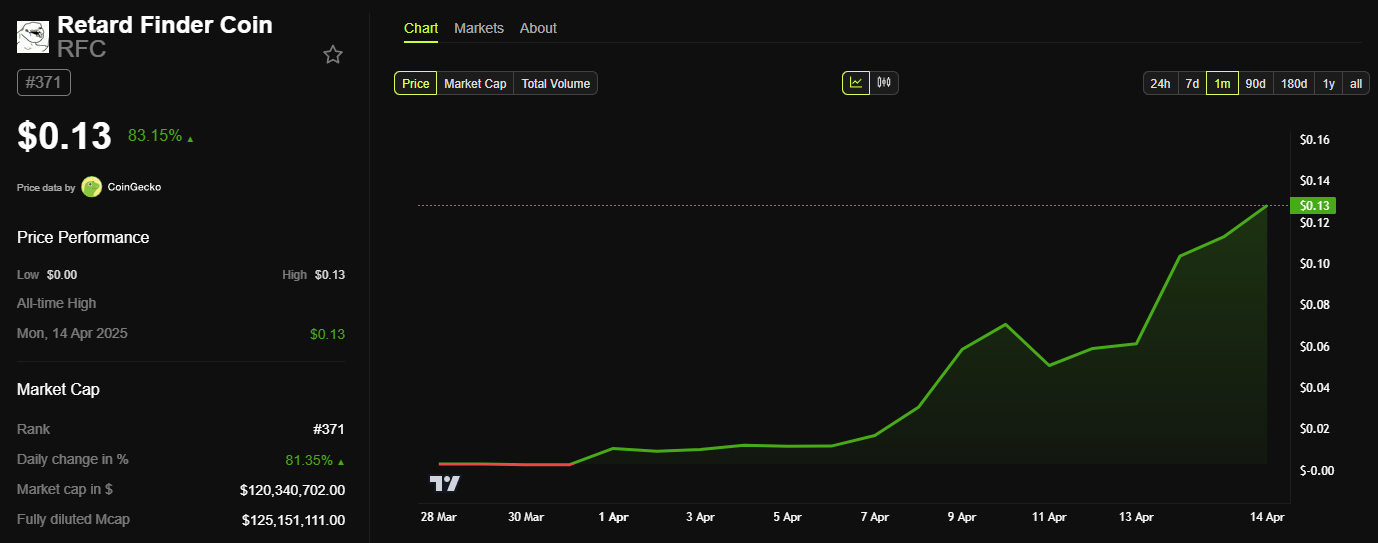

When Meme Coin Frenzy cooled, the delayed Finder Coin (RFC) unexpectedly entered the spotlight. Its prices skyrocketed, exceeding $100 million in market capitalization.

From the average price of $0.012 in early April, the RFC quickly surged to $0.13. This impressive 1,000% profit came in just two weeks. What has driven this explosive rise in RFC, a relatively new meme coin? Explore the factors behind amazing growth.

Why did Retard Finder Coin (RFC) attract investors' attention?

Retard Finder Coin (RFC) is a meme coin that works on the Solana blockchain. It was launched via the Pump.Fun platform, recognized by the rapidly growing memecoin project.

The RFC was inspired by X's “Find Retard” community. The project has a humorous, experimental social tone. They distributed 96% of the tokens via public fair launches, and only 4% were assigned to developer wallets. This gave me the initial sense of transparency.

Unlike many meme coins, RFCs do not offer fixed supply, zero tax, and airdrops, ensuring fairness and sustainability from the start. The RFC quickly gained attention thanks to its humor and viral appeal on social media.

According to Beincrypto, the RFC's market capitalization exceeded $120 million in April. This is a 10-fold increase. The token is currently trading for around $0.13. One important factor driving this rally was the exchange from Elon Musk's official X account.

Performance at Retard Finder Coin (RFC) prices. Source: Beincrypto

Many investors noticed the RFC after Musk was involved in the Return Finder X account at least 25 times since early March. Elon Musk is famous for his funny and often provocative posts about X. He regularly uses memes and satirical comments to attract attention. His tagging on the retard finder account might be considered ock ha ha, but it still draws interest.

This is not the first time a mask has an impact on a cryptographic token. He previously changed his X profile or posted meme-related content that triggers a rally with a meme token.

Musk has never seen a link to his Retard Finder account, but his interaction alone has helped him increase the volume of RFC trading throughout April. Data from the CMC shows that 24-hour trading volumes of tokens jumped from $1 million to nearly $65 million.

Whale accumulation and replacement notes

Beyond the attention of musks, whale accumulation played a major role in the surge in RFC prices.

According to Crypto analysts, Wallet 9MKY1…7O4CH purchased 16.21 million RFC tokens on April 7th at an average price of $0.0174. By April 14th, the investment had generated more than $1.3 million in return. Another wallet, identified as RFC Dev, spent $163 20 days ago to acquire 39.94 million tokens. That investment has since grown to profits of over $4.2 million.

Additionally, meme investors changed their portfolio after discovering the potential of RFCs. LookonChain data reveals that one whale sold 1.56 million Fartcoins (equivalent to $126 million) and purchased 1162 million RFCs. The move helped break the RFC's market capitalization mark of $100 million.

These large transactions have increased liquidity and confidence among small investors. As a result, more people participated and higher token prices were added.

Added a list of RFCs for Binance Alpha and a note from Bitget. Bitget's list has boosted RFC liquidity and accessibility, attracting a new wave of investors. Combined with the presence of the virus in the meme community, this has created a real “tide” around the tokens.

The surge in price for retard finder coins (RFCs) comes from a mix of Elonmask interactions, whale accumulation, and growing attention from interactions like Bitget. However, as a meme coin, RFCs pose a significant risk.

“The RFC has a cluster of bundled wallets holding 8.2%, and the top holder holds 5.7%. It holds almost 14% in total. If you want to throw away coins, be careful as you'll be throwing them hard…”

Market capitalization of meme coins. Source: CoinMarketCap

Its prices depend heavily on market sentiment and speculation, and the project lacks a solid ecosystem foundation. Meanwhile, the overall market capitalization of Memecoin fell sharply from $116 billion at the start of the year to $47 billion, falling nearly 60%.

While RFCs may be in the spotlight for now, sustaining long-term growth is a major challenge.