President Donald Trump announced Tuesday that Venezuela's “interim authorities” would transfer between 30 million and 50 million barrels of oil to the United States, days after the U.S. military captured President Nicolas Maduro in a military raid.

The announcement has fueled speculation about what other Venezuelan assets will be next, including the Bitcoin the country is rumored to hold.

The burning of oil determines the tone.

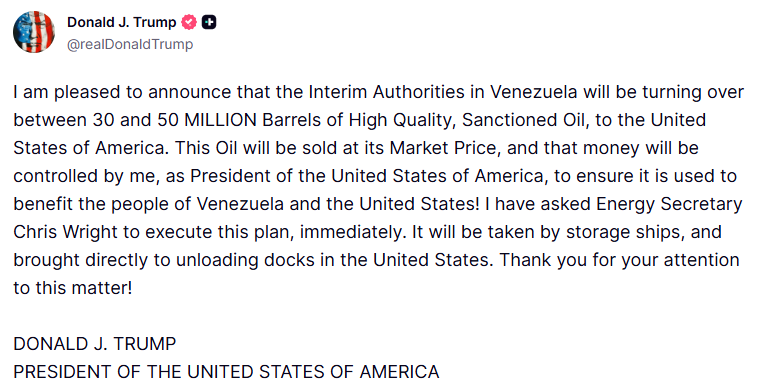

President Trump posted on Truth Social that the oil would be “sold at market price” and that the proceeds would be “controlled by me as President of the United States.” At about $56 per barrel, the deal could be worth up to $2.8 billion.

The White House has scheduled a meeting in the Oval Office on Friday with executives from Exxon, Chevron and ConocoPhillips to discuss Venezuela's oil sector, suggesting Washington's interest goes beyond a one-time transfer. Venezuela has the world's largest proven oil reserves.

President Trump has ordered Energy Secretary Chris Wright to “immediately” implement a plan to transport oil directly to U.S. ports on storage ships.

Bitcoin speculation intensifies

The influx of physical assets into Washington has drawn attention to Venezuela's alleged holdings of virtual currency. According to some reports, the Maduro regime has been accumulating “shadow reserves” of Bitcoin to circumvent international sanctions.

Estimates vary widely. Project Brazen, citing unnamed sources, reported that Venezuela may hold around $60 billion in Bitcoin. According to Bitcointreasuries.net, this figure is just 240 BTC, which is equivalent to about $22 million.

Neither estimate has been verified through on-chain analysis. The wallet has not been made public and the name of the administrator has not been disclosed.

Experts say it is reasonable to believe that Venezuela was seeking exposure to Bitcoin, given its exclusion from global financial markets. The country has a documented history of experimenting with cryptocurrencies, including the Petrotoken, which was launched in 2018 and failed.

Why Bitcoin is different

Unlike oil tankers, which can be transferred to U.S. ports, Bitcoin cannot be physically seized. Confiscation of cryptocurrencies requires either the private key or the cooperation of a custodian located in a U.S. jurisdiction.

Venezuela would not have used the custody services of the United States or its allies given its sanctions status. Maduro's inner circle likely has assets spread across many wallets, making it extremely difficult to track them.

But the same characteristics that make Bitcoin difficult to confiscate also make it incredibly easy to move around for those with the right information. Unlike gold bars or oil barrels, which require physical logistics, anyone with the private key can move Bitcoin anywhere in the world within minutes. If U.S. authorities were to extract private keys from Maduro or his associates, they could immediately seize billions of dollars in cryptocurrencies.

This creates a high-stakes dynamic situation. Assets are either completely inaccessible or easily seized, and there is nothing in between.

What does strategic reserve mean?

This speculation gains further weight given President Trump's executive order to create a strategic Bitcoin reserve “at no cost to taxpayers.” Critics question how the government can accumulate such reserves without making purchases.

Seizing Venezuelan Bitcoin could theoretically address this challenge, provided it exists in meaningful quantities. However, prosecutors must link any evidence directly to criminal charges filed in U.S. courts.

Some crypto market observers see long-term bullish implications regardless of the outcome. Given its stated commitment to building strategic reserves, the administration is likely to hold on to the acquired Bitcoin rather than sell it.

For now, Venezuelan oil is heading to American ports. That Bitcoin, if it ever existed, remains locked with unknown keys and beyond the reach of even the most aggressive law enforcement actions.

President Trump Secures Venezuelan Oil—Is Bitcoin Next?The post appeared first on BeInCrypto.