Pump.Fun is building serious momentum. Solana-based LaunchPad surpasses high lipids in another milestone of its latest comeback: daily revenue.

summary

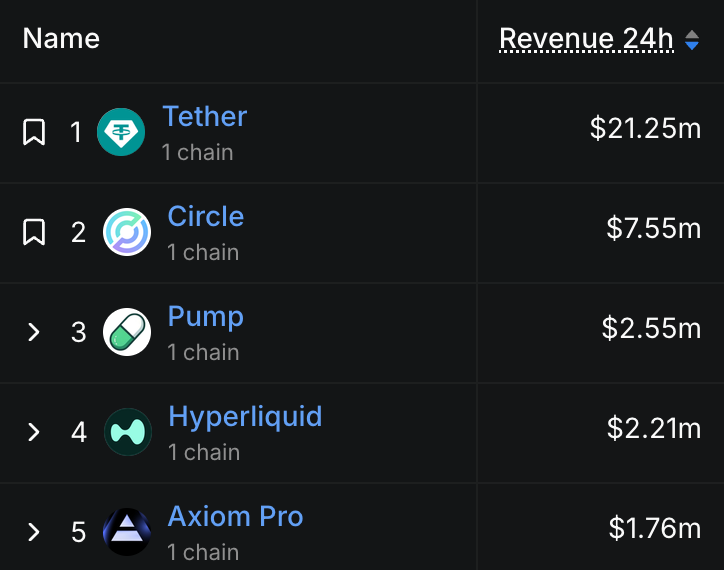

- Pump.Fun generated $2.55 million in 24-hour revenue, surpassing Hyperliquid's $22.1 million.

- Growth occurs after Project Ascend is started when the protocol is started. This introduces dynamic market capitalization-based fees to reward long-term token growth.

- The pump token rose 10.39% that day, surpassing the high-lipid hype token.

According to Defillama data, Solana Memecoin creation tool pump.

Pump.Fun overtakes high lipids with 24-hour revenue generation | Source: Defilama

Pump.Fun has generated around $2.55 million in the last 24 hours, surpassing the high lipids that recorded $2.21 million over the same period. Additionally, MemeCoin Launchpad's cumulative revenues reached $784.56 million, surpassing Hyperliquid's $658.5 million.

This achievement makes Launchpad the highest-paid income dap in Crypto, only causing it to be behind Stablecoin publishers, tethers and circles. At the beginning of February, high lipids had overtaken the pumps. Now, the platform is once again climbing the leaderboard, backed by aggressive buybacks and new projects that could attract more creators.

You might like it too: High lipid price rise after 126x forecast of Arthur Hayes

Project Ascend Targets pump.funLong-term growth

Much of the platform's recent revival will be linked to a strategic update known as Project Ascend, announced on September 2nd. This creator-centered overhaul designs the pump's fun ecosystem 100 times more, increasing the long-term sustainability of Memecoin launched on the platform.

At the heart of this initiative is Dynamic Fees V1, a layered model that links creator fees to token market capitalization. As the market capitalization of a token increases, the associated fees decrease. This design discourages the platform from the criticised pump and dump operation, and discourages developers from relying on community-supported sustainable tokens.

This protocol describes the system as a way to make 10 times more rewarding tokens more rewarding, reducing the excessive cost of projects achieving scale.

In addition to structural changes, buybacks and user activity have strengthened positive momentum. Total buybacks now reach $69.5 million, indicating the platform's ongoing efforts to reduce token supply and stabilize price action.

These buybacks are funded by revenue generated from token launches and platform fees. This is a feedback loop that supports pump (pump) holders' valuation. Additionally, retail participation is increasing. According to on-chain data, the number of unique holders of the token increased to 72,082. This is a sign of an increase in recruitment.

Meanwhile, the platform has recently regained its place as Solana's Top Memo Coin Ranchpad. According to Dune Analytics, approximately 28,000 tokens have been deployed to Pump.Fun in the last 24 hours.

Pumps outweigh chart hype

In addition to revenue control and ecosystem growth, Pump.Fun's native tokens also outweigh the hyper-blooded oxide hype. At the time of writing, per Crypto.news market data, pumps have grown by 12% over 24 hours, and about 32% over the past seven days.

In contrast, hype (hype) has increased by 2.48% on daily charts, but has decreased by 6.40% over the same seven days. Pump.Fun's revenue milestone highlights its growing influence in crypto ecosystems. With strategic upgrades such as Project Ascend, rising user recruitment and strong token performance, the platform is positioned for more growth.

read more: Pump price jumps 13% as a pump.