Bitcoin price appears to have gotten off to a great start, spending most of the new year above the psychological level of $90,000. Although major cryptocurrencies have slowed in recent days, the market has shown considerable bullish intent so far in 2026.

Now, this latest expression of optimism somewhat contradicts recent predictions that Bitcoin prices may be at the beginning of a bear market. This begs the question – could the bull market be close to resuming or is the BTC price just witnessing a rescue rally?

BTC’s recent rally is just a bear market rescue rally — Analyst

In a January 9 post on the X Platform, cryptocurrency analyst Martun shared an interesting data point to answer the question of whether Bitcoin's recent price increase is meaningful or just a bailout rally. Market experts have provided answers based on both on-chain and technical price data.

First, Martun acknowledged that the recent surge is inevitable as Bitcoin prices have found support near the ETF realized price of $85,000. This price level represents the average cost basis of BTC ETF investors, and as expected, buyers defended their positions, leading to a price rebound.

This phenomenon has been highlighted by the Coinbase Premium Gap, another on-chain metric that measures the difference in Bitcoin prices between Coinbase and global exchanges. Maartung said the index started rising just after New Year's Eve, indicating renewed buying activity by U.S.-based investors.

Additionally, a few days after Coinbase's premium gap rise, we started seeing strong capital inflows into spot exchange-traded funds. “This looks more like strategic buying and portfolio rebalancing (new quarter, new year) than emotional FOMO,” Martun added.

Source: @JA_Maartun on X

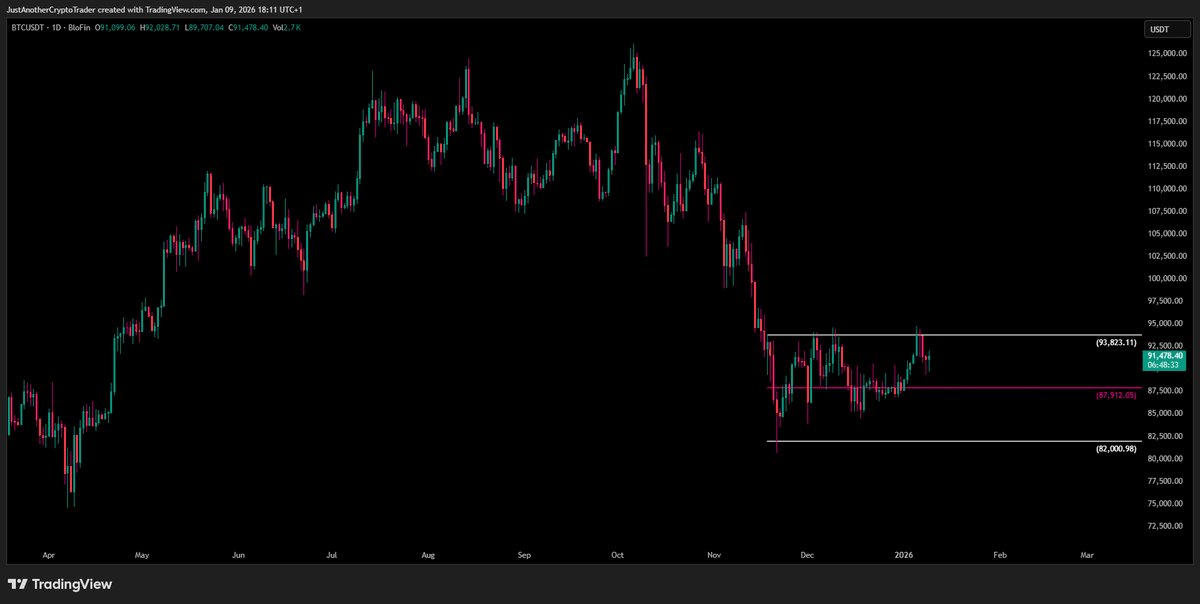

However, the crypto analyst pointed out that this rally was only rejected by Bitcoin price rising to a high of $94,000. Essentially, this suggests that the flagship cryptocurrency does not have the bullish strength to break through its resistance.

Additionally, Martun said Bitcoin is still trading below key on-chain levels such as short-term holder realized price and whale realized price, both of which are acting as significant overhead resistance.

On-chain analysts pointed out that even though prices rose by around 10%, on-chain observations suggest that this recent rally is simply a bear market easing rebound and not a continuation of the trend. Martin concluded that only a clean break and sustained close above $94,000 would indicate a strong intention for the Bitcoin price to rebuild the bullish structure.

Bitcoin price overview

As of this writing, the price of BTC is $90,360, reflecting a drop of almost 1% over the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

editing process for is focused on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, and each page is carefully reviewed by our team of top technology experts and experienced editors. This process ensures the integrity, relevance, and value of your content to your readers.