Ethereum (ETH) is on the verge of destroying the month's all-time high, predicting advanced AI models with AI models exceeding $5,000 by August 31, 2025.

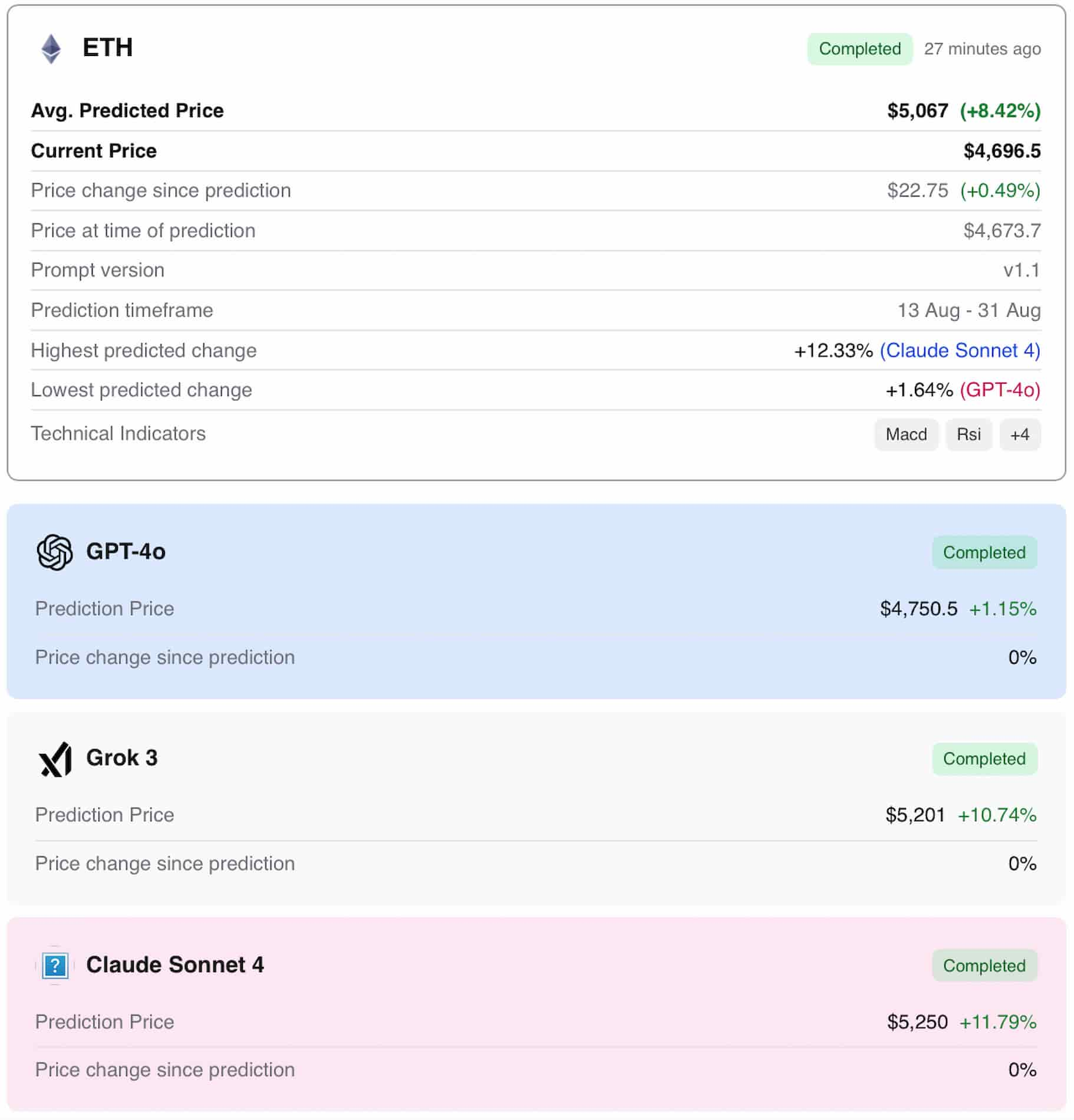

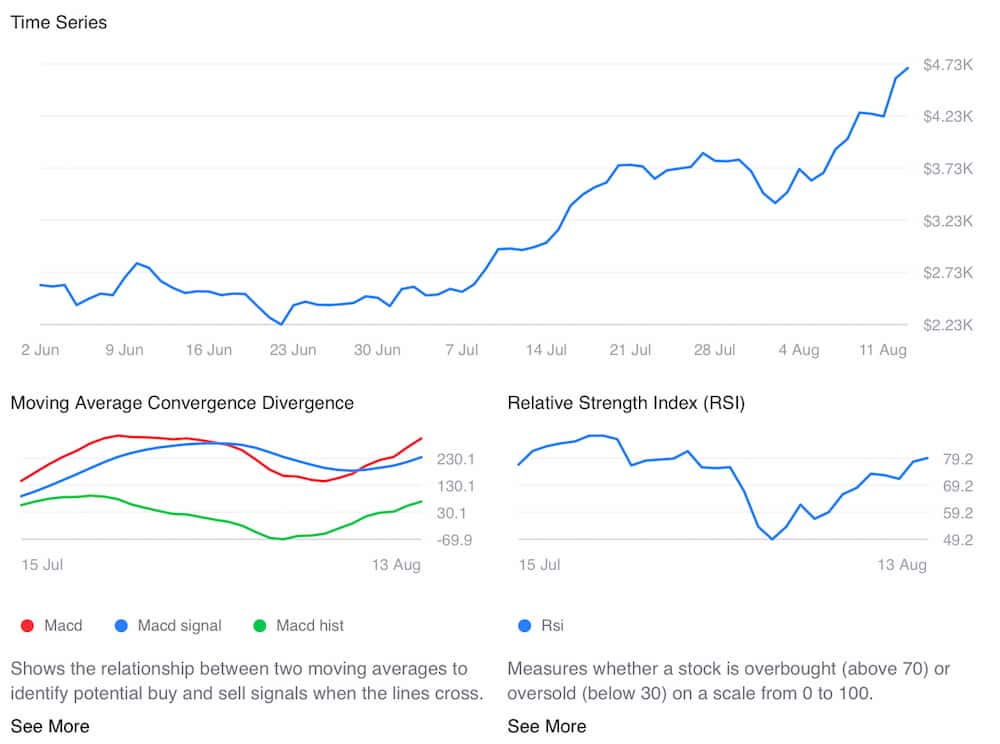

Powered by machine learning models GPT-5, Claude 3.5 Sonnet, and Grok 3 Vision, Finbold's AI price prediction tool places the average Ethereum forecast price at 5,067, along with a set of technical indicators including both MACD, RSI, stochastic oscillators and 50-day and 200-day moving averages.

This represents an upside of 8.42% from the current market level of $4,696.5.

Each model shows a strong confidence that Ethereum will maintain its bullish momentum. The Claude 3.5 Sonnet is the most optimistic and forecasts a price of $5,250.

The Grok 3 Vision is forecasting $5,201, meaning a 10.74% increase, indicating that the upward trend can expand well beyond the psychological $5,000 threshold. Even the more conservative GPT-5 (GPT-4O variant) is expected to rise by $4,750, which will keep ETH comfortable, exceeding recent support levels.

ETH is seeing a large institutional influx

The bullish projection will accelerate behind the record ETF influx of ETFs. On August 11 alone, Ethereum ETF saw a net inflow of $1 billion led by BlackRock ($640 million), Fidelity ($270 million) and Grayscale ($80 million). From August 11th to 12th, inflows exceeded $1.5 billion.

Arkham Intelligence Data shows BlackRock wallet activity with multiple high value ETH transfers from Coinbase Prime is on the rise. Despite the strong sales of retailers, the institutional appetite is growing. Dynamic Santiment Notes have historically been even more advanced.

The crypto-centric company, backed by Peter Thiel, co-founder of 180 Life Sciences Corp. Palantir, adding fuel to the rally, recently disclosed its holdings of 82,186 ETH ($4,600 worth $349 million).

ETH is currently trading nearly $4,700, just 6.4% below the peak of its momentum indicator at $4,891 in November 2021. The RSI is above 79, suggesting strong purchasing pressure, but MACD remains in the positive territory.

If AI forecasts continue, Ethereum could not only recover its history highs by the end of August, but also break it intermittently and headed the stage of potential price discovery to Q4.