This is a segment of the 0xResearch newsletter. Subscribe to read the full edition.

Obol is launching its native Obol Token today.

Token holders can wager Obol as collateral for Obol or for liquid staking tokens that can be used to vote in retrospective funding rounds (RAF).

“After years of building trustworthy, distributed validator technology that eliminates a single point of failure, we have governance in the hands of the community,” says Thomas Heremans, CEO of the Obol Association.

“Obol tokens represent more than just governance. It is a coordinating mechanism across the operators' ecosystem that is revolutionizing how Ethereum secures infrastructure.”

What is OBOL?

Obol is the middleware technology provider for Ethereum Network Staking. The company will enable “Distributed Verification Equipment” (DV). This allows multiple independent nodes to collectively manipulate a single validator by sharing duties and private keys.

This solves the long-standing problems faced by networks of proofs.

Ethereum Variators have a stake in ETH ($64.7 billion) of around 34 million people today. Large institutions in particular could manage hundreds of millions of dollars as a single operator entity. These operators host Validators on the same hardware server or enriched geographical jurisdiction and may be subject to technical disruption or regulatory risks.

Thanks to corporate-enabled distributed Validator technology such as Obol and SSV, multiple nodes (2 of 2, 4 of 7, 7 of 7, 7 of 7) can now run one Ethereum Validator globally at once.

Therefore, if one node goes down, there is no confusion in the validator and reduces exposure to these concentration risks.

This helps the Validator avoid reductions, reduce the risk of a single point of failure, thereby improving validator uptime and overall network resilience.

Today, over 800 unique node operators run OBOL-powered variators, from major staking services to solo homestakers. The $975 million ETH from Lido, Etherfi, Stakewise, Swell, Bitcoin Suisse and others is protected by Obol's distributed validation device clusters across Ethereum today.

Thanks to Oboru, Lido has increased its operators from 36 to over 200, according to a press release.

Etherfi, the largest redevelopment protocol with a $5.4 billion TVL, has now been able to expand its operators from 10 to nearly 100. Approximately 258,784 ETH ($499 million) are being wagered in OBOL DVS today. Added 40 Testnet is set to move to the mainnet immediately.

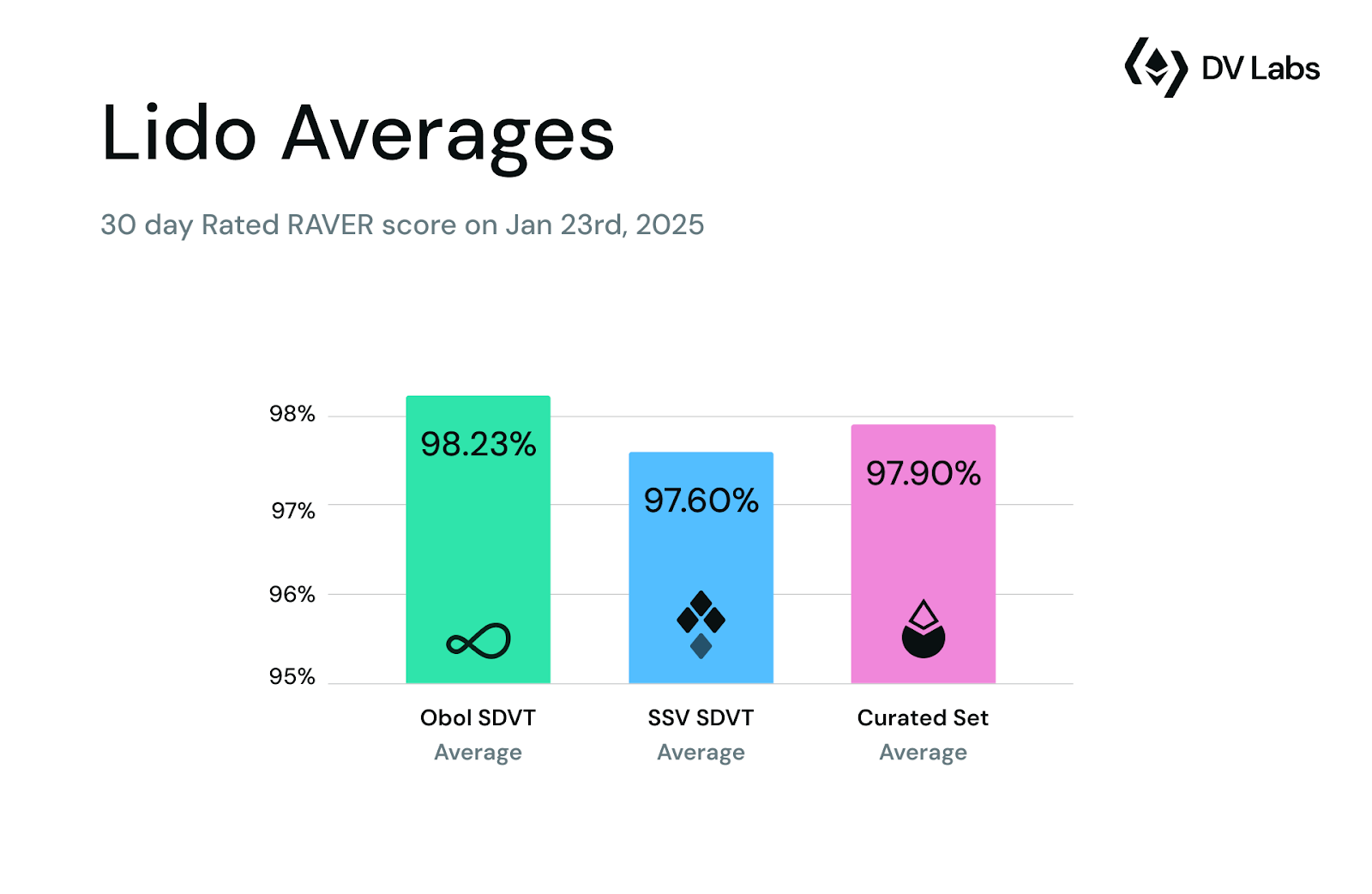

According to DV Labs, OBOL DVT's 30-day RAVER score in January 2025 was 98.23%, surpassing the SSV SDVT and curated Lido set. The RAVER score is a metric used to measure the effectiveness of enablement in the success of proposals and certifications in Ethereum staking.

Source: DV Labs

Upgrading the Pectra network, Released yesterday and includes EIP-7251. This has increased the Maximum Verification Fluid shares from previous CAPs of 32 ETH to 2048 ETH. It supports an institution that can integrate thousands of validators.

“The EIP-7251 represents a much-anticipated leap in verification device efficiency,” Helemans told Blockworks.

“By enabling validator integration, we address one of the biggest operational burdens faced by large stakers and agencies,” Helemans said. He forecasts “up to 80% reductions in operational and infrastructure costs.”