The recent surge in Bitcoin at the beginning of October has rekindled market excitement due to the continued rallies. Is October really going to be a historic “up-to-bar”?

This brings new attention to the “four-year cycle” theory, supposing that the Bitcoin bull market and bear market are repeated in a predictable pattern linked in half.

See historical patterns

Joao Wedson, CEO of investment analytics firm Alphractal, focuses on key figures over the 548 days.

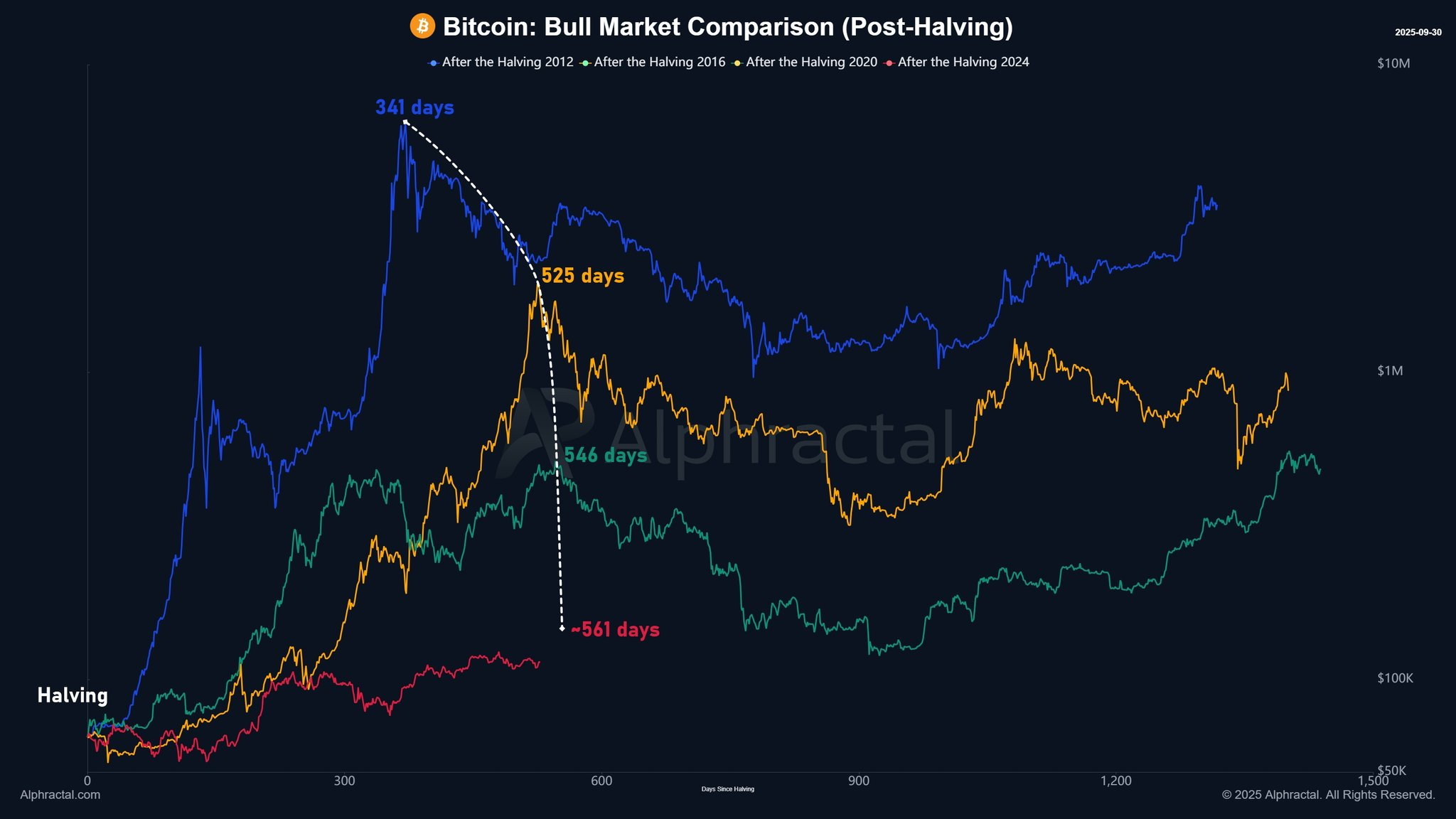

An analysis of Bitcoin's past cycles shows a subtle difference in the number of days between each half and the subsequent all-time high (ATH). The 2012 cycle took 371 days, 525 days in 2016 and 546 days in 2020.

This subtly extended trend suggests that the current cycle is in its final stage. Wedson said this is strongly consistent with other fractal and market cycle indicators, such as fractal cycles and maximum crossing SMAs.

He believes the magic number for this cycle is 548. This is because prices are likely to peak. Bitcoin is now 528 days after the rally since its final half on April 19, 2024.

Bitcoin: A bull market comparison. Source: Alphractal.com

If Bitcoin peaks on the 548th day, it will be October 19, 2025. If he expands his hypothesis to the maximum range, a price peak could occur by November 1, 2025.

Another forecast: peak hits on December 23, 2025

Another Crypto analyst, Seliseli46, also calculated the end of the current Bull Run. A closer look at Bitcoin's past cycles shows that each lasted about 152 weeks. He explained on his X account that this is about 1,064 days.

- The first cycle began after the market bottom in early 2015 and ended at its peak in late 2017.

- The second cycle began in late 2018 and peaked in November 2021.

Assuming that the third cycle began at the bottom of the market in November 2022, adding 152 weeks will end around December 23, 2025.

Analysts explained that the calculations blend well with Bitcoin's historic trend of reaching an all-time high of about 12-18 months later. However, he pointed out that the 152-week cycle is more hypothetical and subject to external factors such as regulation, market sentiment and technological advances.

Is the post here “Up to Ber” of Bitcoin? Analysts turn to the four-year cycle that first appeared in Beincrypto.