Lighter, the second largest decentralized perpetual exchange, was one of many platforms to experience a platform outage during the October 10 cryptocurrency market flash crash. To compensate affected users, Lighter distributed points leading to future token airdrops.

Reiter announced the redemption plan on October 14th, offering a 250,000 point reduction to traders affected by technical issues with the platform during and after the crash.

While points may seem like vague compensation for lost funds, demand for Writer Points is high, reaching $100 per point on the OTC market before Friday's event. As of October 16th, the highest bid was $81.

The team has faced some backlash over its compensation package, but while lighter traders generally seem satisfied with the response, depositors in the platform's lighter liquidity pool (LLP) are unimpressed.

Broken down, traders affected by the outage lost $25 million and received 150,000 points, LLP investors suffered a 5% loss (approximately 21.5 million) but received only 25,000 points, and the platform suffered a sequencer failure after the crash, causing traders to lose an additional $7 million and be compensated with 75,000 points.

To summarize, Lighter users lost approximately $50 million during platform downtime and received $20 million worth of Lighter points as compensation. Of course, the OTC price is just an indicator and there is no guarantee that the Lighter token will receive the same valuation after launch.

It's also worth noting that a significant portion of the $25 million lost in the crash during the outage was likely unrecoverable, as price fluctuations were so fast and violent that many traders were liquidated whether the platform was up or not.

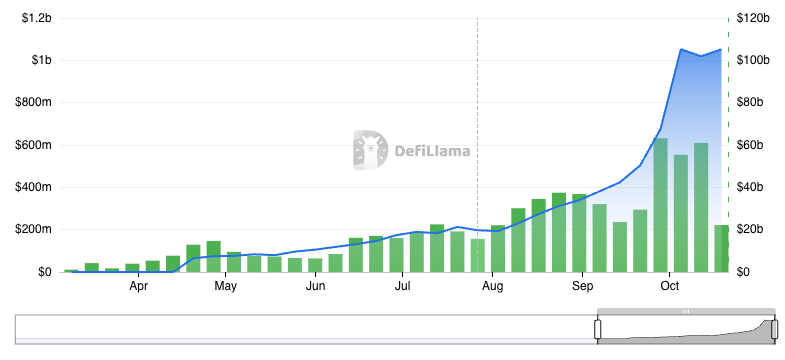

Despite the setback, Reiter remains the second most popular PERP DEX in DeFi, trailing only Hyper Liquid. The DEX still maintains a total value locked (TVL) of over $1 billion and processed $7.3 billion in volume in the last 24 hours (compared to Hyperliquid's $8.8 billion)

TVL and Perp Volume Lightening – DeFiLlama