The leading Crypto Bitcoin (BTC) shows signs of a potential surge as the market is watching today's Federal Reserve Conference. The Fed plans to offer first cuts starting today, December 2024.

On-chain data shows that traders are positioned for gatherings. This is because we expect easing monetary policy could serve as a catalyst to recover BTC's $120,000.

Bitcoin set for lift-off as a Fed rate hopes boosts trust among investors

The two-day Fed meeting began on Tuesday, raising expectations in the crypto market. Traders are betting that interest rate cuts will inject fresh capital into risky assets, pushing BTC upwards.

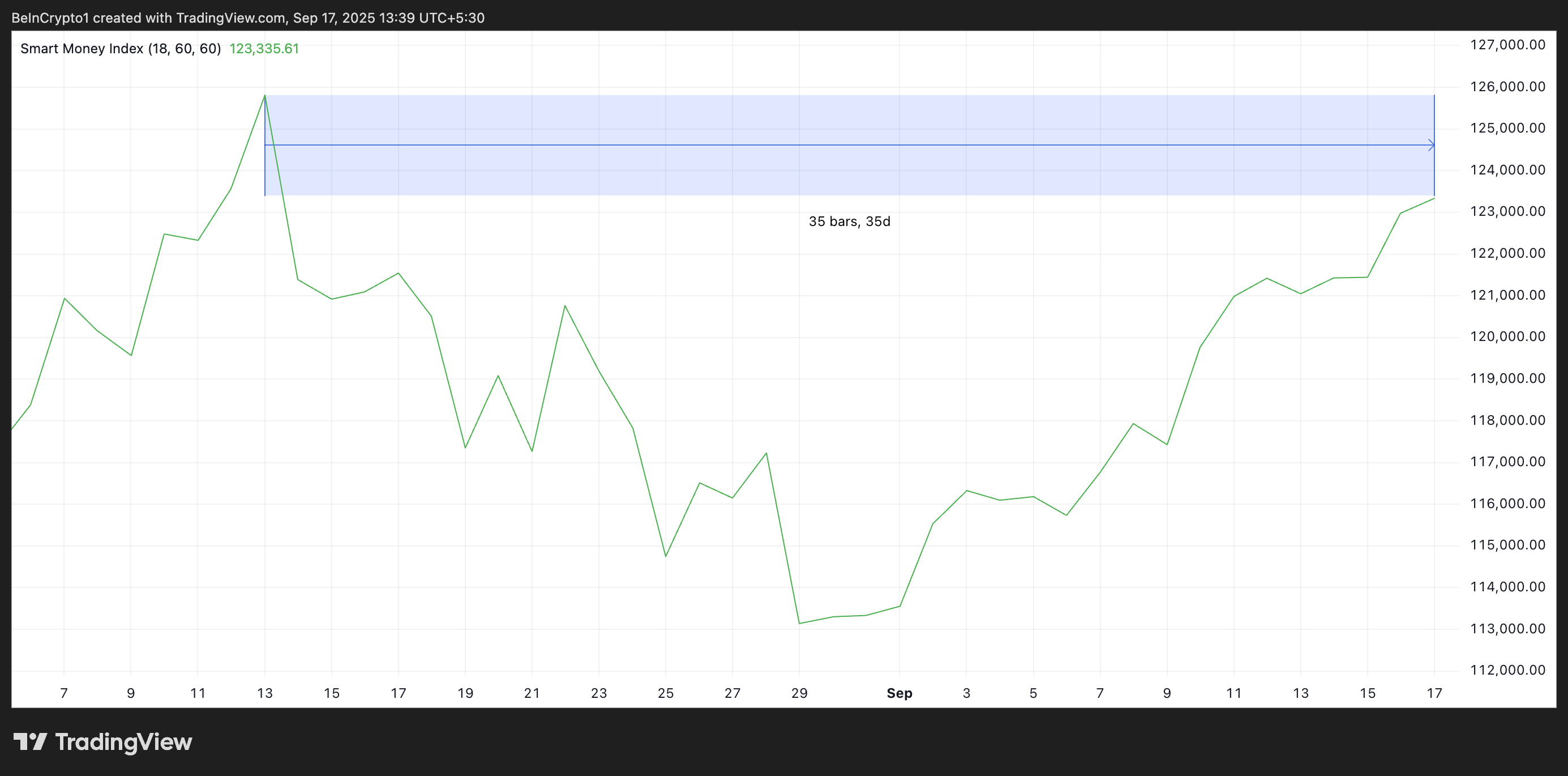

Measurements from technical indicators support this bullish sentiment. For example, BTC's Smart Money Index (SMI) is on a rising trend, indicating that key players are increasingly adding digital assets to their holdings. At the time of writing, the momentum indicator is at a 35-day high of 123,400.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya's daily crypto newsletter.

Bitcoin SMI. Source: TradingView

The SMI indicator tracks the activity of institutional investors by analyzing price movements at a particular time of the trading day, particularly during the final session.

The surge in SMI has boosted confidence among institutional investors and pointed to bull market outlook. The rise in BTC's SMI shows that key investors are accumulating ahead of the FOMC meeting, reflecting strong confidence in sustained gatherings.

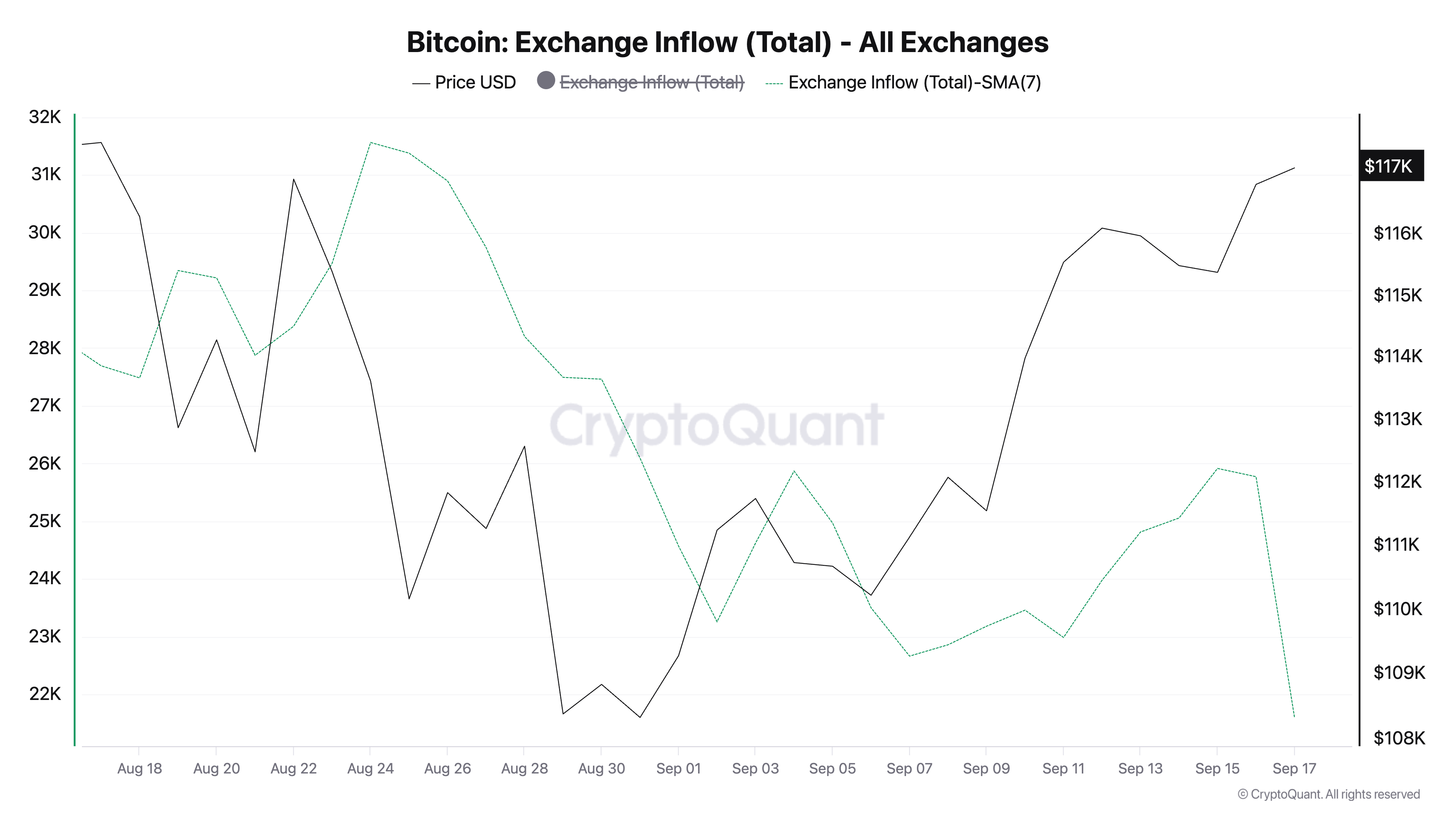

Furthermore, BTC exchange inflows fell to the lowest level in over 18 months, indicating a broader market decline in selling.

According to Cryptoquant data, the seven-day moving average of exchange influx, which was significantly reduced from 51,000 BTC in July, fell to 21,000 BTC.

Bitcoin exchange inflow. Source: Cryptoquant

The average BTC deposit per transaction has also halved from 1.14 BTC in mid-July to 0.57 BTC in September. According to a new encrypted report, this indicates a decline in sales pressure from large holders.

These trends indicate that sales pressures across the market are eased. This allows you to stabilize the price of the coin and create conditions for sustained upward movement.

If the market holds major support, then $120,000 within range

The market is showing increased confidence as few coins increase exchanges and accumulation. It increases the chances of meetings heading towards $120,000 in the short term.

For this to happen, however, the King Coin must first break on the barrier for $119,367 and be turned over onto the support floor. If successful, this could open the path to a BTC price rally to $122,190.

Bitcoin price analysis. Source: TradingView

However, changes in hadling patterns to distribution may prevent this. In that scenario, the value of the coin could be $115,892 to be immersed in support.

The post shows the Fed's rate has been reduced. Do Bitcoin need to get back $120,000? It first appeared in Beincrypto.