The warm chain data shows that more than half of the Etherrium supply retains only 10 addresses. The following is how other ETH -based tokens like SHIBA INU accumulate.

SHIBA INU, Uniswap and Ethereum are one of the most centralized ETH tokens.

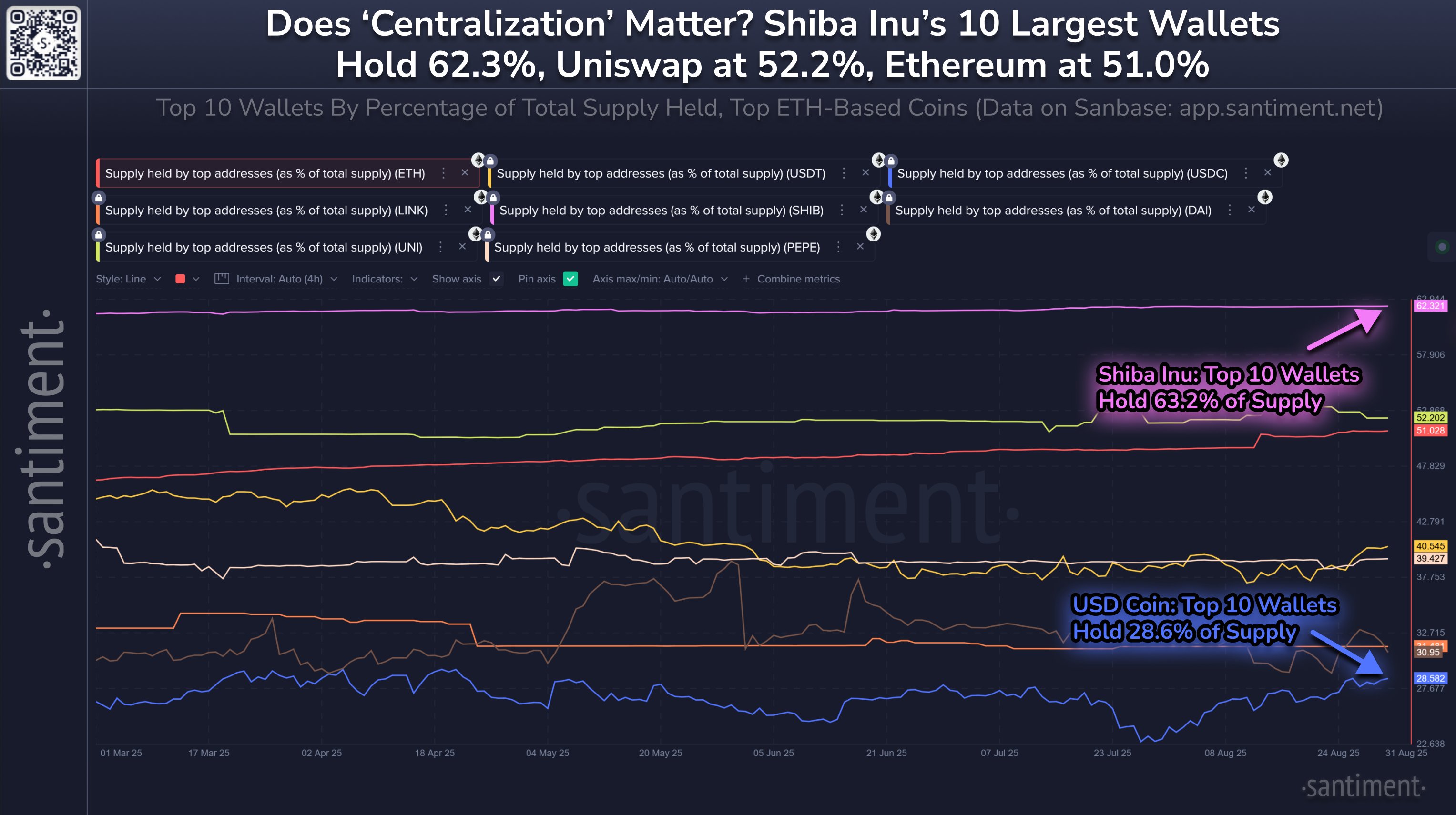

In the new post of X, Santiment, an on-chain analytics company, talked about how other assets of Ethereum Ecosystem confront each other in terms of supply in the top 10 wallets.

Below is a chart shared by SANTIMENT, which shows the trend of this metrics on eight cryptocurrencies over the last few months.

Looks like SHIB is at the top of the list at the moment | Source: Santiment on X

In the graph, 51%of Etherrium supply appears to be owned by the 10 largest wallets in the network. This is mostly the other ETH -based tokens on the list.

The two coins in this metrics are Shiba inu (SHIB) and Uniswap (UNI). The latter is 52.2%, slightly ahead of ETH, but the former is 62.3%.

In general, the supply of cryptocurrency tends to be a constructive signal. This is because only a few players are needed to move the market.

In addition to market epidemiology, there is another disadvantage in centralization of supply. Network security is weakened. Chains, such as Ether Lee, run in the consensus mechanism called steak proof (POS). In this system, the effective test called Starkers must lock the steak to get the next block to the chain.

The higher the steak in the validation test, the more likely it will be fixed. If a single steak crosses a 51%supply threshold, the blockchain can be completely controlled.

This type of attack does not exist in Bitcoin, which does not exist in Bitcoin, where the WOROF-of-Work (WOF-WORK) consensus mechanism is used instead. In the POW network, miners compete with each other using computing power. But here too, if the validity tester controls 51%of the network computing resources, he can make the BTC suitable for his will.

Considering that Ether Lee has 10 holders who control 51%of the supply, they can attack the network if they gather together. But the possibility of it is very thin.

Nevertheless, facts such as ETH, SHIB and UNI can be seen that it is centralized to some holders. In contrast, other tokens in the ecosystem, such as USDC (28.6%), DAI (31%) and Chain Link (31.5%), are in a healthier area in this metric side.

ETH price

Ether Leeum has been priced at $ 4,380 in a surge of nearly 4%over the last 24 hours.

The price of the coin seems to have shot up over the past day | Source: ETHUSDT on TradingView

DALL-E, Santiment.net's main image, TradingView.com chart

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor's team. This process ensures the integrity, relevance and value of the reader's content.