Polymarket is recruiting an in-house team of traders and market makers to prepare for forecast growth. The addition of market makers could boost Polymarket after a record month of activity in November.

Polymarket has reportedly expanded its team and added internal market makers who can trade with customers. The forecasting platform aims to improve liquidity and so far relies primarily on whales to hold a selection of positions.

The market maker function has faced criticism in the past for its potential to distort the market through transactions with retailers.

The hiring announcement comes as rumors are circulating that Wintermute and other market makers will be joining Polymarket. The platform is also closely monitored for high-profile whales and long-standing accounts. winning streak.

Polymarket whales still hold significant influence

While polymarkets are growing, there are also concerns that the presence of whales could skew forecasts, which rely on the knowledge of retailers and ordinary social media users.

Also found Polymarket Explorer account Connect to your Wintermute wallet. The platform has grown enough to the point of specialization as traders seek arbitrage, niche expertise, and a way to be the first to know the true odds.

Cryptocurrency market maker Jump Trading has joined Kalsi in the past few months, opening the door to market maker support.

According to Bloomberg, based on anonymous sources familiar with the matter, Polymarket has approached traders, including some with a track record in professional sports betting, about joining its internal trading team.

Market makers challenge polymarket neutrality

During its rise to fame in 2024, Polymarket was introduced as an engine of truth discovery based on the opinions of decentralized traders. However, Kalsi took a different approach and applied an in-house team that often deals with users.

This approach could mimic regular sportsbook betting, where the platform sets the odds and profits from its customers' losses. However, market makers may play a role in ensuring liquidity in a particular market by taking on less popular positions.

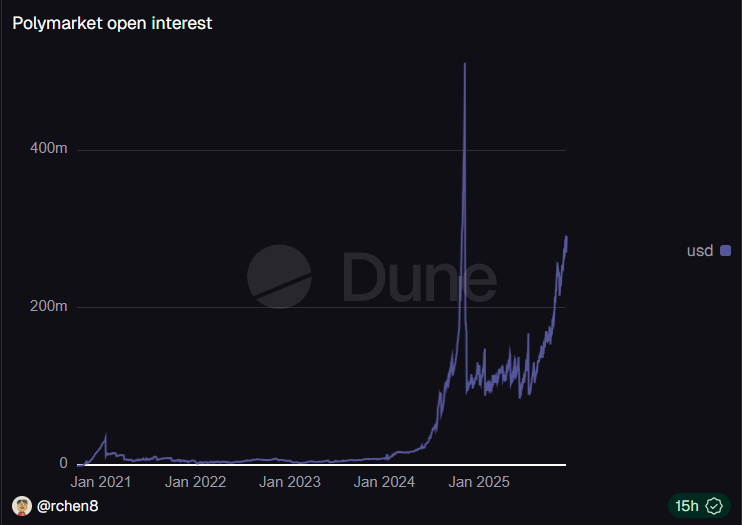

The mention of an in-house team comes just as Polymarket begins a closed beta of its iOS app and prepares to launch in the US market. The app is already gaining popularity and is expected to gain mainstream adoption. The platform has over $286 million in open interest and has grown vertically over the past two months.

Although Polymarket has not yet surpassed its open interest record from late 2024, it is on a rapid growth trajectory.

Polymarket's open interest has increased rapidly over the past two months due to an influx of new users and an increase in open queries. |Source: Dune Analytics

Polymarket is already one of the major trading venues, and its trading volume has recently expanded to surpass that of Solana. meme token groove. Forecasting has also become more influential ahead of the perpetual futures market, making it simpler to do without technical or trading knowledge.

Polymarket also lacked rapid liquidations and losses like other crypto markets, which made it more attractive. In November, Polymarket hit a record of over 494,000 active traders.