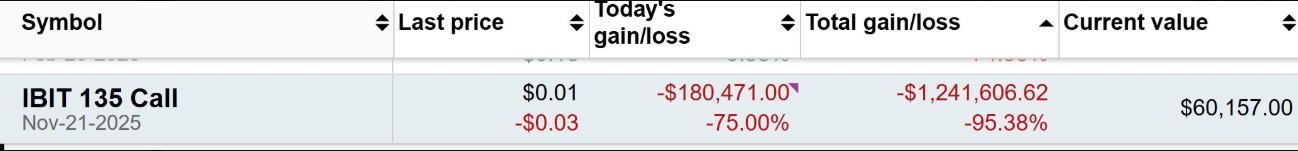

Former Ohio Treasurer Josh Mandel, once hailed as an early political champion of Bitcoin, has disclosed personal losses of more than $1.2 million on call options related to BlackRock's iShares Bitcoin Trust (IBIT).

The former state official's bet followed his bold prediction that Bitcoin would reach $444,000 by November 8th, a prediction that apparently did not materialize.

Ohio cryptocurrency tax pioneer loses $1.2 million betting on Bitcoin options

Mandel shared details of the failed trade in a post on Twitter, saying he went “all in” on an IBIT call option, only to watch it expire worthless.

“Early in the cycle, I exposed a portfolio of only MSTR and MSTR options. I was initially completely long, but as I predicted Bitcoin would hit $84,000, I sold an in-the-money covered call. Shifted short…These moves worked well enough, but I got impatient with the last call at $444,000.As the saying goes, you're only as good as your last call.''

Mandel added that his post was intended to be “transparent” and denied accusations that he misled investors or sought to profit through the coin issuance.

Josh Mandel lost $1.2 million trading Bitcoin options. Source: Mandel of X

Long before retail Bitcoin speculation reached the American mainstream, Josh Mandel helped “plant the flag” for crypto adoption in Ohio.

In November 2018, as state treasurer, he launched OhioCrypto.com, the first U.S. government platform that allows businesses to pay state taxes in Bitcoin. Payments processed through BitPay were automatically converted to US dollars and sent to the Treasury.

At the time, Mandel described Bitcoin as a “legitimate form of currency” and positioned Ohio State as a leader in blockchain innovation.

“We're planting a flag for Ohio,” he told reporters, arguing the measure would modernize the state's finances and attract technology-forward companies.

However, the program faced regulatory hurdles under his successor, Treasury Secretary Robert Sprague, who suspended the program in 2019 after determining that BitPay's payment structure may have violated state procurement laws. Fewer than 10 companies were using the service before it was shut down.

Bitcoin ETF options market risks and lessons

Mandel’s high-stakes loss comes amid a surge in interest in Bitcoin ETF options since their launch in late 2024. As Open Volume Research noted, Bitcoin ETF options trading volume soared, with many traders favoring bullish positions.

However, Bitcoin ETFs have underperformed recently, with outflows reaching levels seen in May. In fact, it only recently recorded its first inflow after consecutive outflows of $2.9 billion.

Nevertheless, speculative long-term bets like Mandel's remain outliers, highlighting significant risks associated with options and Bitcoin price volatility.

By disclosing investment losses, Mandel is a reminder that even the most experienced celebrities and crypto pioneers can misjudge the timing and risk of digital assets.

As regulated crypto derivatives expand and attract more investors, Mandel's experience shows that even if market predictions are widely shared, there is no guarantee of success.

The post Man Who Once Made Ohio Pay His Taxes in Cryptocurrency Loses $1.2 Million on Bitcoin Options appeared first on BeInCrypto.