This is a segment of the Forward Guidance Newsletter. Subscribe to read the full edition.

Next week is Fed FOMC day and I feel it will be very controversial.

On the other hand, if President Trump pushes Speaker Jerome Powell, he will be cutting interest rates by 100bps as soon as possible.

Meanwhile, FOMC is stumbling over the line. They are in “wait” mode. This is because they don't want to respond to flashy or hawk directions until they have a better understanding of where the tariff policy is.

However, doing nothing is also a policy decision.

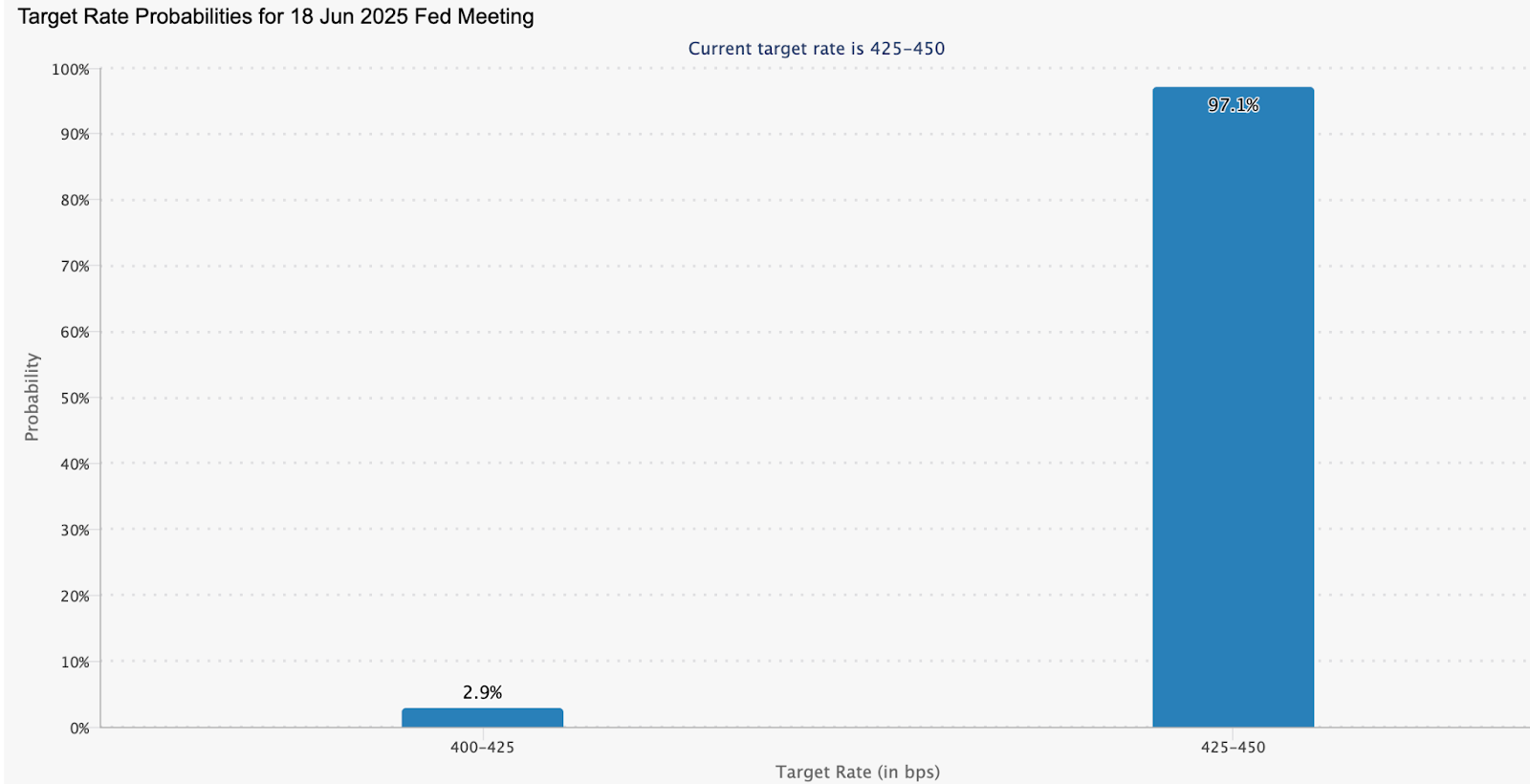

Currently, there is a 97% unspoken chance for the Fed to suspend, so we can hardly hope for a cut next week.

Source: CME

However, there will be a dotplot meeting next week, so you will see the latest information on the Fed's Economic Forecast Overview (SEP). If the Fed wants to inform the diche slope, the SEP is what is used to inform the diche.

To measure whether that's true, let's take a look at some of the latest economic data that will drive the FOMC thinking next week.

The Fed claims to be > being

Labor

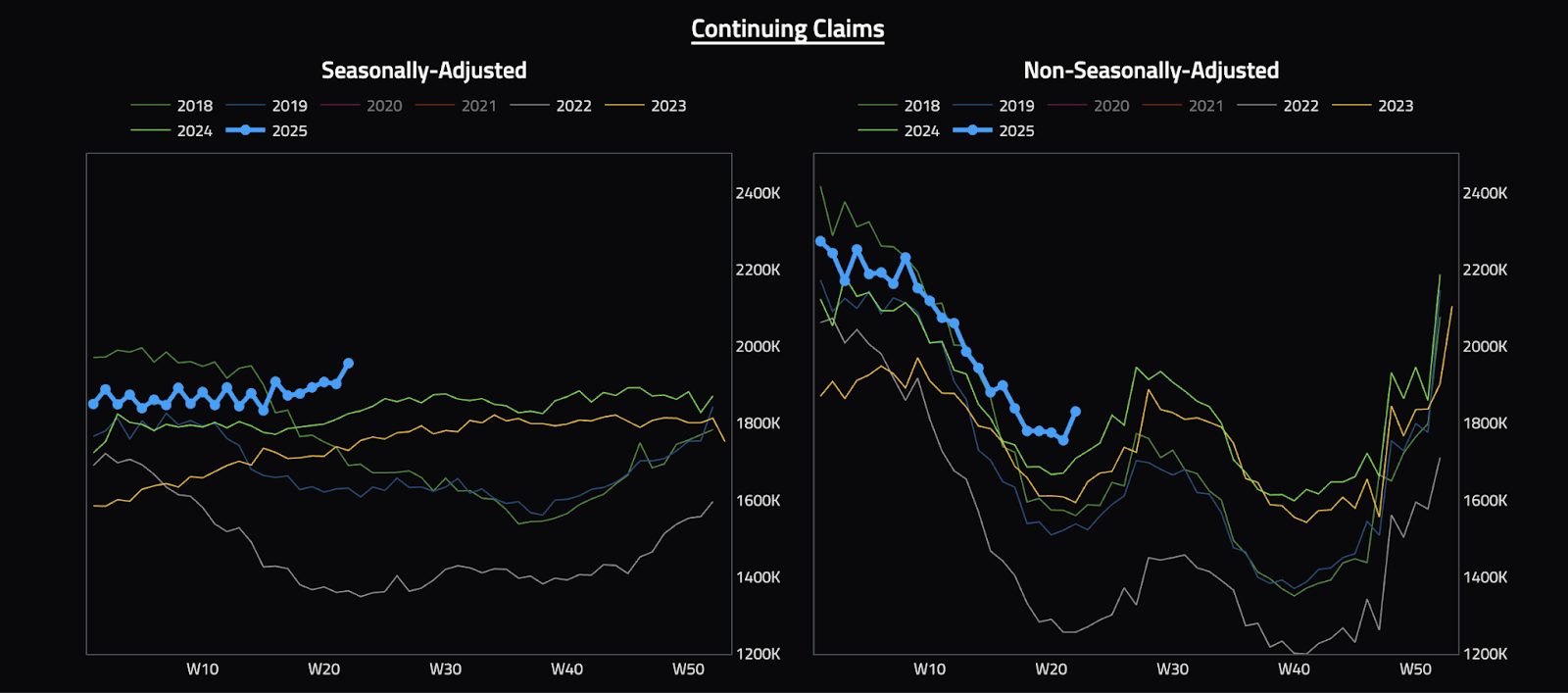

This week we saw a huge increase in continuing unemployed claims.

Source: Augur Infinity

Although we have never seen the same surge in unemployment rates or initial unemployed claims, this rise further examines whether the currently fewer companies are currently employed. But they are not at the time of the layoff either. We are now in a depleted regime.

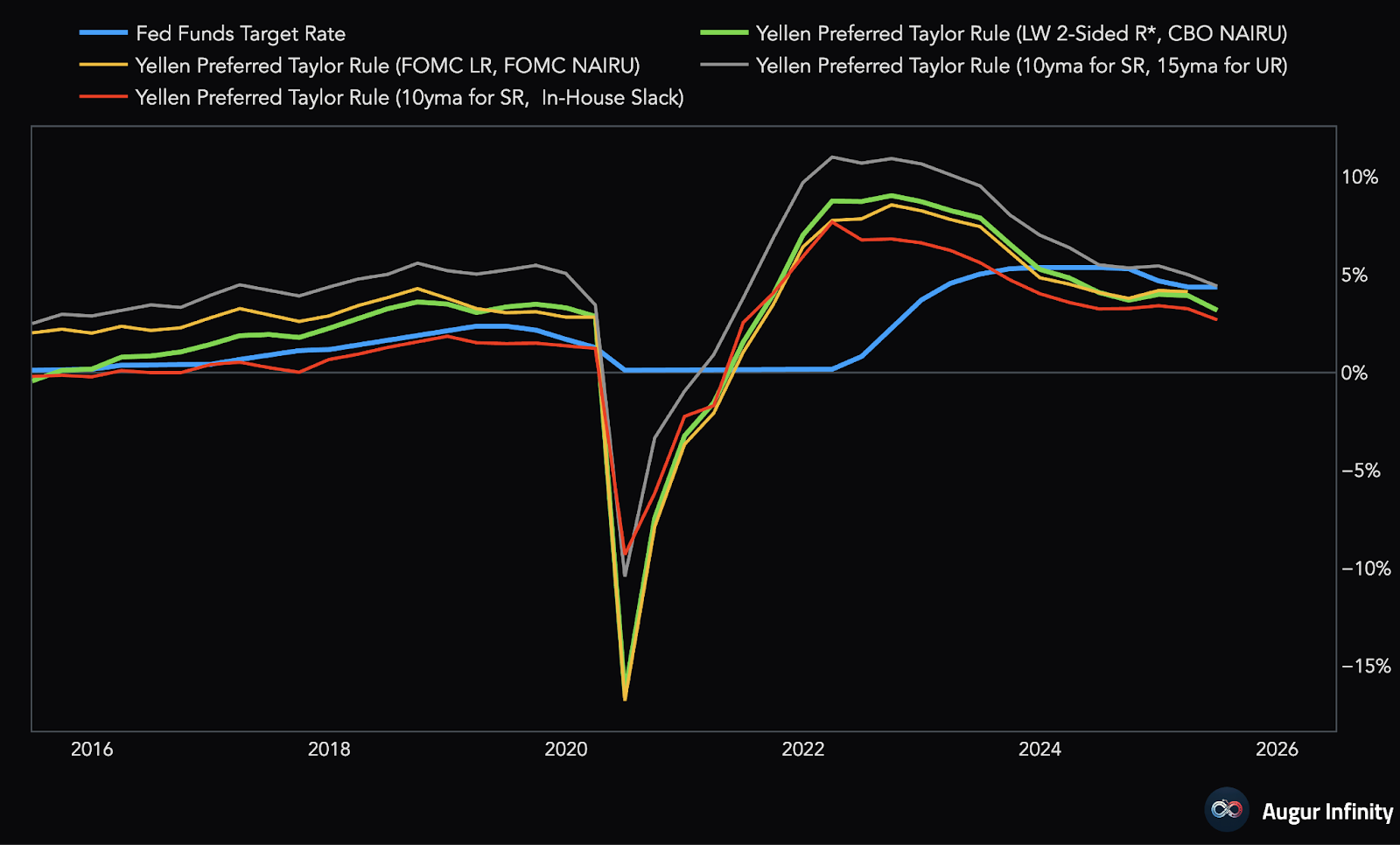

This is an unstable place. By the time the labour market deteriorates to the point where unemployment and negative salary numbers are surged, as mentioned earlier, the Fed is very behind in models like Taylor's Rule.

inflation

The reason the Fed has not cut interest rates preemptively from a labor market perspective is due to concerns about the shift in tariffs to higher inflation, thus questioning the Fed's stable price mission.

However, this week's CPI data makes me wonder how much the tariff impact will be on inflation.

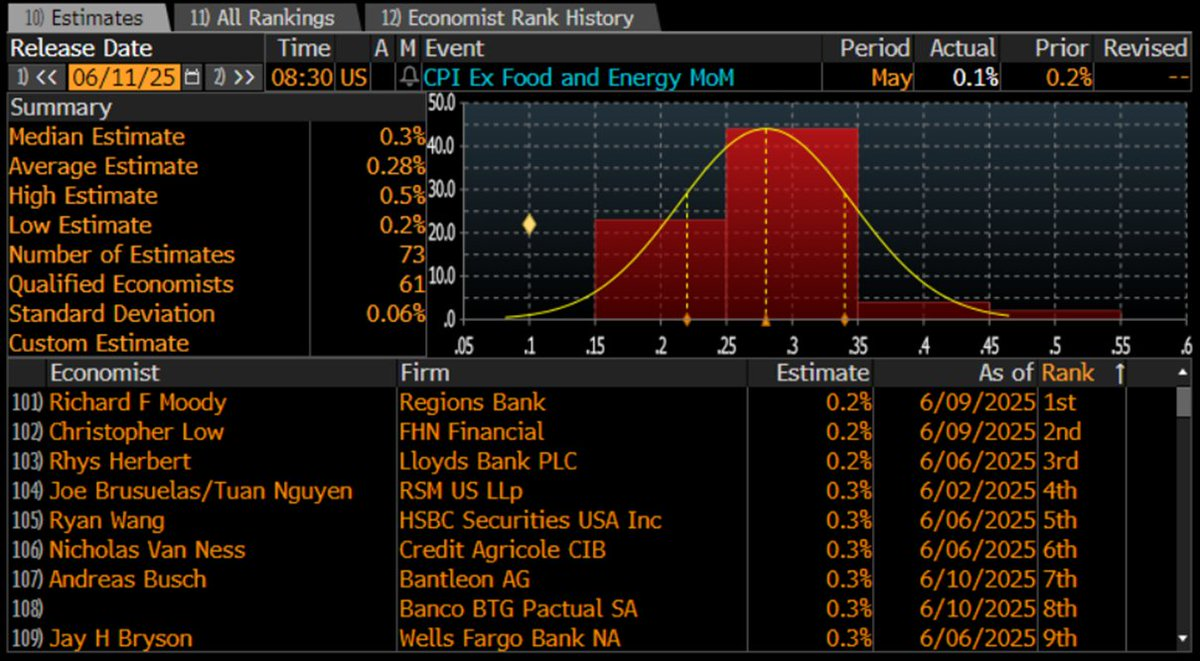

Core CPI came in at 0.1% of the month. This lost the major drawback of one economist of the 73 surveyed unanticipated.

Source: Bloomberg.

That alone is enough for the Fed to sigh with peace of mind that inflation is heading towards its 2% target.

However, the problem is inflation expectations in light of the sudden rise in tariffs.

After being burned multiple times with disconnects before it becomes clear that inflation is on the path to 2%, the Fed does not want to make the same mistake.