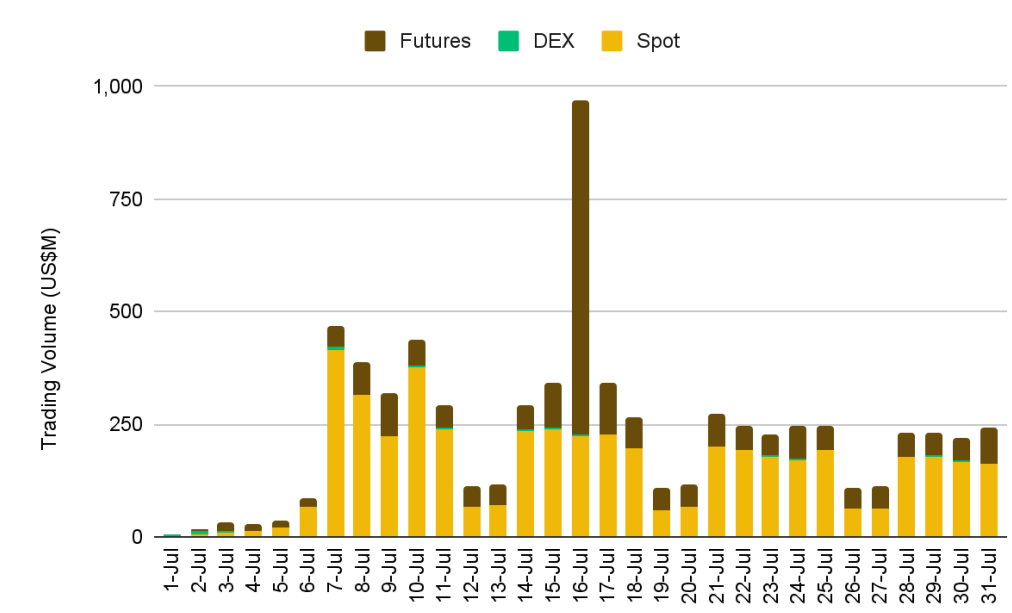

Source: Binance Research

Blockchain addresses holding tokenized stocks have skyrocketed from 1,600 in June to over 90,000 in July, indicating an increase in investor demand for tokenized stocks.

Related: As ether purchases accelerate, corporate crypto has been held by the Ministry of Finance

Tokenized stocks could surpass $1.3 trillion by absorbing 1% of the global equity market

Tokenized stocks could present $1 trillion in market opportunities due to increased investor demand.

Tokenized stocks could exceed the $1.3 trillion market capitalization if only 1% of global stocks were tokenized on the blockchain. According to Binance Research, this will result in tokenized stocks that are at their peak worth eight times the Defi market.

As the two segments “strengthen each other and drive the adoption of blockchains into the mainstream,” more tokenized financial products will drive the demand for a more “sleek” defi infrastructure.

Related: Bitcoin will become the fifth global asset ahead of “Crypto Week” and flip Amazon: Finance Redefined

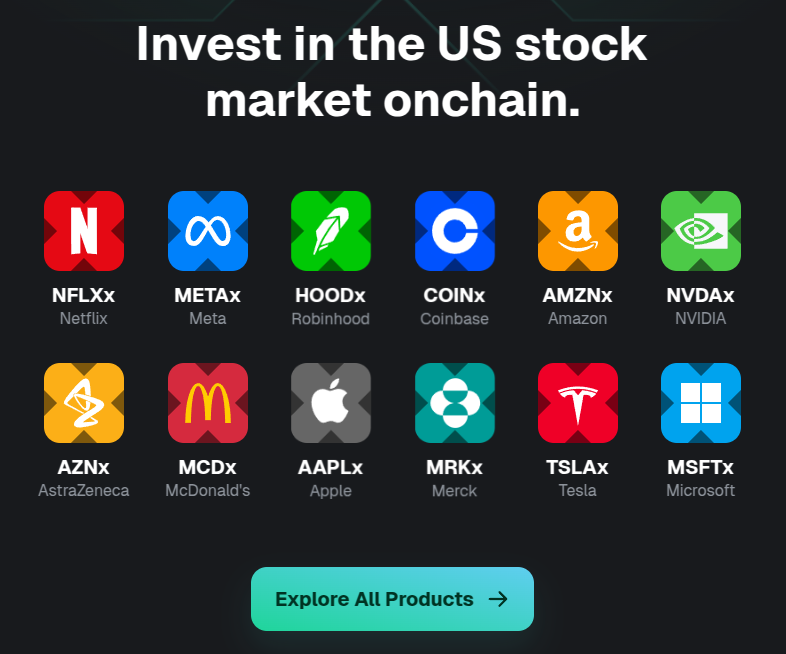

More than 60 tokenized stocks have been made public on major exchanges, including Kraken via Backed Finance's Xstocks, Bybit and Solana's Defi Ecosystem, focusing on popular blue chip stocks such as Amazon, Nvidia, Apple, Tesla and Microsoft.

XStocks Supported Asset Showcase. sauce: stock

Tokenized Xstocks promises a huge difference from traditional counterparts, including 24/7 trading, free transferable assets, and lack of fees on Kraken Exchange.

But the ultimate goal of tokenization is not simply to bring traditional products to the blockchain, but to unleash a new level of accessibility for investors beyond the on-chain of Wall Street systems.

“Tokenized stocks aren't just “Wall Street on the Blockchain.” That misses the point,” Greenberg said. He added that stocks need to “feel like the internet.”

https://www.youtube.com/watch?v=alc2u0ynfca

Magazine: Will Robinhood's tokenized stocks really take over the world? Pros and Cons