Bitcoin (BTC) appears to be poised with a rather short slant, as it is bordered towards the $110,000 mark and potentially to a new history high.

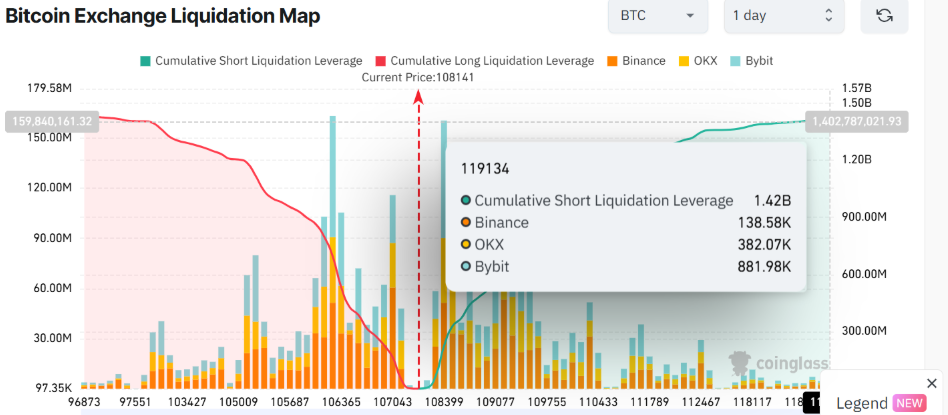

Specifically, there is a noticeable accumulation of short positions of nearly $119,000 across exchanges such as Bybit, OKX and Binance. If Bitcoin continues to move upward, it could liquidate $1.4 billion shorts, potentially causing a potential short squeeze, according to the latest on-chain data obtained by Finbold. Coinglass June 29th.

The liquidation map shows that even if long exposures decrease, short leverage increases and shows imbalance. So breakouts over $110,000 act as catalysts, forcing them to cover their shorts and increase the price.

It is worth noting that Bitcoin's recent gatherings are partially fueled by easing geopolitical tensions in the Middle East. To this end, analysts suggest that if rebounds are generated, it could potentially lead to a potentially history-high next week.

Bitcoin shows more bullish momentum

In addition to the bullish setup, analyst Ali Martinez noted on the X-Post June 28th that Bitcoin's market value (MVRV) ratio approaches the golden cross on the 30-day simple moving average (SMA).

This pattern, historically linked to price increases, is a signal that improves investors' profitability, which could be a potential trigger to increase purchases.

In particular, the MVRV ratio measures how excessive or undervalued Bitcoin is related to the holder's cost base. Crossovers above the 30-day SMA usually show reinforcement of capital sentiment and influx.

Bitcoin price analysis

By press time, Bitcoin was $108,190, up 0.8% over 24 hours and 2.4% per week.

At the same time, technical indicators support bullish cases. Bitcoin is trading above the $105,901 50-day SMA, while the 200-day SMA is $87,663, confirming a strong long-term uptrend. The 14-day RSI stands at 55.89, indicating a neutral but supportive stance on the continued benefits.

Featured Images via ShutterStock