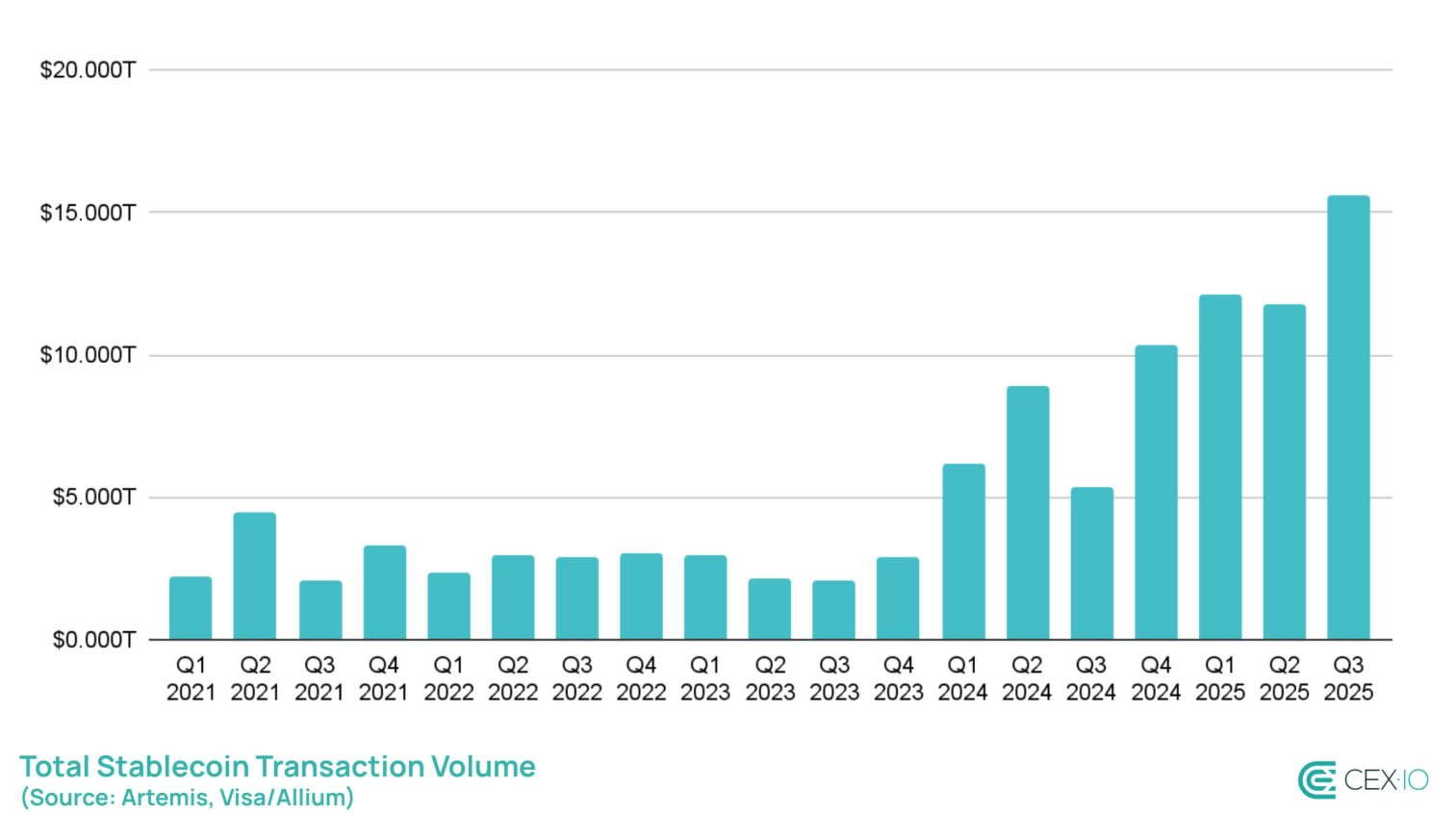

According to a new survey from Crypto Exchange Cex.io, Stablecoin transfers surged to a record $15.6 trillion in the third quarter of 2025, resulting in many of the activities linked to automated trading bots.

On Wednesday, Illya Otychenko, a market research analyst at CEX.IO, called the third quarter of 2025 the “most active period” for Stablecoins. During the quarter, the value of the Stablecoin transfer reached $15.6 trillion.

Otychenko told CointeLegraph that using Visa/Allium and Artemis data, it showed that bot-driven transfers account for about 71% of Q3's stable coin transfers.

Organic non-bot activity accounts for around 20%, with the remaining 9% being attributed to internal smart contract transactions and internal exchange operations.

Total safe transaction volume. Source: CEX.IO

Differentiating bots is important for policymakers

Researchers said it would be “important” for policymakers to distinguish between the two when assessing systematic risk and real-world adoption.

When asked how they distinguished between high-frequency trading bots and operating activities like washing transactions, Otychenko told Cointelegraph that both of these numbers are captured by the 71% figure.

“They've both been captured, with invalid high-frequency bots with over 1,000 monthly trades and $10 million each month dominated the 71% figure above,” Otychenko said.

He added that the largest extractable value bots and those interacting with distributed finance protocols represent less than half of the total security amount.

“This highlights that while bots promote liquidity and activity, a significant portion may not reflect meaningful economic use,” he said.

Retail Stablecoin transfers have hit record highs

The report flagged an increase in unlabeled high-frequency transfers that could be inflated activity metrics, but highlighted a sharp increase in retail-sized stubcoin transfers under $250.

The report found that retail activity reached a new record high in September and the third quarter of the year, marking 2025 as “the most active year ever for retail stabilization.” According to the report, retail-sized Stablecoin activity is set to surpass $60 billion by the end of the year.

Cex.io said the transaction remains a major factor in retail adoption. The exchange said its internal data showed that nearly 88% of transactions under $250 are linked to exchange activities.

However, stock increases are related to remittances, payments and fiat cash out, referring to use cases beyond transactions.

The exchange said overall, non-trading stubcoin activity jumped over 15% in 2025, reflecting the appeal of stubcoin for everyday trading.

“Both categories point to the role of stubcoin's growth in promoting payments, remittances and revenue,” Cex.io said.

Related: Stablecoin Boom makes “cryption” a risk risk as a fragmented rule. The economy is exposed.

USDT and USDC dominate a $46 billion quarterly inflow

Apart from the value of the transaction, a net inflow refers to the difference between stable coins that were created and redeemed in the third quarter of 2025. RWA.xyz data was shown to have recorded more than $46 billion in Net inflows in the third quarter.

Tether's USDT led the quarter with a net inflow of nearly $20 billion, followed by Circle's USDC at $12.3 billion. Meanwhile, synthetic stubcoin Ecena USDE (USDE) had a net inflow of $9 billion during the quarter.

magazine: XRP is Thailand's top performance asset. Shanghai Dumpfil: Asia Express