Metaplanet, a Tokyo-listed company, has been actively accumulating Bitcoin, increasing pressure as stock prices fall, threatening the funding model it used to build one of the world's largest corporate Bitcoin Treasury Ministry.

Despite a roughly 2% increase in Bitcoin (BTC) during the same period, the company's stocks fell 54% since mid-June. This decline puts the capital-raising “flywheel” under stress. This is a mechanism that relies on rising stock prices to unlock funds through MS warrants issued to major investors, EVO funds.

By cutting these warrants sharply, exercises of these warrants are no longer attractive to EVOs, squeezing Metaplanet's liquidity and slowing down Bitcoin's acquisition strategy, according to a report from Bloomberg on Sunday.

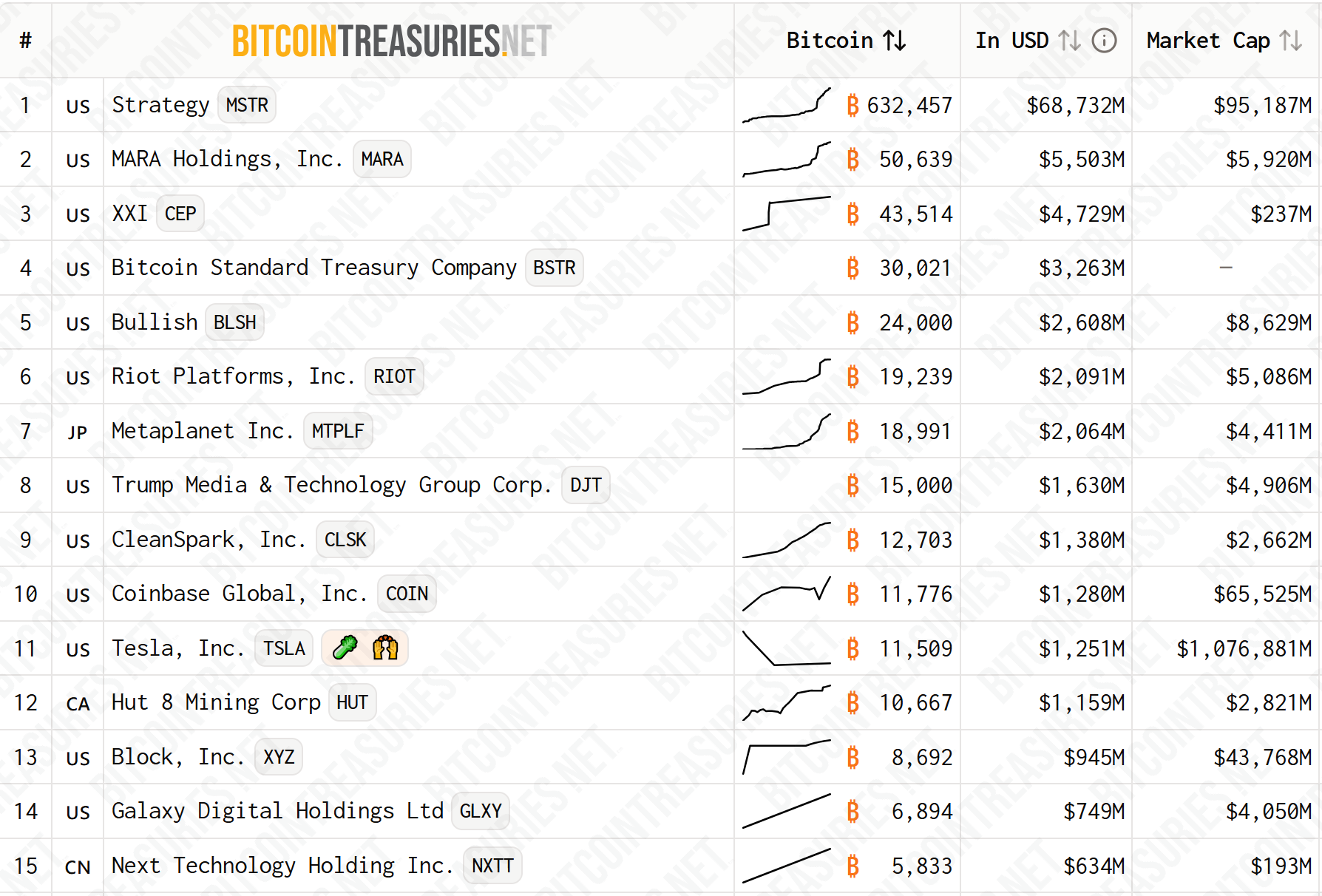

According to bitcointreasuries.net, Metaplanet, led by former Goldman Sachs trader Simon Jerrovich, currently owns 18,991 BTC, making it the seventh largest public holder. The company has ambitions to grow its stack to 100,000 BTC by the end of 2026 and 210,000 BTC by 2027.

Top 15 Bitcoin finance companies. Source: bitcointreasuries.net

Related: Metaplanet, Smartweb adds nearly $100 million to Bitcoin to the Treasury

Metaplanet looks at overseas markets

With the “flywheel” strategy losing momentum, Gerovic is turning to alternative funding. On Wednesday, Metaplanet announced plans to raise approximately 130.3 billion yen ($880 million) through publicly traded share offerings in overseas markets.

Additionally, shareholders will vote on Monday whether to approve the issuance of up to 555 million shares, a rare measure in Japan that could raise 55.5 billion yen ($3.7 billion).

In an interview with Bloomberg, Gerovich called preferred stocks a “defensive mechanism” and allowed capital injections without diluting ordinary shareholders if the stock fell further. These stocks are expected to offer an annual dividend of up to 6% and initially limit the company's 25% Bitcoin holdings, which could appeal to yield-hungered Japanese investors.

Related: Metaplanet plans to raise another $3.7 billion to buy Bitcoin

The fall of Bitcoin Premium puts Metaplanet's strategy at risk

However, analysts are cautious. “The Bitcoin Premium determines the success of your overall strategy,” said Eric Benoit of Natix. That premium is the difference in Metaplanet's market capitalization and Bitcoin Holding's value, falling just twice as much from more than eight times in June, increasing the risk of dilution.

The company has suspended EVO warrant exercises from September 3rd to 30th, paving the way for preferred shares. It remains to be seen whether this shift will stabilize Metaplanet's funding strategy.

Meanwhile, Metaplanet was upgraded from small caps to intermediate stocks in a semi-annual review in September 2025 by FTSE Russell, earning inclusion in the FTSE Japan Index. The move follows the company's strong second quarter performance.

magazine: Bitcoin's long-term security budget issues: an imminent crisis or FUD?