Pantera Capital's adherence to the Bitcoin Harving Cycle allows for impressive accuracy to forecast Bitcoin prices in 2022, highlighting how asset supply schedules will affect valuations even as cycle skepticism increases.

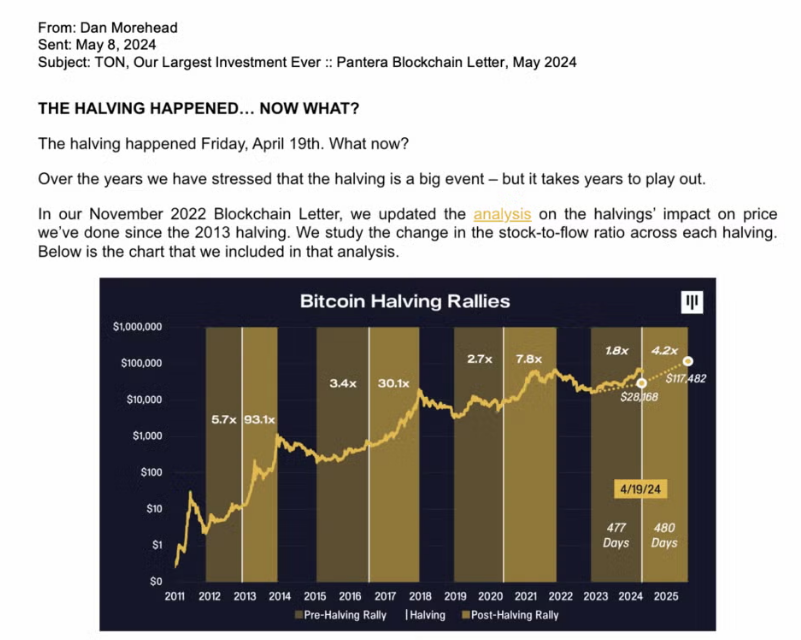

In November of that year, Pantera published a price list that mapped Bitcoin (BTC) Harving Grary and showed a decline in returns after each four years of epoch. Given the typical timing between market bottoms and post-harving gatherings, the company is projected to reach $117,482 by August 11, 2025.

Bitcoin was closed at over $119,000 on August 11, according to Coin Metrics data cited by CNBC.

Excerpt from May 2024 blockchain letter. Capital Panther

Amidst the flood of Bitcoin price forecasts, Pantera stood out for its remarkable accuracy. Bitcoin was heading towards a low cycle, below $16,000 at the time of its initial forecast, according to Bitbo.

Bitcoin is currently trading nearly $120,000, up over 660% from 2022 Low.

The rally highlights the predicted strength of Bitcoin's four-year price cycle. This closely coincides with half of its events and generally follows a pattern of postharving gatherings, cycle peaks, corrections and accumulation.

Analysts such as Bob Loukas apply Cycle Theory to map highs and lows of Bitcoin. Loukas correctly identified the start of the new four-year cycle in January 2023, less than two months after Bitcoin reached its bottom.

sauce: Bob Lucas

Does institutional adoption change the story of the Bitcoin cycle?

Half Bitcoin cycles bring a fresh story about why this is “different this time” and why the four-year cycle pattern is destined to fade.

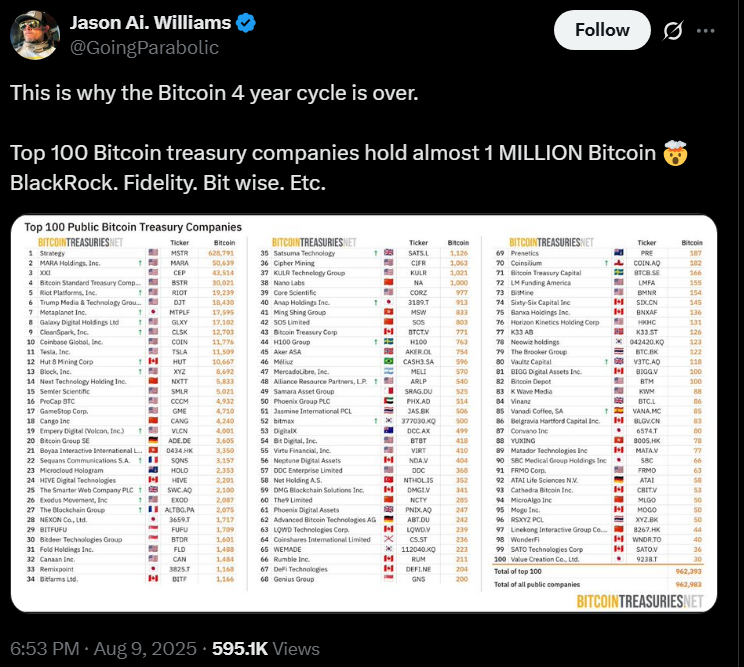

For their credibility, those who predict the erosion of these dynamics have a strong point this time. Bitcoin has never been this institutionalized, along with companies that own exchange trade funds (ETFs) and millions of BTC.

Starting in January 2024, US spot Bitcoin ETFs have become the most successful ETF debut in history. According to Bitbo, ETFs currently hold 7.1% of their Bitcoin supply. Public companies and private companies together account for an additional 1.36 million BTC.

Author and investor Jason Williams points to the rise of the Bitcoin Treasury successor company as a reason to believe that “the four-year Bitcoin cycle is over.”

sauce: Jason Williams

Bitcoin advocate Pierre Rochard agreed, “Halving is not important for float trading, 95% of the BTC is mined and the supply comes from the acquisition of OGS.