Some trading activity and volumes reported on prediction market platform Polymarket may be significantly higher due to a “data bug”, according to researchers at Paradigm.

“We found that nearly every major dashboard was double-counting polymarket volumes that were not related to wash trading,” said Storm, a researcher at a venture capital firm.

Storm explained that this is because “Polymarket's on-chain data contains redundant representations of each transaction.”

“Polymarket’s on-chain data is highly complex, which has led to widespread adoption of flawed accounting methods.”

When a trade occurs in Polymarket, the system emits multiple “OrderFilled” events. One set for makers with existing orders and another set for takers executing trades.

These events are not separate transactions, but describe the same transaction from different perspectives. However, many major dashboards combine these to count the same volume twice.

Polymarket is seen as a rare crypto success these days, as spot and derivatives markets are in turmoil. If that headline metric turns out to be potentially inaccurate on many dashboards, some of that perceived success can be tarnished.

Polymarket’s complex blockchain data

The researchers went on to explain that the accounting bug “inflates the volume of notional value and cash flow, both types of volume metrics commonly used for market forecasting.”

“Polymarket data is notoriously confusing to cryptocurrency data analysts… There are too many interacting layers of complexity in the data to unravel using block explorers alone.”

Related: Polymarket plans to use in-house market makers to trade with users: report

This complexity arises because Polymarket transactions can be simple swaps, or “splits” and “mergers” where both parties exchange cash for opposing positions.

Smart contracts emit redundant events for tracking purposes, and standard blockchain explorers do not make this distinction clear, the researchers said.

Cointelegraph reached out to Polymarket for comment, but did not immediately receive a response.

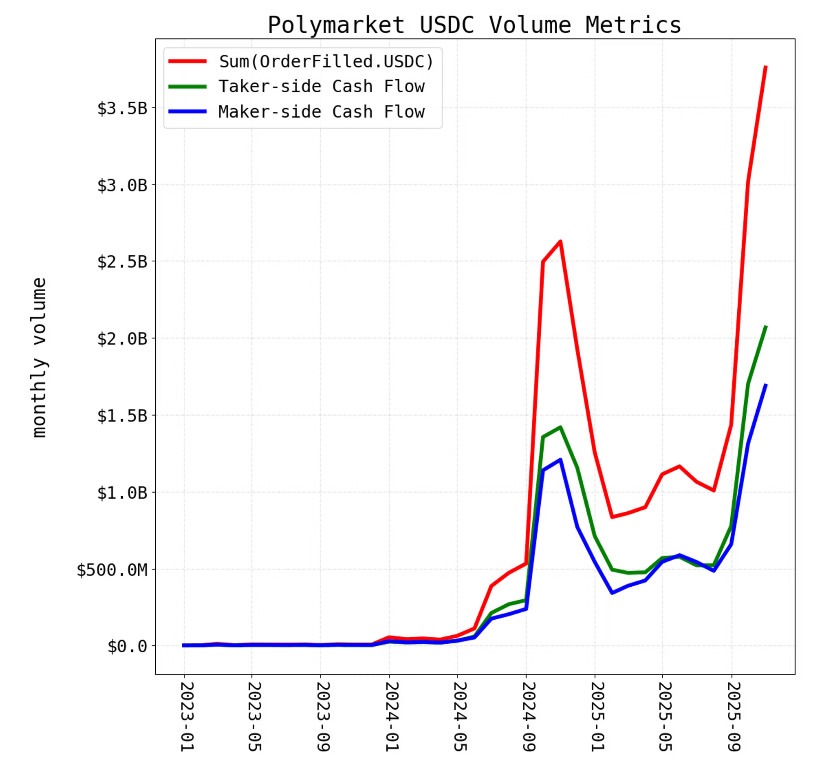

Polymarket volume using various metrics. sauce: paradigm

Polymarket is valued at $9 billion

Intercontinental Exchange (ICE) this week reportedly valued the prediction platform at $9 billion, with trading volume of $25 billion, but that number may now be in question.

In September, it was reported that Polymarket was preparing to launch in the US at a valuation of $10 billion. In October, Bloomberg reported that the company was considering raising capital at a valuation of $12 billion to $15 billion.

Meanwhile, Dune Analytics reported that the platform achieved a record monthly trading volume of $3.7 billion in November, which could be double the actual number if Paradigm's research is correct.

“DefiLlama, Allium, Blockworks, and many Dune dashboards were double-counted,” the researchers said.

Prediction markets are rapidly evolving into an important financial sector, and “as the category matures, the industry should converge on consistent, transparent, and objective reporting standards,” the researchers concluded.

magazine: Kalsi taps Solana in XRP's 'now or never' moment: Hodler's Digest