The Fed has started cutting interest rates, but no one seems to know how far to go, not even the Fed itself. The market is caught in the middle of this guessing game; Bitcoin price is heating up. As the world's largest cryptocurrency hovers around $107,000 after plummeting from October highs, traders have one question: Is Bitcoin's next big move already underway, or is the downside about to break?

Macro settings: FRB without compass

The US Federal Reserve has begun lowering interest rates, but discussions within the central bank have not yet been resolved. “neutral interest rate”. The mythical point that monetary policy neither stimulates nor restricts the economy. remains elusive.

If the neutral interest rate ends up being higher than expected (around 3.5% to 3.9%), the Fed's room to cut rates further will be limited. This means that borrowing costs will continue to rise for an extended period of time, liquidity will tighten, and risk assets like Bitcoin will be exposed to stronger headwinds. On the other hand, a true neutral rate closer to 2.5% could lead to a softer landing and more fuel for Bitcoin's next rally.

The post-COVID-19 situation complicates this situation. Rising government spending, AI-driven productivity debates, and the reconfiguration of global supply chains are all pushing up inflation expectations, forcing the Fed to put its foot closer to the brake than the gas. That uncertainty alone is enough to keep Bitcoin's price volatile.

Bitcoin Price Prediction: BTC Loses Support Near $107,000

BTC/USD daily chart- TradingView

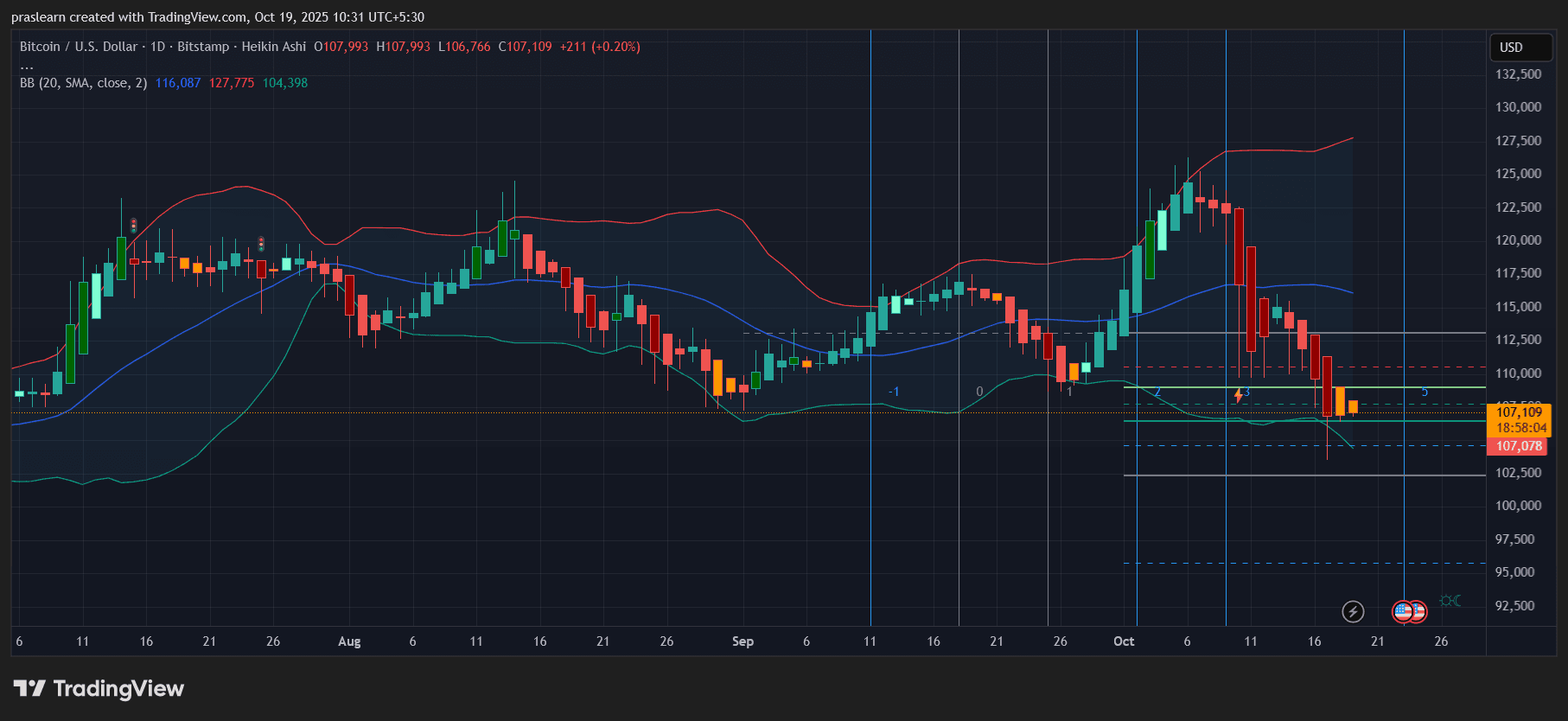

The daily Bitcoin price chart shows a cautious situation. After failing to breakout above $122,000 in early October, Bitcoin has fallen sharply and is currently testing the lower end of the Bollinger Bands around $104,000. The Heikin Ashi candlestick shows sustained bearish momentum – a long red body with a minimal top core – confirming strong selling pressure.

The 20-day SMA (approximately $116,000) has become a resistance ceiling, and the price has consolidated below it. The short-term bias will remain bearish until Bitcoin price regains this zone. If current momentum holds, downside price targets lie near $103,000 and $99,500, a key confluence zone where historical demand has intervened previously.

However, the flattening of the lower Bollinger Band suggests that the decline may slow. A few sideways sessions around $106,000 to $108,000 could lead to a sharp rebound or another drop towards $100,000.

Relationship between liquidity and “neutral rate”

Bitcoin prices have historically responded to liquidity conditions more than anything else. Every major rally, from the $10,000 mark in 2020 to the all-time high in 2024, coincided with easing financial conditions.

If the Fed moves below neutral rates and cuts rates too aggressively, there is a risk that the liquidity-driven rally will reignite. In that case, BTC price could quickly bounce back from the $105,000 area and head towards $115,000-$120,000 in a short squeeze. However, if the Fed tightens again or signals that interest rates will remain high for “a longer period of time,” speculative capital could dry up and BTC prices could fall to the psychological $100,000 level, and potentially even to $95,000 if panic accelerates.

Sentiment and volatility outlook

Market sentiment remains mixed. Derivatives data shows lower leverage, with spot trading volumes declining since early October. This is a classic setup for volatility compression: the calm before the directional storm.

The Bollinger Band squeeze on the daily chart supports this idea. If volatility picks up again, the direction of the breakout will likely set the tone for the rest of the fourth quarter. A close above $110,000 could trigger a rescue bounce towards $117,000, while a break below $104,000 would confirm a deeper retracement.

broader economic impact

Bitcoin prices aren't just responding to interest rate cuts. They are reacting to uncertainty about what will happen next. The Fed's confusion about where the “neutral rate” is actually set means markets are trading in the dark.

If structural forces such as AI productivity and fiscal expansion push up real interest rates, the long-term view of Bitcoin as a hedge against fiat currency declines will strengthen. However, in the short term, tight liquidity and rising yields are keeping speculative appetite low.

Bitcoin price prediction: what happens next?

The next 10-14 days will be critical. Please note the following:

- Whether BTC price maintains the $106,000 to $104,000 support band.

- How the Fed communicates its next interest rate path — a hawkish tone could accelerate downside momentum.

- Changes in bond yields: If the 10-year Treasury bond rises above 4.5%, it could put further pressure on cryptocurrencies.

If BTC price stabilizes and consolidates without falling below $104,000, we expect it to rebound towards $112,000-115,000 by early November. However, if the current macro environment deteriorates and liquidity becomes tight, we will likely see a significant drop from $98,000 to $100,000 before the next macro-driven wave of recovery arrives.