Stocks in Opendoor Technologies (OPEN) have skyrocketed over 170% in the last five days after being awarded meme stock of the season by traders on Wallstreetbets on Reddit.

Stocks in the online real estate market have seen speculative interest and surges in trading volume over the past month after attracting attention among traders on Wallstreetbets on Reddit.

Opendoor's stock, previously a penny stock, has skyrocketed over 500% over the past 30 days, trading at $3.11 at the time of writing.

The surge in interest has risen to more than five times the long-term average, highlighted by a dramatic spike in daily trading volumes, according to Yahoo Finance data.

On Monday alone, roughly 1.9 billion Opendoor stocks changed their hands based on fact set data cited by CNBC.

Opendoor's parabolic rally has a market capitalization of $2.3 billion. sauce: Yahoo Finance

With over 19 million members, Subreddit is known for defending high-risk trading strategies, and often targets stocks that will strengthen community support. This is a major candidate for the short squeeze.

The memestock frenzy reached a fever pitch during the Covid-19 pandemic, fuelling record stimulus payments that allow for a wave of retail. Through platforms such as Wallstreetbets, inventory such as GameStop (GME) and AMC Entertainment (AMC) have gained explosive profits despite their weak bases.

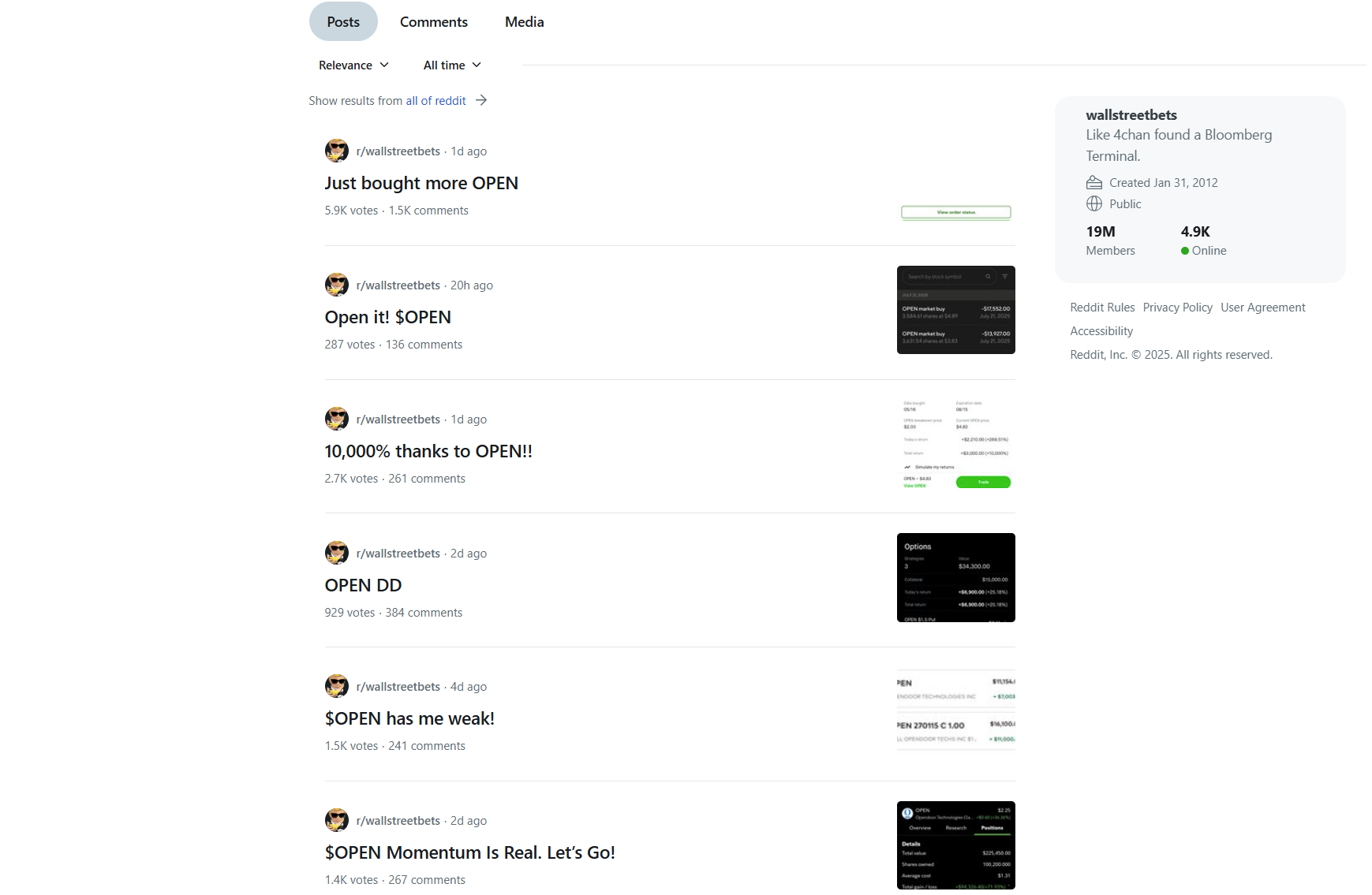

Several threads about Opendoor have recently appeared on Wallstreetbets. sauce: r/wallstreetbets

GameStop's meteor rise helped the company to stem potential bankruptcy.

Since then, GME has evolved into a vital Bitcoin (BTC) holder, bringing up billions to invest in digital assets. The company currently owns 4,710 BTC, ranking it as the 17th largest publicly traded Bitcoin investor, according to industry data.

Nevertheless, Opendoor's finances suggest a more stable foundation than many other memestock favorites identified by Wallstreetbets and others. In the first quarter, the company reported revenue of $1.2 billion. This was a 2% decrease from the previous year, but a 6% increase from the previous quarter. In particular, Opendoor has reached $99 million in gross profit.

Meme Stock, Crypto, S&P 500 Rally

The revival of meme stock enthusiasts is unfolding along with a record recovery in the US stock market and a rise in the code, which has been past its first market capitalization of $4 trillion.

Analysts say the rally is supported by increasing confidence in the economic outlook, ease of inflation, expectations for interest rate cuts this fall, and recovery in corporate revenues in the face of rising tariff-related risks.

Meanwhile, Bitcoin's momentum is being driven by institutional investors who take the long-term view that digital assets continue to be grateful over time, according to Jeff Mei, chief operating officer of Crypto Exchange BTSE.

The stocks and crypto markets appear to be closely tracking the global M2 money supply. This is the first high-profile correlation during the pandemic, following global liquidity trends, typically with a delay of 3-6 months.

Bitcoin prices are closely tracked with the breakouts of Global M2 Money Supply. sauce: Cointelegraph