Japan's long-standing bond market has skyrocketed above 3% for the first time since 2000, with global investors awakening.

While this may seem like an overtly localized shift, analysts warn that it could mark the beginning of a wider liquidity squeeze that echoes across risky assets, including Bitcoin.

Japan's bond shock sends warnings to global markets

Japan's long-term interest rates have surpassed important thresholds, causing a stir in the global market. For the first time since 2000, Japan's 30-year government bond yields rose 3.065% from 10 basis points (BPS).

Several analysts flagged the development and interpreted it as a potential first signal for a broader liquidity throttle. This spike represents a significant reversal of the economy, representing ultra-loose monetary policy and near-zero interest rates.

Analysts warn that this could be an early warning for global markets, particularly risky assets such as Bitcoin (BTC).

Japan has kept interest rates low for years, leaving global markets liquidity and risk-on. In particular, its cheap capital was fueled everything, including crypto.

“Japan's 30-year-old harvest is 3%, not seen since 2000. Most of the world's most beneficial and aging, most chronically low inflation economies lead the global bond market. Open your eyes.

Against this backdrop, the tone of financial social media as a whole has shifted from curiosity to concern, while Barchart has expressed concern in the collective market.

That meaning is particularly volatile for the crypto market. Bitbull, a well-known market analyst, suggested that this development could mark a turning point for the entire cycle.

“Japan's 30-year bond yields exceeded 3% for the first time in decades. That may not sound dramatic… But it's a big signal… Now the rates are rising, so money can cause less money flow.

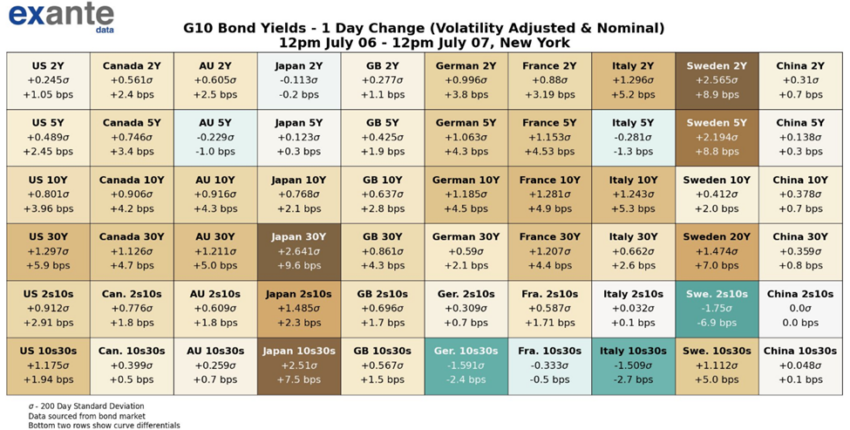

Exante data has confirmed the yields of Japan 30Y in the most statistically significant movement among the G10 bond market over the past 24 hours and supported its view.

“The biggest move in the last 24 hours was Japan's 30-30 bond yields, which had two standard deviations during the period.

G10 bond yield. Source: x Exante data

However, despite the macro trembling, Bitcoin remains abnormally stable. At the time of writing, BTC is trading at $108,217, and is trading firmly within the strictest range.

“…Even with the slower spot momentum, Bitcoin's technical and bullish market position remains structurally unharmed. After bounced $98,000 during a war-driven DIP and forming a strong support level in the $106,500 range, BTC continues to surpass the $100,000 psychological support level.

Bitcoin (BTC) price performance. Source: Beincrypto

The extraordinary stability of Bitcoin can attract risk averse investors

Ark Invest analyst David Puell pointed to this unusual mildness amid the wider volatility, noting that it could attract a cohort of risk aversion investors.

“From May and October 2023, the 6m and 1 year skews of both broad volatility and extreme tails have been uninterrupted and positive, unlike previous bull markets.

Meanwhile, the accumulation of companies continues. Genius Group, a public company that has established itself as a “Bitcoin-first” education company, has raised its Treasury target by 10 times. CEO Roger Hamilton highlighted the company's conviction in a post on X (Twitter).

“We are currently seeing the price rise of Bitcoin purchased for Bitcoin Treasury. We are pleased to announce this significant increase in Bitcoin Treasury target to 10,000 Bitcoin,” revealed Hamilton.

Japan's yield shock could be more than a local event as the global bond market flashes warnings and players in the facility double Bitcoin.

It could mark the beginning of a new macro reality based on feelings shared among analysts.