Bitcoin found support at the key $80k level, prompting bullish rebounds. However, the 200-day moving average currently serves as a significant resistance, suggesting that the short term is likely to be a consolidated phase within the $80,000 to $87,000 range.

Technical Analysis

By Shayan

Daily Charts

Bitcoin recently printed a bullish rebound after finding strong support in the key range of $75,000 to $80,000. The field has historically served as a psychological and technical floor, and bullish divergence between RSI and prices confirmed a slowdown in bearish momentum and signaled new buyers' interest.

However, the current gatherings are approaching critical resistance levels, which is the 200-day moving average.

This MA acts as a dynamic resistance zone and can hold prices at the upper limit in the short term. As a result, Bitcoin could continue its integration within the $75,000 to $87,000 range until a critical breakout occurs. If the Bulls succeed in pushing beyond the 200-day MA, their next major target will be at the psychological $100,000 level.

4-hour chart

In the lower time frame, Bitcoin found strong support in the midline of the downward channel, prompting impulsive surges and potential signals of accumulation at these levels. Prices are currently testing the channel's upper boundary at nearly $84,000.

This trend line and a breakout seen above the previous swing high will disable the bear structure and open the path to the key $90K resistance zone.

Conversely, failing to exceed this level could strengthen the current bear market structure, which could result in an update of downward pressure during the medium term.

On-Chain Analysis

By Shayan

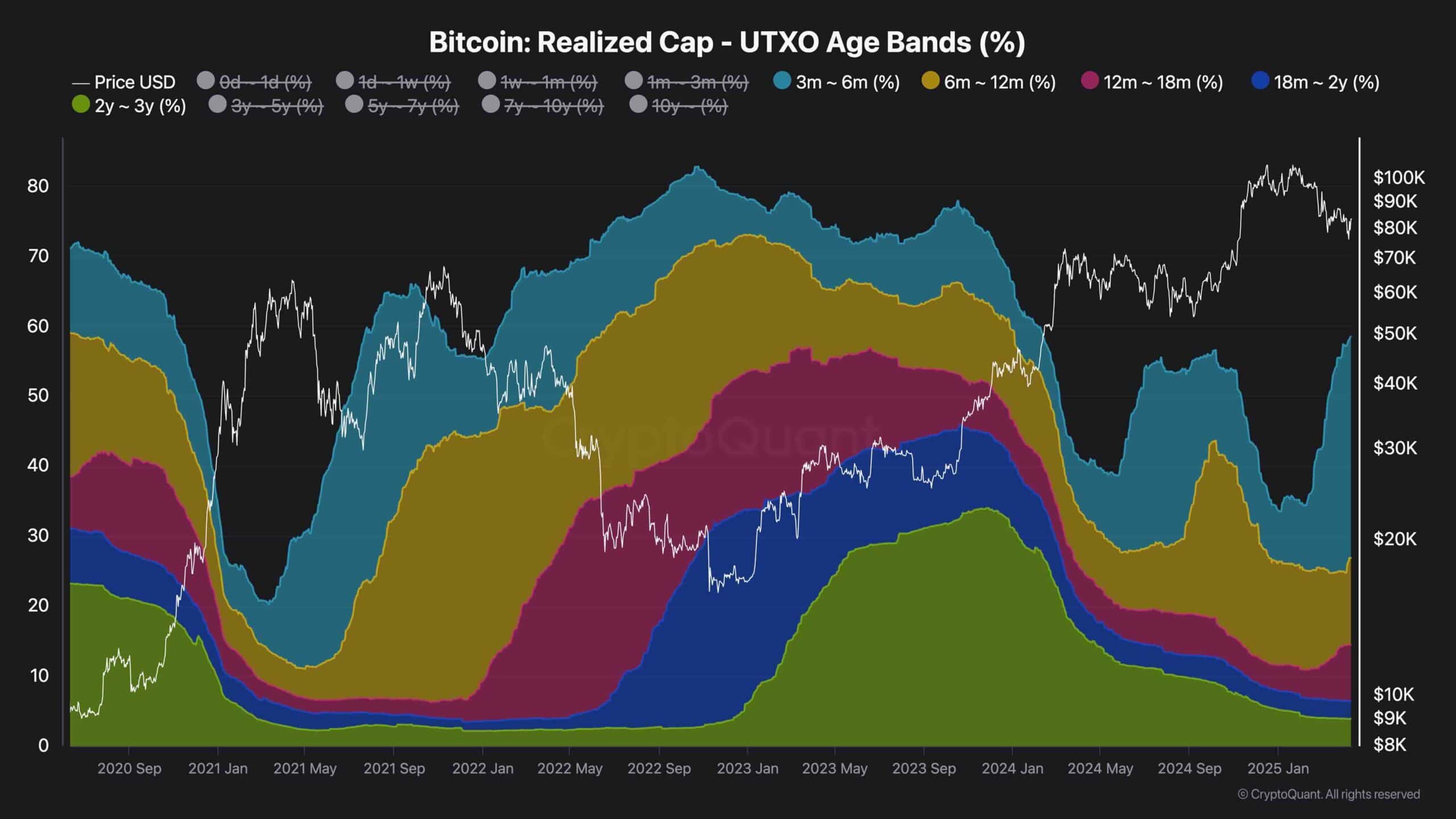

The realized Cap UTXO Age Bands (%) is a powerful on-chain metric that breaks down the realisation cap of Bitcoin by the age of UTXOS (unused transaction output), providing insight into investor behavior based on retention period.

According to the latest data, the percentage of coins held by cohorts from 3-6 months and 6-12 months has steadily climbed. This rise closely reflects the accumulation patterns seen during the long revisions of the summer of 2024, and reflects increased confidence among holders.

This behavior shows a tendency to “hadling.” Investors will maintain the coin despite ongoing market corrections and refrain from selling in the face of volatility. As more coins move to long-term holders' hands, the available circular supply will be reduced and the rarity of Bitcoin will increase.

Historically, these supply constraints have catalyzed strong price increases when new demand is met. These dynamics often set the best stage of price discovery and new history.

Therefore, the current chain structure shows that the ongoing drawdown is the beginning of the bear market and is unlikely to be a sound correction within the wider bull cycle.