Ethereum is adding new wallets at a record pace while recovering from last month's crash. Over the past week, the network recorded approximately 327,100 new Ether wallets created per day. According to the latest on-chain data, Sunday marked an all-time high with approximately 393,600 wallets created in a single day. This was the largest single-day increase ever recorded for Ethereum.

This comes at a time when the global cryptocurrency market is issuing green indexes led by bulls. The cumulative market capitalization of digital assets rose more than 4% in the past 24 hours, reaching a level of $3.25 trillion. Ether price has increased over 7% in the past 30 days as Bitcoin successfully recovered the $95,000 level.

Lower fees trigger new activity on Ethereum

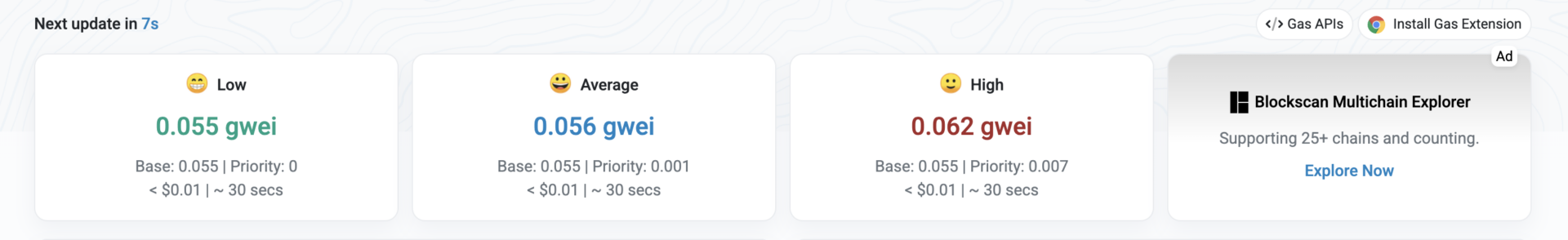

Following a protocol upgrade rolled out in early December, there was a sudden surge in ETH wallets. The Fusaka upgrade changes the way data is processed on the network. This reduced the cost for L2 systems to post information to Ethereum. This move made transactions cheaper and smoother for users on the network. Average gas cost fell to 0.051 Gwei.

Ethereum gas price; Source: EtherScan

The drop in prices has led to increased network activity. According to data from Santiment, stablecoin transfers on Ethereum reached a record late last year. The total in the fourth quarter reached approximately $8 trillion. Payment and settlement flows of that scale often require new wallets. This suggests that users stocked up on ETH when the price of ETH fell, which ultimately supported address growth.

Santimento data said trends from late December to January also show new users entering the ecosystem. However, wallets are being created as users explore decentralized finance games and NFT-related applications. He added that seasonal factors may be at play. Cryptocurrency markets often see new price increases at the turn of the year. Traders and developers tend to reset their strategies.

The Crypto Fear and Greed Index shows that investor sentiment has become “neutral” after spending weeks in “fear” territory. Ether has failed to break above $3,300 multiple times over the past two months. With a new push, ETH was able to overcome this barrier. Ethereum price has increased by about 8% in the past 24 hours. At the time of writing, it is trading at an average price of $3,348.

DEX trading retreats

Activity across decentralized apps appears to be subdued. According to data from DefiLlama, the total DEX trading volume in the past two weeks was $150.4 billion. This number was a significant decrease from the $340 billion record set in January 2025. Ethereum’s 7-day DEX volume is hovering near $9 billion. It reached its peak of $27.8 billion in October.

Derivatives markets also suggest that the situation is calming down. The 30-day implied volatility indicator associated with Bitcoin and Ether has declined. These indicators reflect expectations for price changes. A low reading suggests traders are looking for a reduction in short-term moves. This comes despite ongoing geopolitical risks and changes in ETF flows.

At the same time, SharpLink Gaming has expanded its exposure to this asset. The company has accumulated over 865,000 ETH. As of Tuesday, the stock was valued at about $2.75 billion. Last week, SharpLink deployed $170 million worth of Ether on its Linea Layer 2 network.