Fabian Dori, chief investment officer at Digital Asset Bank Sygnum, said banks that provide crypto loans prefer crypto collateral in the form of on-chain assets rather than exchange sales funds (ETFs).

Dori said that because on-chain assets are more liquid, lenders can liquidate collateral in real time, allowing lenders to demand margin calls for crypto-assisted loans and provide borrowers with a higher loan and value (LTV) ratio. Dori told the Cointelegraph:

“In reality, it's desirable to have a direct token as collateral. It can be done 24/7, so if you need to perform margin calls on the ETF late at night on a Friday, it's even more difficult if the market closes.

The crypto loan-value ratio refers to the total amount of loans with collateral that supports the loan, such as Bitcoin (BTC), Ethereum (ETH), or other tokens accepted by the lender.

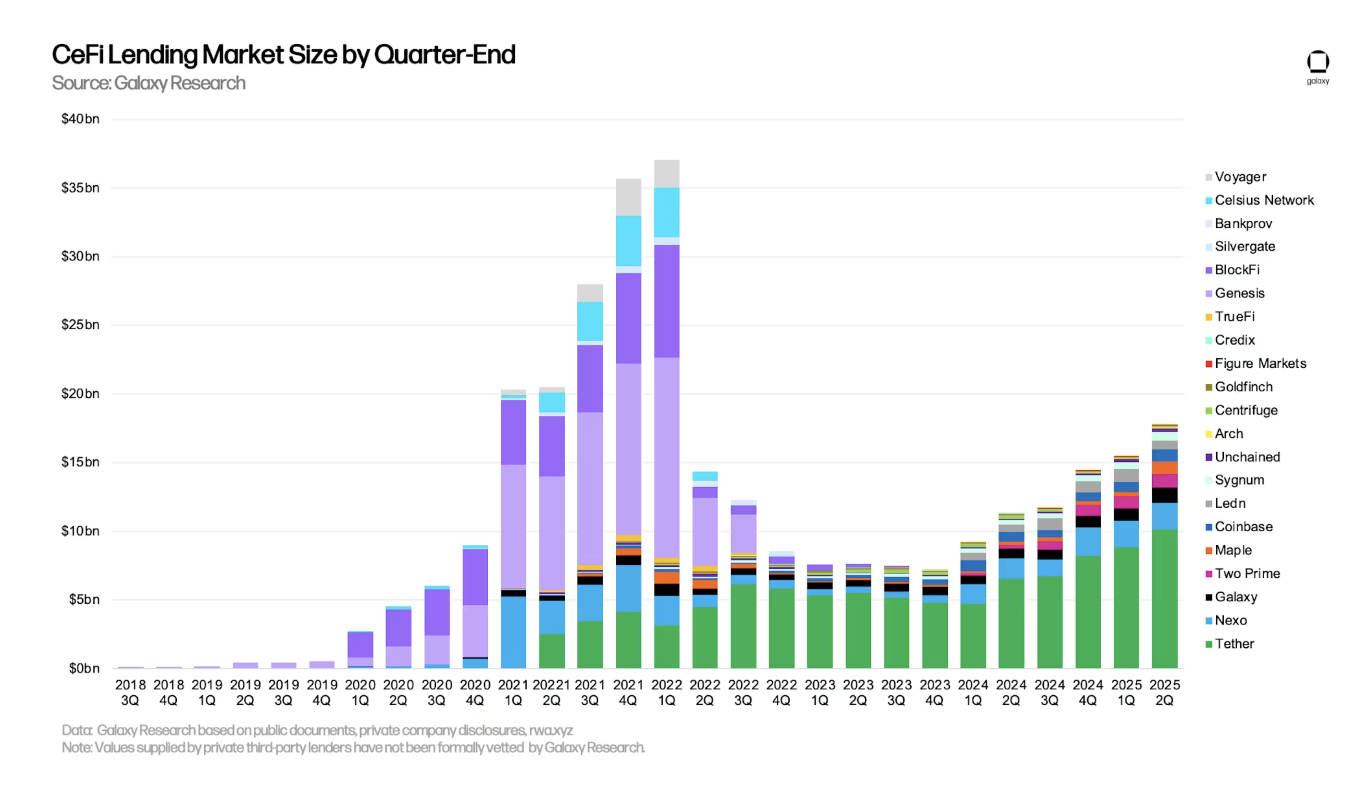

Cryptocurrency loans from centralized institutions have declined significantly in the Bear market in 2022, with several crypto lending companies exploding, but again rising. sauce: Galaxy

A high LTV ratio means that borrowers have access to more credits in terms of the collateral posted crypto, while a low LTV means that they get fewer loans for the same amount of collateral.

Crypto-backed loans are still in their early stages, Dori said, but he was convinced that the sector would continue to grow as Crypto gains widespread adoption.

Financial institutions are steadily accepting crypto-protected loans in line with the idea that crypto lenders are open to US stock exchanges and traditional financial (Tradfi) companies accept them as collateral for their loans.

Related: South Korea will limit crypto loan interest rates to 20% and take advantage of prohibited loans

Crypto Lending will debut on Wall Street as Tradfi warms up to crypto-support lending

Crypto-aid lender Figure Technology debuted on Thursday on the NASDAQ Exchange, a high-tech-focused U.S. stock exchange.

https://www.youtube.com/watch?v=ly-sjgrakrs

According to Yahoo Finance, our shares have skyrocketed by over 24% during the first day trading and now have a market capitalization of over $6.8 billion.

JP Morgan of Financial Services Company is also considering offering clients Crypto-backed loans. This is a development that will take place in 2026 if the Legacy Financial giants advance their ideas.

magazine: Mortgages using Crypto as collateral: Are risks outweighing compensation?