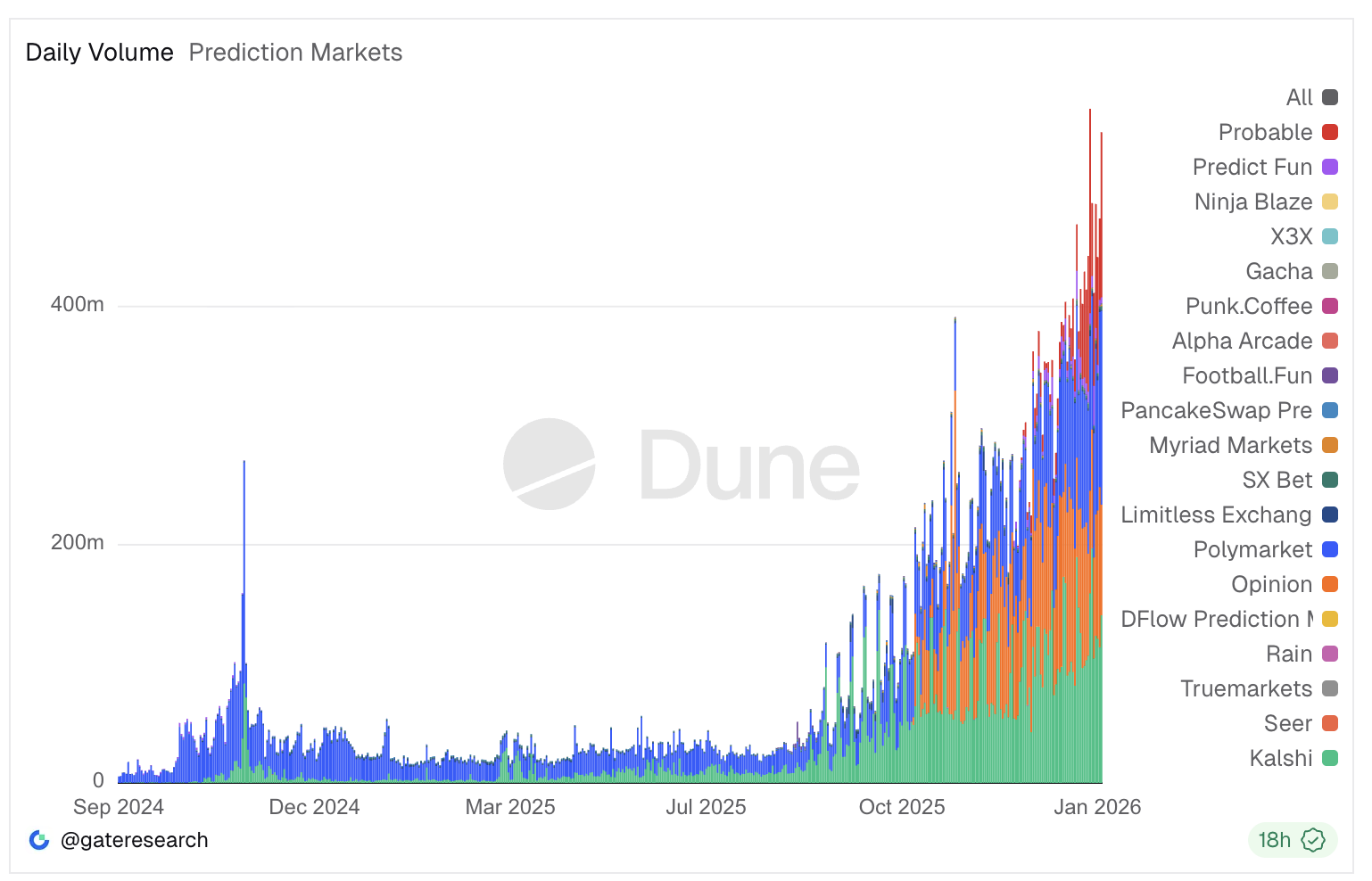

January was a big month for prediction markets. Total trading volume for the month exceeded $12 billion, a new record high. Kalshi, Polymarket, Oinion, and Probable each surpassed $1 billion on their own.

Charges were incurred after the activity. On-chain fees exceeded $11 million in January across prediction markets. Opinions alone generated $6.14 million.

Polymarket added $2.62 million. The remaining platforms let users top up their balances by placing bets tied to politics, sports, and other real-world outcomes.

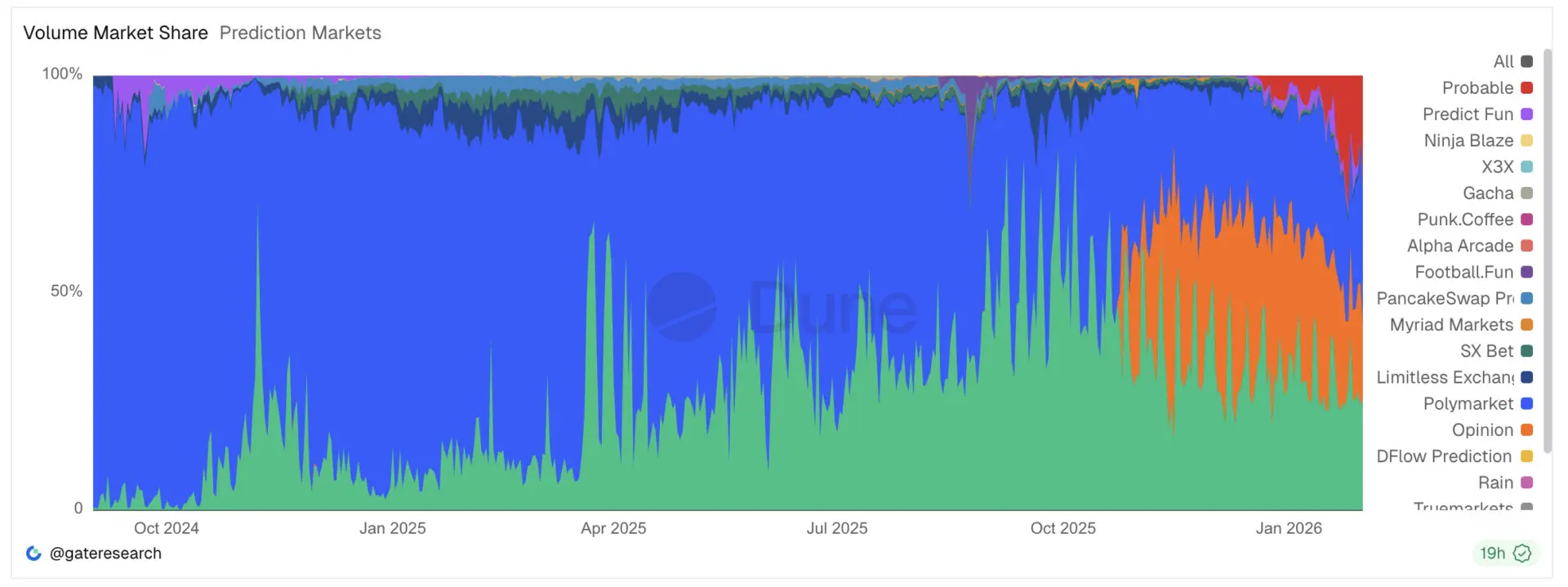

Calci and Polymarket lead in volume, share and open interest

According to Dune data, Karshi's 7-day average trading volume was $137 million, and its 30-day average was $119.66 million.

Kalshi's 90-day average reached $97.54 Million, with week-over-week trading volume increasing by 10.62%, month-over-month volume increasing by 37.71%, and quarter-on-quarter volume increasing by 128.63%.

Source: Dune

Kalsi currently holds a market share of 28.10% for 7-days, 29.80% for 30-days and 31.36% for 90-days. Total open interest was $428.18 million. The volume-to-open interest ratio is 32%, a level that traders are closely monitoring in any forecast setting.

Polymarket was nearby. Its 7-day average volume reached $129.16 Million. The 30-day average hit $110.19 million. The 90-day average printed $82.23 million. Week-on-week trading volume increased by 15.76%.

The month-on-month increase was 48.53%. This was an increase of 162.49% quarter-over-quarter. The market share was 26.49% for 7 days, 27.45% for 30 days, and 26.44% for 90 days. Open interest reached $405.85 million. The trading volume to open interest ratio was 31.83%.

That's probably an extreme number. Its 7-day average volume hit $101.78 Million. Month-on-month trading volume increased by 589.70%. Open interest was just $3.55 million. This resulted in a volume-to-open interest ratio of 2870.49%, one of the highest across the forecasting sector.

Opinion had a 7-day volume of $101.02 million, 30-day volume of $107.14 million, and 90-day volume of $90.22 million. Open interest remained at $128.23 million, with a ratio of 78.78%.

Smaller platforms experience sharp fluctuations in weekly and monthly data

Predict Fun had a seven-day average of $10.97 million. Week-on-week trading volume decreased by 25.83%. Up 277.84% from the previous month. The quarter-over-quarter ratio was extreme due to lower activity earlier.

Open interest was $21.37 million, with a ratio of 51.36%. Limitless Exchange averaged $3.51 million over 7 days. Weekly trading volume increased by 170.03%. The open interest was $364,21,000 and the ratio was 962.77%.

SX Bet had 7-day trading volume of $2.52 million and open interest of $7.4408 million. The ratio reached 338.66%. PancakeSwap Prediction had a 7-day trading volume of $566,36,000 and a market share of 0.12%.

Myriad Markets' average open interest was $4.2705M and open interest was $8.0832M. Football.Fun handled $291.76 million weekly and had an open interest of $5.09 million, giving it a low ratio of 5.73%.

Rain had a significant weekly increase of 8,101.94% on a volume of $116,23,000. DFlow prediction market hit $94,71,000 with weekly growth of 111.48% and open interest of $1.41 million.

Source: Dune

Alpha Arcade, Gacha, Seer, X3X, Truemarkets, Ninja Blaze, and Punk.Coffee all remain small but continue to report volume, open interest, and ratios, showing how wide the range of predictions has become.

Regulators are rewriting the rules for prediction markets as politics and sports drive activity

The Commodity Futures Trading Commission announced new rules for the multibillion-dollar forecasting industry. “The time has come for clear rules and a clear understanding that the CFTC supports legitimate innovation in these markets,” said Commissioner Michael Selig. “We will continue to support the responsible development of the event contract market,” he added.

Calci and Polymarket's U.S. arm operate a CFTC-regulated exchange that allows users to trade election and Super Bowl-related outcomes. Activity surged despite pushback from gaming regulators in some states. Based on data from Dune Analytics, the majority of Kalsi's volume came from sports contracts.

The Trump family also moved into the space. Donald Trump Jr. became an advisor to both Calci and Polymarket. Trump Media & Technology Group, Inc. has announced plans for its own marketplace. No companies commented on this rule change.

Mr. Selig withdrew a 2024 proposal put forth under former president Rostin Behnam to ban sports and political contracts. He also rescinded a 2025 staff recommendation related to the lawsuit. “That's actually adding to the uncertainty in the market,” Selig said. He added that the CFTC will protect its exclusive authority over commodity derivatives.

Selig took office in December and spoke at the Cryptocurrency Regulatory Commission alongside SEC Chairman Paul Atkins. The two agencies said they intend to work together as lawmakers debate oversight. The Senate Agriculture Committee passed a bill that would give the CFTC authority over physical goods such as Bitcoin. A companion bill in the Senate Banking Committee stalled over limits on exchange fees. Selig said formal legislation is still needed.