Ethereum continues to undergo a correction phase after failing to maintain momentum above $4,200. Market sentiment remains cautious, with ETH trading near $3,700, indicating both technical and sentimental weakness. Buyers seem to be losing control and focus has shifted to the major support zones below.

technical analysis

Written by Shayan

daily chart

On the daily time frame, ETH has broken below the long-term ascending channel structure and the 100-day moving average located around $4,100. The price is currently trending towards the 0.5 Fibonacci retracement level at $3,530. This zone is an important area that previously acted as support and is the home of the recent rally in August.

The RSI near 37 indicates bearish momentum, but has not yet reached oversold territory, suggesting there is still room for further downside. A clean breakdown below $3,500 could pave the way to the 0.618 retracement level at $3,200, while a retracement of the previous high near $4,200 would be the first sign of a recovery.

4 hour chart

The 4-hour chart shows clear bearish order flow as the downtrend worsens after losing the $4,200 level and failing to regain it. The recent rejection from this zone confirms a bearish shift in the short-term market structure.

RSI remains weak at around 33, suggesting that sellers still have the upper hand. The next demand zone is around $3,500 to $3,400, and buyers held that position during the recent large liquidation event. However, failure to sustain this level could accelerate the move towards $3,200 or even deeper down to $3,000.

sentiment analysis

long liquidation

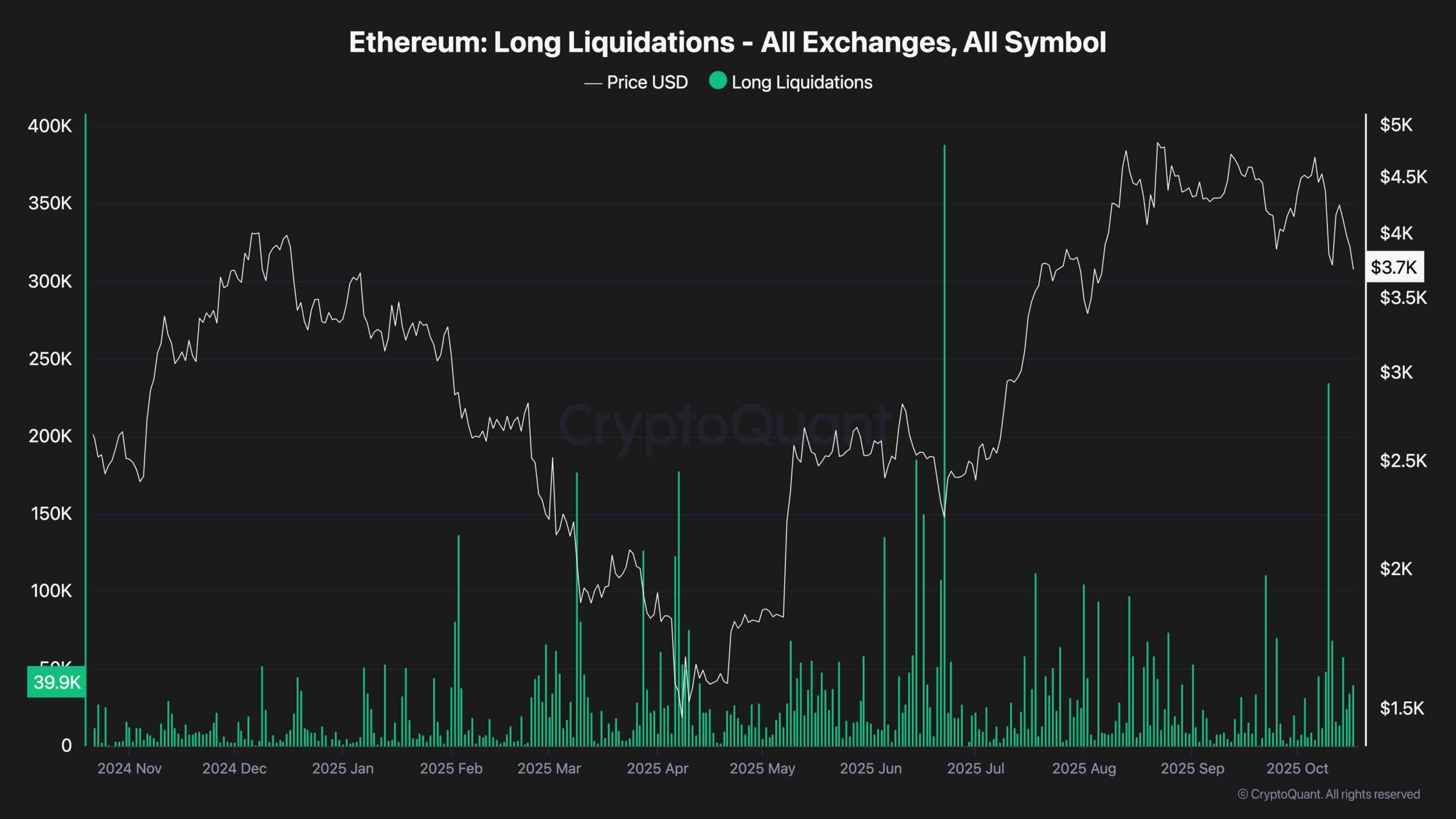

Ethereum’s recent decline has caused a notable spike in long-term liquidations across all exchanges, making it one of the largest deleveraging events in recent months. This surge in forced selling reflects how overconfident long traders were caught off guard by the market's rapid reversal.

Historically, such liquidation spikes often appear near local bottoms as leveraged positions are flushed out. However, the magnitude of this latest move suggests panic is brewing among retail traders, and institutions are likely waiting for clearer confirmation before re-entering.

Overall, the sentiment remains one of fear and risk aversion, with traders favoring caution over aggressive long exposures in the short term.