important notes

- Brandt said past violations of similar structures led to declines of nearly 80%.

- Bitcoin continues to struggle below the key resistance level at $93,000, mainly due to selling pressure from retail investors.

- Investors remain nervous as important macro events are coming up this week, including the US Consumer Price Index in November and the Bank of Japan's decision to raise interest rates.

Despite the Fed’s interest rate cuts and the end of quantitative tightening (QT), Bitcoin remains BTC $89,866 24 hour volatility: 0.3% Market capitalization: $1.79 trillion Vol. 24 hours: $3.509 billion The price is under strong selling pressure and is once again trading below $90,000.

This week will be an important week with the release of the US consumer price index for November and the Bank of Japan's decision to raise interest rates.

Peter Brandt predicts Bitcoin price crash

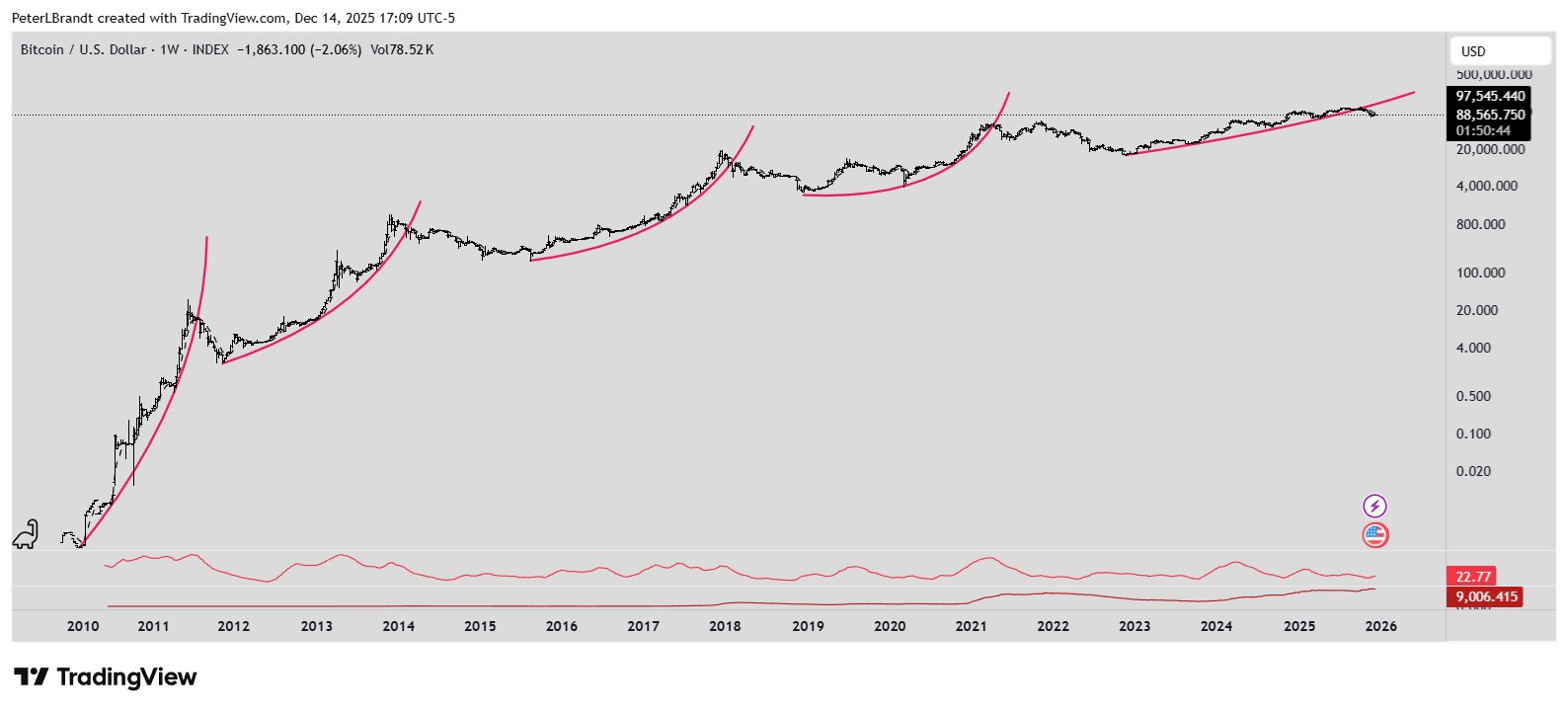

Veteran trader Peter Brandt has warned that Bitcoin may be entering a deeper correction based on past market cycles. Brandt pointed out that Bitcoin bull cycles typically follow a parabolic progression. However, once BTC broke the parabolic trend, Bitcoin price crashed nearly 80% from its peak.

Bitcoin breaks below parabolic trend | Source: Peter Brandt

According to Brandt, the current parabolic structure has been violated, as shown in the image above. This further increases the risk of significant drawdowns. Brandt suggested that based on historical trends, Bitcoin's roughly 80% decline from its all-time high would suggest a price level closer to $25,240.

Most of the selling pressure on BTC is coming from retail investors. Bitcoin price is facing a strong rebound at $93,000, and the bulls have not been able to break out of it.

Over the past week, BTC has once again fallen below the $90,000 level and is testing the $88,000 support. Nevertheless, some market experts remain bullish on BTC.

Market analyst Captain Fybic said a breakout in Bitcoin prices could be on the horizon. However, he stressed that bulls need to regain resistance at $93,000 to regain upside momentum.

Related article: Binance Whale inflows collapse as retail investors continue to sell Bitcoin

Fibig noted that while buyers are struggling to break above $93,000, resistance is gradually weakening due to repeated retests.

$BTC breakout is just a matter of time.. 📈🔥

The bulls need to reclaim the $93,000 resistance to fully regain bullish momentum.

The bulls are still struggling to regain the $93,000 resistance, but this resistance has gotten weaker with each retest.

If the wedge breaks upward… pic.twitter.com/vRDZdqpBYP

— Captain Faibik🐺 (@CryptoFaibik) December 15, 2025

Meanwhile, Strategy CEO Michael Saylor hinted that more BTC purchases will be made in the future. The largest Bitcoin treasury company already holds 660,524 BTC worth $58.5 billion.

US CPI and Bank of Japan rate hike decision looms

Prior to this, on Thursday, December 18th, the US will release the CPI (Consumer Price Inflation) figures for November. Recent forecasts for U.S. consumer price inflation in November 2025 indicate an increase of approximately 3.1% year-over-year and approximately 0.4% month-over-month. These numbers could influence the Fed's decision to cut interest rates in the future.

Meanwhile, the Bank of Japan's interest rate decision is coming up on December 19th.

The last three times Japan has raised interest rates, the BTC dollar has fallen by 20% to 30%.

The Bank of Japan is expected to raise interest rates again on December 19th.

Will it be different this time? pic.twitter.com/2Glf0U9jQd

— Ted (@TedPillows) December 14, 2025

Popular market analyst Ted Pillows pointed out that the last three times the Bank of Japan announced interest rate hikes, Bitcoin prices fell by 20-30%. If history repeats itself, we cannot rule out the possibility that it could drop to $70,000.

Disclaimer: Coinspeaker is committed to providing fair and transparent reporting. This article is intended to provide accurate and timely information but should not be taken as financial or investment advice. Market conditions can change rapidly, so we recommend that you verify the information yourself and consult a professional before making any decisions based on this content.