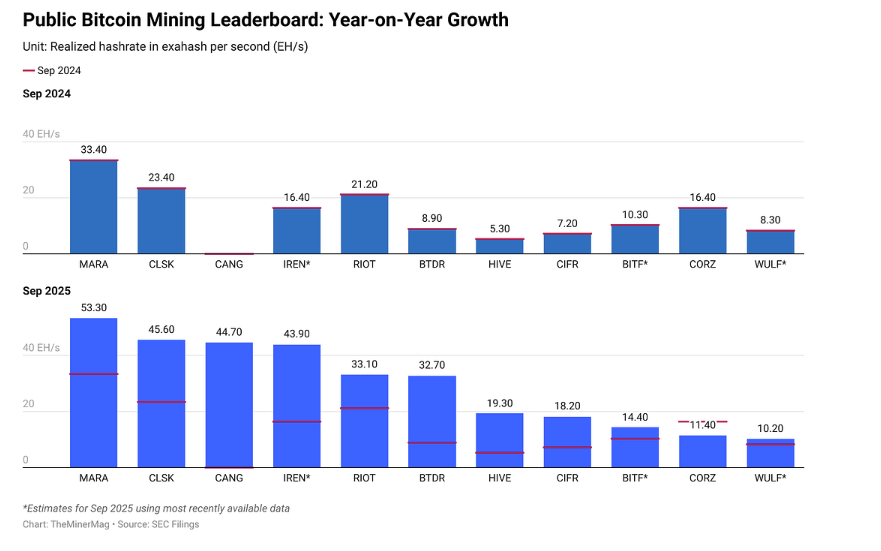

The Bitcoin mining industry is becoming increasingly competitive, with so-called Tier 2 operators closing the gap on the incumbent leaders in achieved hashrate, a sign of a more level playing field after the halving in 2024.

According to The Miner Mag, companies like Cipher Mining, Bitdeer, and HIVE Digital are rapidly expanding their realized hashrate after years of infrastructure growth, closing the gap with top players like MARA Holdings, CleanSpark, and Cango.

“Their rise highlights how middle-class public miners, once far behind, are rapidly expanding production since the 2024 halving,” Miner Mag wrote in its latest Miner Weekly Newsletter.

While MARA, CleanSpark, and Cango maintained their positions as the top three public miners, rivals such as IREN, Cipher, Bitdeer, and HIVE Digital recorded significant year-on-year increases in realized hashrate.

In total, top public miners reached 326 exahashes per second (EH/s) in realized hash rate in September, more than double the level recorded the previous year. Together, they currently account for nearly a third of Bitcoin's total network hash rate.

Year-on-year increase in realized hash rate. Source: The Miner Mag

Hashrate represents the total computational power that miners contribute to securing the Bitcoin blockchain. However, the achieved hashrate is actual On-chain performance, or the speed at which valid blocks are successfully mined.

For listed miners, it also serves as a more accurate indicator of operational efficiency and revenue potential, making it a key metric ahead of the third-quarter earnings season.

Related: Solo Bitcoin miner earns $347,000, 'pure self-sovereignty at work'

Bitcoin miners intensify hash war

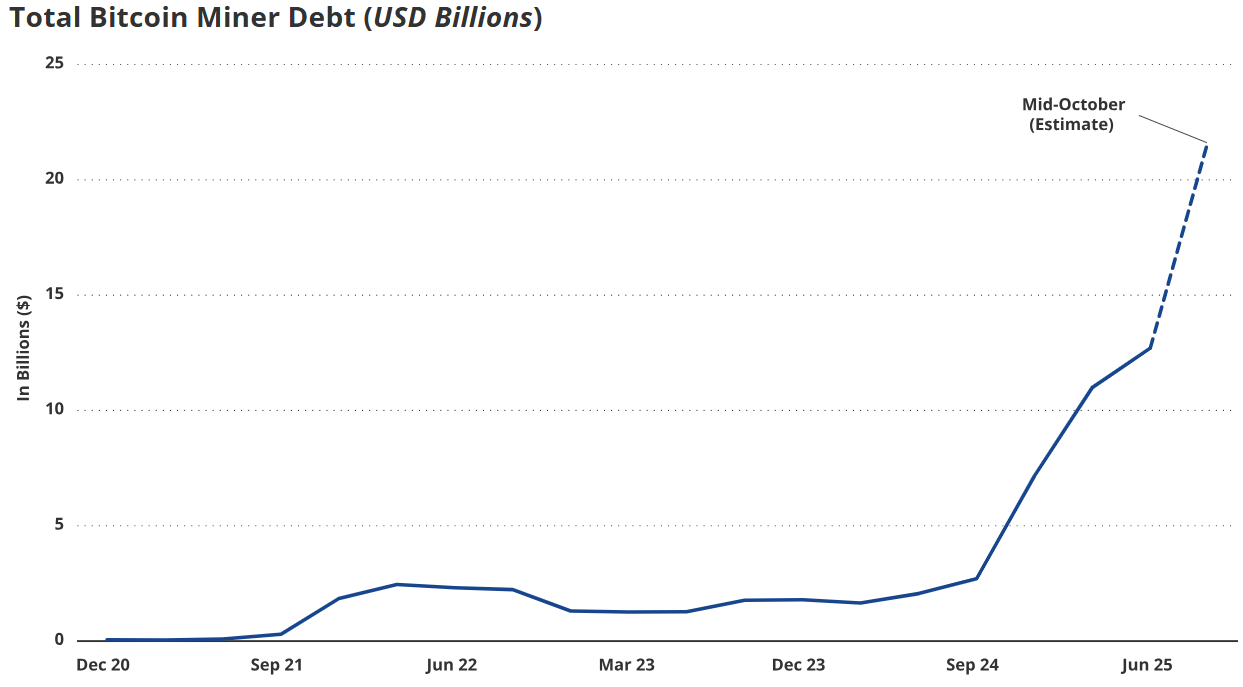

In the race for market share, Bitcoin mining companies are taking on record levels of debt as they expand into new mining equipment, artificial intelligence infrastructure and other capital-intensive businesses.

Total debt across the sector has jumped to $12.7 billion from $2.1 billion just 12 months ago, according to VanEck research. The researchers noted that miners will need to continually invest in next-generation hardware to maintain their share of Bitcoin's total hashrate and keep up with competitors.

Bitcoin miners' debt increases. sauce: Van Eck

Some mining companies are turning to AI and high-performance computing workloads to diversify their revenue streams and offset profit declines following the 2024 Bitcoin (BTC) halving, which saw the block reward drop to 3.125 BTC.

Related: HIVE Digital accelerates AI pivot with $100M HPC expansion — Cointelegraph Exclusive