Metaplanet stock prices crashed and entered the bare market as demand for Bitcoin treasury companies declined and investors began booking profits.

summary

- Metaplanet's stock price plummeted 55% from the previous day.

- Stocks fell as Bitcoin finance companies dived.

- Technical analysis points to more downsides in the short term.

Metaplanet stocks plummeted to 910 yen ($6.18). This is the lowest level seen since May 23rd, 55% below this year's peak. This decline marked the company's market capitalization from 1.14 trillion yen to 638 billion yen.

Why Metaplanet stock price crashed

There are several reasons why Metaplanet stock prices have fallen over the past few months, despite Bitcoin (BTC) being a few points below its all-time high.

First, there are signs that demand for Bitcoin Treasury stocks is weakening. For example, the strategy, the largest Bitcoin accumulator, has dropped by 30% from an all-time high. Other similar companies like Mara Holdings and Trump Media have also fallen double digits.

Second, Metaplanet's shares fell due to profits from some investors. At its peak in June, stock prices rose more than 15,000% from its 2024 lowest level.

You might like it too: Will the Stellar Protocol 23 upgrade increase PI network prices?

It is common for stocks to be pulled back after a large gathering. From a technical analysis perspective, it is possible that inventory has entered the distribution or markdown phase of Wyckoff theory.

Third, there is continued concern about Metaplanet's assessment. Despite a 55% decline from an all-time high, its net asset value (NAV) is higher than other Bitcoin finance companies, with two multiple stands. The strategy has a NAV multiple of 1.47, with Mara being 1.

Furthermore, concerns about continuous dilution remain. In a statement last week, the company announced plans to raise another $3.7 billion to buy Bitcoin. The move will increase dilution as it surged from 114 million in January last year to 460 million.

Metaplanet Stock Price Technology Analysis

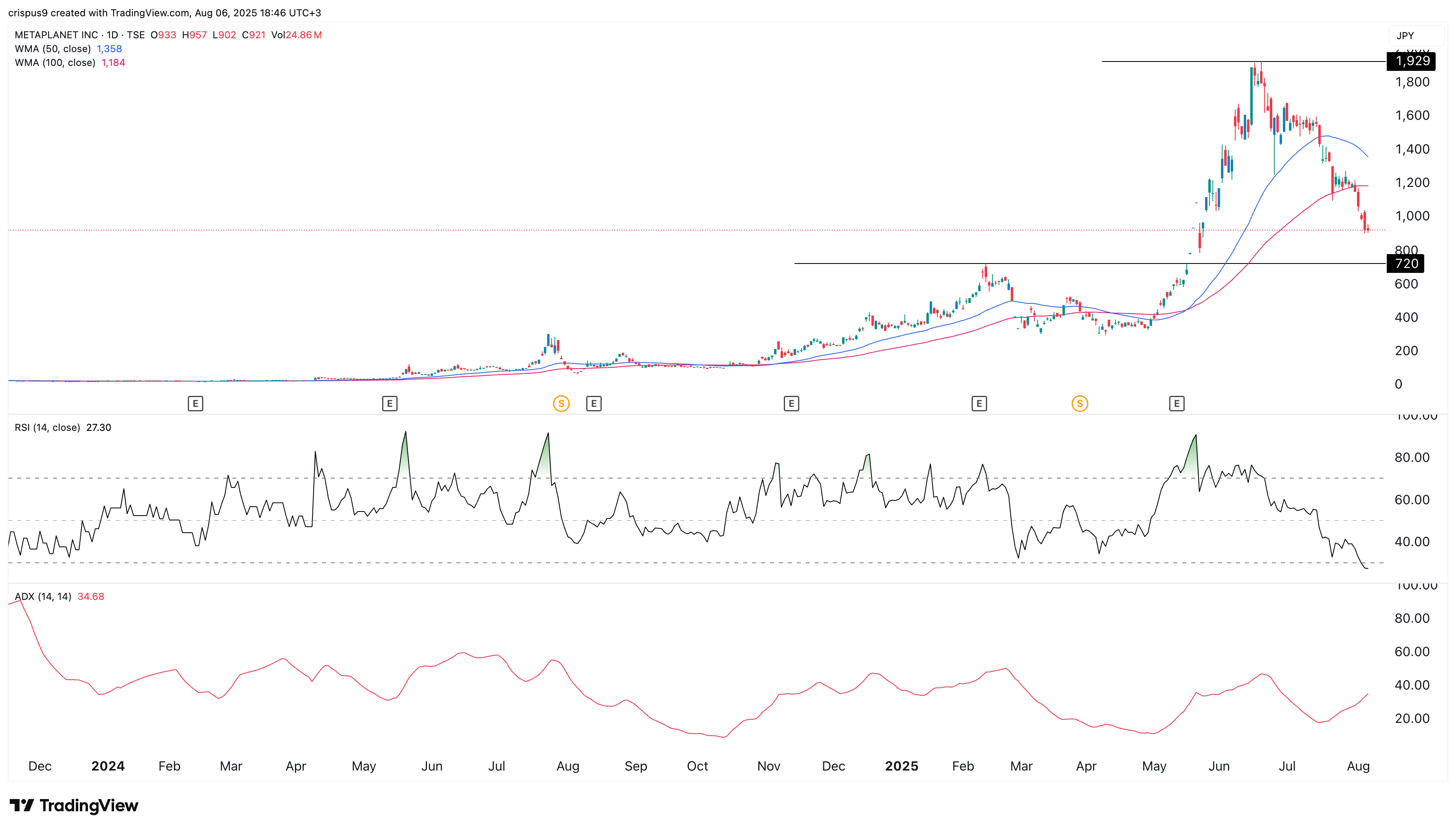

Metaplanet Stock Chart | Source: TradingView

Daily charts show Metaplanet stocks have been on a strong bearish trend over the past few months, falling from a June high of 1,929 to 920 yen.

It fell below the weighted moving averages of 50 and 100 days. Meanwhile, the relative strength index fell to 27 and the average direction index rose to 35. These momentum indicators suggest that bearish trends are strengthened.

Therefore, the path for the lowest resistance in Metaplanet stock price is downwards, with the next target being 720 yen, the highest point in February.

You might like it too: The S&P 500 opens higher among major corporate revenues, Bitcoin holds $114K