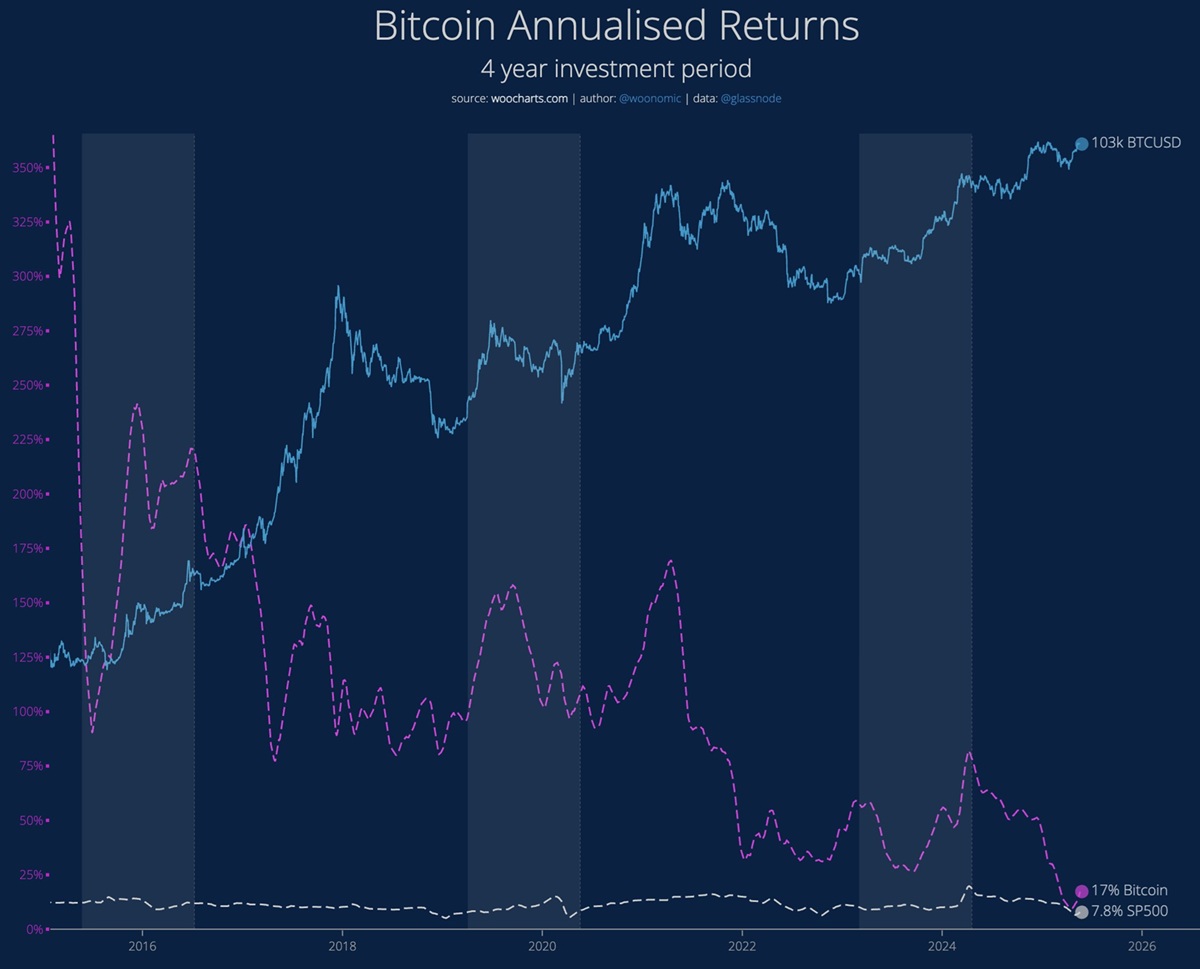

Famous cryptocurrency analyst Willie Wu shared a prominent analysis of Bitcoin (BTC)'s annual combined return rate (CAGR).

Wu noted that investors have unrealistic expectations about BTC and said he has turned his attention to changes that have happened over the years.

“People see BTC as an asset that will forever rise, but the actual CAGR chart is clear.” Woo, who reminded Bitcoin's annual return exceeded 100% in 2017, claimed that this period is currently behind us.

The chart shared by WOO compares Bitcoin's annual return rate with the SP500.

Analysts rate 2020 as a turning point. This year, he said, was the time when Bitcoin was adopted by institutional investors and several states. Wu said this institutionalization has led to a decline in combined annual revenues from 30-40%, and this percentage continues to decline over time.

“Bitcoin is currently trading as the latest macro asset of the last 150 years,” Wu said, adding that the return rate will decrease as the network saves more capital. In the long term, analysts who noted that money supply growth is around 5% and global GDP growth is around 3%, predict that Bitcoin's annual combined return will ultimately stabilize at 8%.

However, Woo said the process could take 15-20 years, adding that BTC's performance will remain unparalleled among public investment products in the long term up to this period.

*This is not investment advice.