Ethereum is still in a correction phase, with recent price movements showing compression rather than expansion. Volatility has reduced and markets are now rotating within well-defined technical boundaries.

technical analysis

Written by Shayan

daily chart

On the daily time frame, ETH trades within a well-defined range. The upper end of this range is capped by the long-noticed downtrend line, which continues to act as dynamic resistance. All recent attempts to move higher have been rejected near this trendline, confirming that sellers remain aggressive on the upside, rather than the price moving into a breakout phase.

On the downside, the asset remains above a key static support zone around $2.5,000. This level has repeatedly absorbed selling pressure in recent trading, preventing further declines to the downside. As a result, Ethereum is effectively trapped between downtrendline resistance and horizontal demand, forming a compressed structure that reflects indecision rather than trend continuation.

The daily structure favors the range-bound situation as long as the price stays below the downtrend line and above the $2.5,000 support. A daily closing price outside this range is required to resolve the current consolidation and determine the next direction.

4 hour chart

On the 4-hour time frame, recent price action makes clear near-term market intent. Ethereum previously formed a flag structure following a reaction from localized lows, but the breakout attempt failed to sustain. The asset briefly fell below flag support before quickly reversing in what was clearly a false breakout.

This failure shifted short-term momentum back in favor of buyers, leading to renewed upward pressure. A false breakout caught Long under the flag and contributed to his subsequent impulsive refusal. Prices have since turned higher and are now trading within a broader range structure rather than starting a new bullish leg.

The failure to break out of the flag resistance suggests that bullish strength remains limited in the current environment. Unless Ethereum is able to regain and sustain the broken structure with strong follow-through, any attempt at an upward move may remain corrective and vulnerable to rejection.

Overall, Ethereum continues to show signs of consolidation rather than expansion. The daily price is compressed between the resistance of the downtrend line and the support at $2.5,000, and the 4-hour chart confirms the bearish continuation has failed, so the market will remain in a neutral to bearish stance until a clear resolution emerges.

On-chain analysis

Written by Shayan

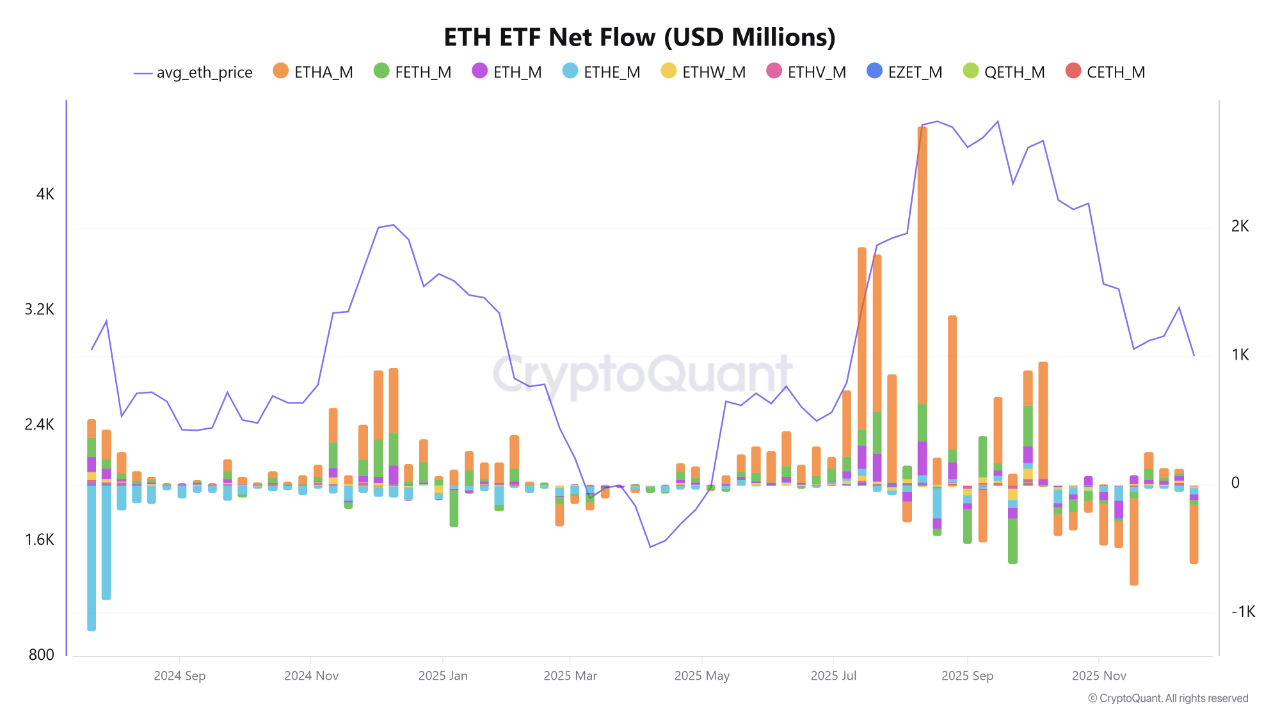

While the broader crypto market remains highly volatile, recent Spot Ethereum ETF data paints a cautious picture for the second-largest cryptocurrency. A wave of institutional outflows during the week starting December 15th created significant seller-side pressure on ETH price movement.

According to the latest statistics, Ethereum ETFs have seen significant net outflows, led by BlackRock's Ethereum ETF (ETHA), which alone saw about $467 million leave the fund. Total weekly outflows exceeded $600 million, highlighting a clear reduction in institutional risk appetite for Ethereum at current price levels, with the asset trading around $2.8 million.

The timing of these flows is particularly important. Sustained negative net flows at the start of each weekly candlestick will significantly reduce liquidity on the buy side. Ethereum's ability to defend key support zones diminishes as large institutions begin the week aggressively reducing their exposure.

Overall, financial institutions' visible reluctance to accumulate Ethereum at current levels, most clearly reflected in the large outflows from BlackRock's ETFs, stands out as a clear warning signal. Until ETF flows stabilize and return to positive territory, Ethereum will likely remain under pressure and will likely head towards lower support levels.