Predictive Oncology (POAI), a biotechnology company specializing in AI-driven cancer research, has announced its $344.4 million digital assets and finance ministry, focusing on AETHIR's ATH tokens.

The capital strategy is a predictive oncology that was developed from the guidance from the Web3 Investment and Advisory Company, DNA Fund, and was disclosed on Monday from BTIG, which served as a placement agent. According to the DNA Fund, it was composed as two simultaneous private placements, including cash investments, including ATH tokens in kind contributions and cash investments and another announcement.

This structure allows predictive oncology to implement a hybrid finance model that records tokenized depin infrastructure as balance sheet assets and links traditional stock markets with decentralized computing networks. The ATH Treasury is directly linked to Aethir's decentralized GPU infrastructure.

AETHIR is a distributed cloud network that provides GPU infrastructure for AI, high-performance computing and gaming applications. The network uses blockchain technology to coordinate and distribute access to physical computing resources and positions it as a major participant in the Depin market.

According to CoinmarketCap, the network's native asset, ATH, is currently trading at less than $0.06 with a market capitalization of around $2.3 billion. ATH's 24-hour trading volume has probably increased by more than 330%, due to a announcement from the Ministry of Forecast Oncology and Treasury.

went (A) Token price. sauce: coinmarketcap

Related: VC Roundup: Investors will continue to support depin, web3 games, layer-1 rwas

Predictive Oncology Blockchain Pivot Lift Stock

The shift to a decentralized infrastructure in predictive oncology attracted early attention from investors, and surged by more than 70% on Monday following an announcement from the Ministry of Digital Assets Treasury. The rally has pushed stocks to the highest level since March.

Prior to the announcement, predictive oncology traded as a penny stock with a history of quarterly losses for the past two years, with limited revenues. The company reported net losses of just $2,682 for the second quarter of 2025, with $110,310 for the first quarter, and more than $2 million for each period.

In the most recent quarter, forecast oncology raised approximately $586,000 through its market offerings to help its operations.

In March, the company sold Skyline Medical Division. This has produced automated fluid waste management devices used in medical centres as part of a broader strategy to reduce and focus on AI-driven drug discovery.

Predictive Oncology's new strategy is positioned in the growth group of small and medium-sized businesses and microcap companies that pivot towards a digital asset financing model. In July, the former Biotech Company 180 Life Sciences announced plans to reform as Ethzilla and accumulate Ether (ETH) as a financial asset.

Other stock trading companies, including Mill City Ventures (MCVT), Nature's Miracle (NMHI), Upexi (UPXI), Helius Medical Technologies (HSDT), and Avax One (formerly Agriforce Growing Systems), have made similar moves to integrate crypto assets into their balance sheets.

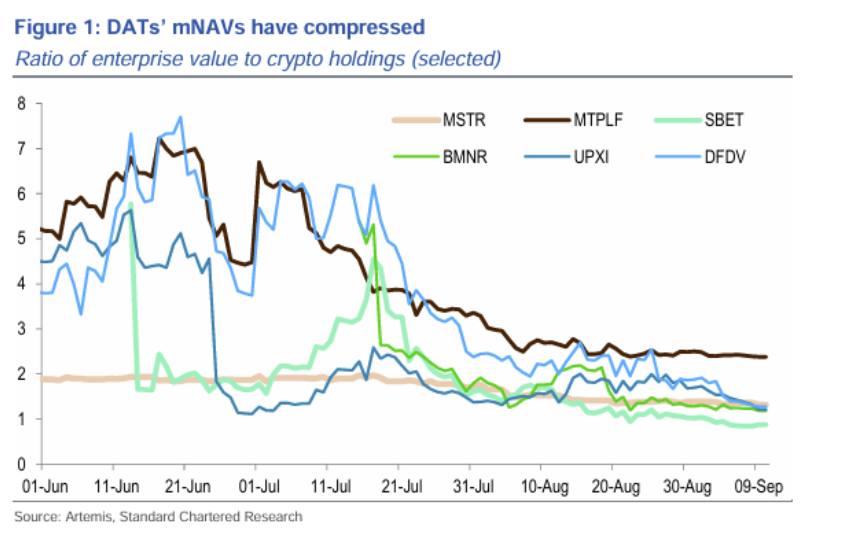

Standard Chartered analysts warn that digital asset financing companies may face valuation as market net asset value (MNAVS) that compares crypto holdings.

The largest Digital Assets Treasury (DAT) companies have experienced MNAV compression in recent months. Source: Standard Chartered

“We consider market saturation to be a major factor in recent MNAV compression,” writes Standard Chartered, referring to the rapid growth of companies adopting this year's digital asset financing strategy.

Related: After a $400 million splurge, ETH Treasurer's Eye stocks buyback amid leverage concerns