Privacy coin zcash experienced a sharp price collapse, dropping to $316 on December 2nd, a drop of over 30% since November 26th. Technical analysis remains bearish, with one analyst expecting the coin to continue declining towards the $297-$311 support range before a possible reversal.

Double-digit loss due to ZEC market capitalization contraction

Privacy coin Zcash (ZEC) fell to $316 on December 2nd, its lowest price in almost a month. The price drop comes as the strong privacy claims that fueled recent stock gains have faded, leading to hefty losses.

ZEC rose to just under $380 at one point, helped by a rally in the broader crypto market triggered by headlines about asset management giant Vanguard. However, that momentum quickly dissipated, indicating the coin’s fragile technical support level and the temporary nature of the sentiment-driven rally. Privacy Coin was back below $350 at press time (1:30 p.m. ET).

ZEC was one of the few digital assets to post negative returns for seven days. In fact, it had the notable distinction of being the only high-cap altcoin with double-digit losses. Since peaking at $700 on November 20, ZEC’s market cap has shrunk from nearly $11.5 billion to $5.67 billion, losing its position as the most capitalized privacy coin in the process. The reversal has fueled claims of a coordinated “pump-and-dump” scheme, with critics arguing that the rally was driven by hype rather than fundamentals.

Governance systems under attack

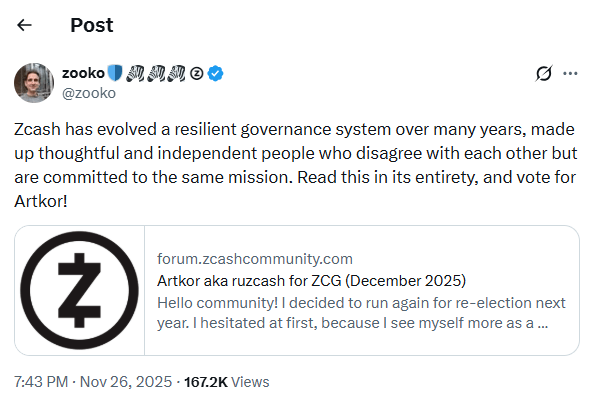

Analysts have pointed to Zcash's controversial governance model as a key factor behind the privacy coin's recent struggles, with the system drawing harsh criticism from prominent industry voices. The flashpoint came on November 26th, when co-founder Zuko Wilcox defended the current committee-driven off-chain governance structure in a post about X. This framework, backed by bodies such as the Zcash Community Grants Committee (ZCG), places decision-making power in the hands of a small group of appointed individuals, an approach that many argue undermines decentralization.

Wilcox argued that the system works because it relies on “thoughtful and independent” people who are dedicated to the protocol's mission. This defense immediately sparked a backlash. Navy's Ravikanth, whose past comments appear to have triggered ZEC's parabolic rally, accused the governance system of being “outdated”. He argued that the system was flawed, saying:

“A ‘trusted’ third party is a security flaw, and it doesn’t matter if they are ‘thoughtful and independent.’ All governance of decentralized protocols must be on-chain and private.”

read more: Privacy coin ZEC soars after announcement of Thorswap support and Grayscale Trust

Ethereum co-founder Vitalik Buterin added to the chorus of disapproval by claiming that “token voting is bad in every sense of the word.” “Privacy is exactly the kind of thing that will erode over time if you leave it to the median token holder,” Buterin said.

A public debate about the fundamental future of Zcash's governance coincided with the plummeting price. ZEC has fallen more than 30% since Wilcox's post on November 26th. Still, some technology analysts predict further declines in privacy coins. Analyst Aldi gave a bearish outlook in a Dec. 2 post, saying he expects the decline to continue until a key support level is reached.

“We are heading headlong into the $297-$311 magnet. The RSI (squeezed here) but price is barely reacting. This means sellers are still choking the market. When the indicators scream 'buy' and prices don't move anything, the flush usually goes even deeper,” the analyst explained.

Aldi confirmed that it will maintain its short position unless ZEC regains the $380 level.

Frequently asked questions 💡

- Why did ZEC fall to $316? The rise of privacy coins has faded as the hype has run out of steam.

- How much was the loss? ZEC has fallen more than 30% since November 26, with its market capitalization shrinking from $11.5 billion to $5.67 billion.

- What role did governance play? Zcash’s off-chain commission system drew harsh criticism from industry leaders such as Naval Ravikant and Vitalik Buterin.

- What does the future hold? Analysts warn of further declines unless ZEC regains the $380 resistance level.