Ethereum has been a tough week, slipping almost 6.2% over the past seven days. Most analysts are looking for further corrections, but the token has stabilized itself. Over the past 24 hours, Ethereum prices have risen by 0.1% and are trading in neutral territory.

This movement alone doesn't change much, but the mix of on-chain and chart signals suggests that something more interesting may be built.

Short term holders will recede

One of the updated signs of strength comes from short-term wallets. These are addresses that usually hold ETH for days or weeks prior to sale. After several weeks of trimming exposure, the group began purchasing again.

ETH purchases will go back to track: GlassNode

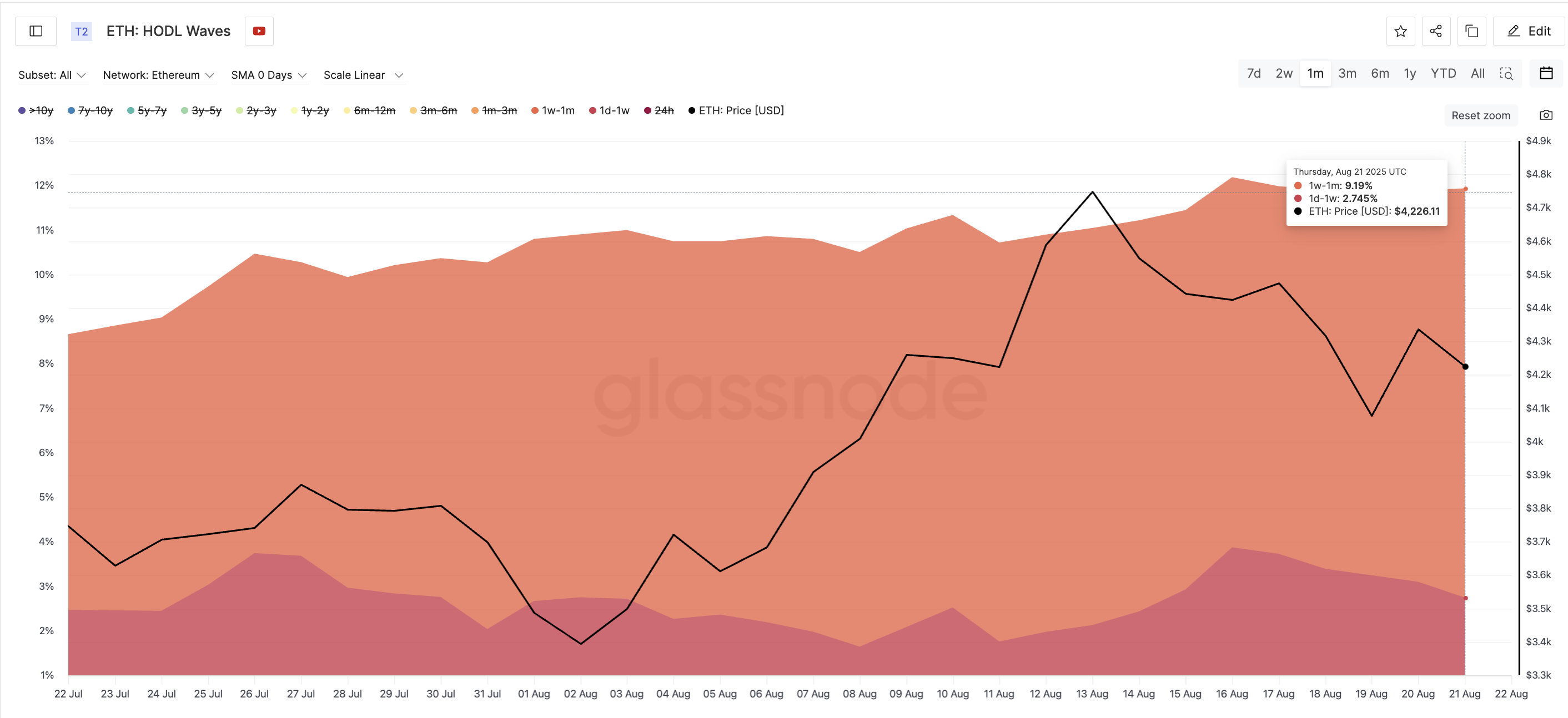

According to the data, holders for a week to one month have increased from 6.9% on July 22 to 9.19% on August 21 to 6.9%.

Hodl Waves shows the share of coins held across a variety of time bands, from days to years. It helps to clarify whether short-term traders or long-term holders are driving market activity.

Why is this important? These short-term cohorts often respond first when they see an opportunity. Their new activities suggest confidence that ETH prices may be ready to find local floors and increase their next move.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya's daily crypto newsletter.

SOPR gives tips at the bottom of the market

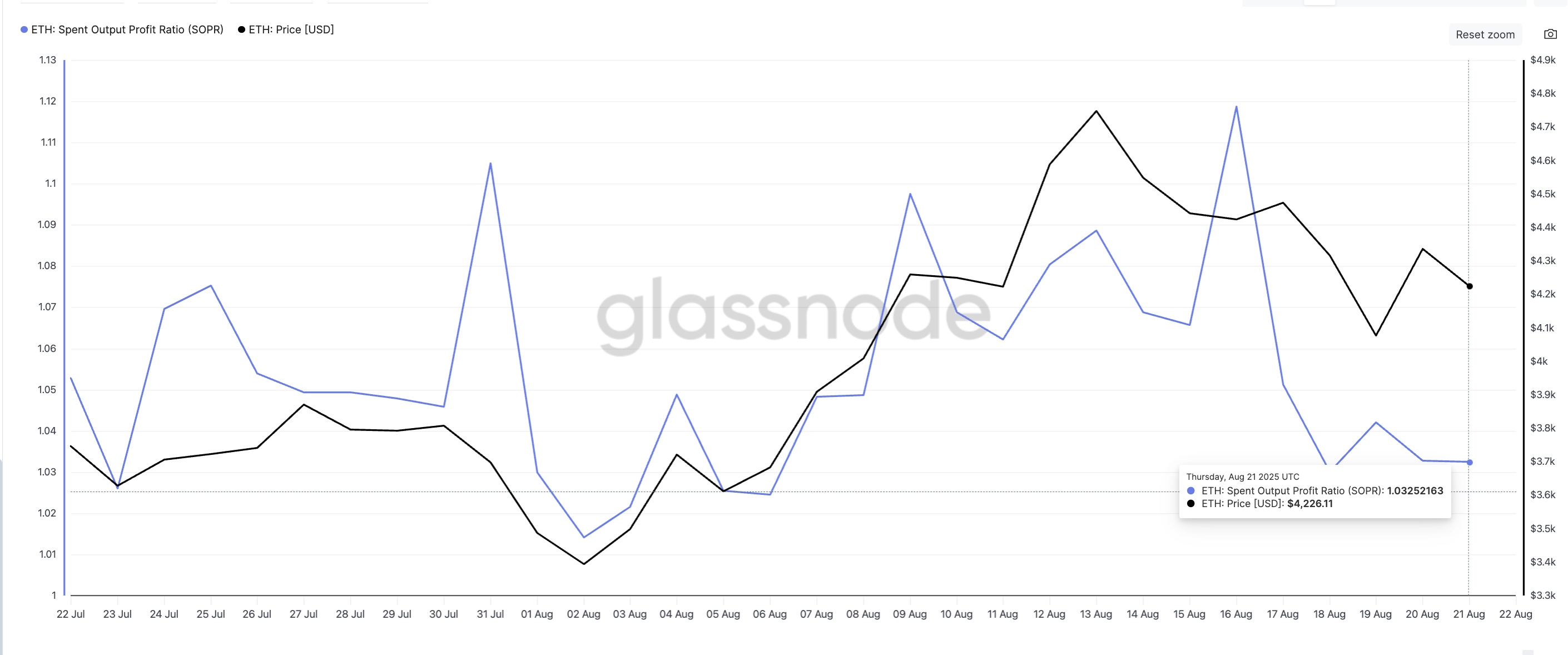

Another part of the puzzle comes from the Used Output Profit Ratio (SOPR), a metric that tracks whether coins travelled in the chain are being sold in profit or loss. If the SOPR is high, it means the holder is cashing in profit. Approx. 1 or less, when the price is corrected, it is shown that sellers are making less profits near the local bottom.

ETH Prices and SOPR: GlassNode

Over the past week, ETH's SOPR has fallen from 1.11 to 1.03. A similar movement was last observed on July 31, when the ratio fell from 1.10 to 1.01. At the time, the drop marked the bottom of the market. ETH bounced back from $3,612 to $4,748 the following day. It's a 31% meeting.

A similar setup may be in place now. A decline in SOPR suggests that profit acquisition is dry while sellers are weakening, creating conditions for buyers to recede. As history repeats itself, this could be an early signal of another rising Ethereum price.

Ethereum price pattern for reversed head and shoulders

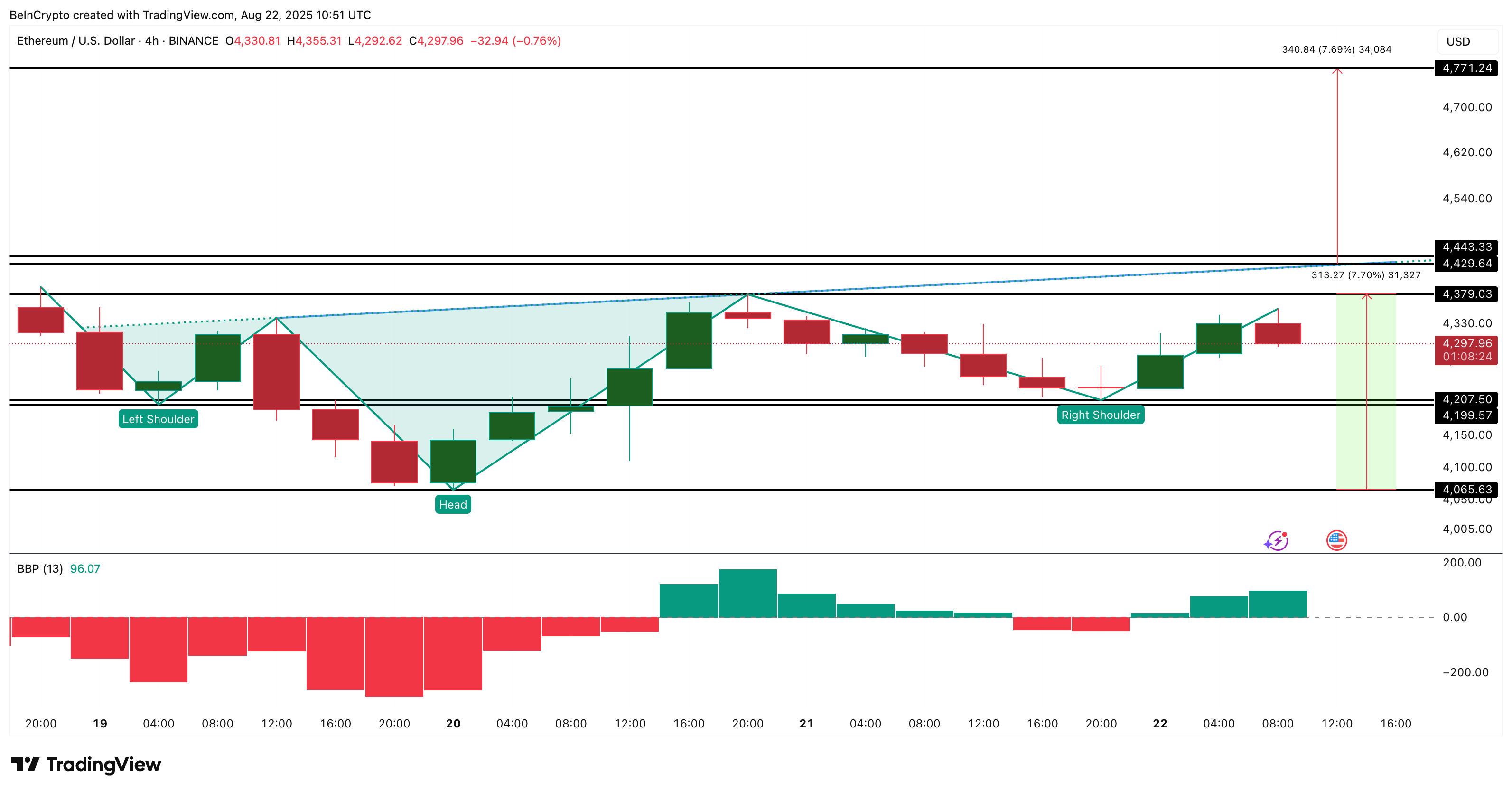

Beyond the on-chain signal, the price chart itself flashes a powerful setup. On the 4-hour chart, ETH forms a reverse head and shoulder pattern. This is a classic bull inverted signal. The neckline in this pattern is close to $4,379 and is sloping slightly upward, which often reinforces the breakout case.

Ethereum Price Analysis: TradingView

For confirmation, the ETH price must be cleared at $4,443. In that case, the technical goal would refer to $4,770, calculated from the distance between the neckline and the head. This is alongside a wider bullish signal from short-term buyers and SOPR. While Ethereum prices float in a breakout pattern, even bullish momentum increases bolster bullish cases.

The bullish increase in momentum can be indicated by the rising green bars of the bullbear power indicator. This measures the gap between the highest price and the moving average and indicates whether the buyer or seller is in control.

Still, traders need to monitor the invalidation level. When ETH drops below $4,207 (right shoulder base), the pattern breaks down and the bullish paper weakens.

One bullish pattern was able to launch Ethereum (ETH) priced at $4,770.