In the wake of the mantra scandal, Quin Thompson, founder and chief investment officer of Towker Capital, once again raised the red flag on another RWA project, Ondo Finance.

On April 14, Quin Thompson used X to issue an updated warning about Ondo Finance (Ondo) in light of the recent mantra fiasco, saying, “We're wise to carefully save this thread in light of the recent mantra $om token scams.”

In the post, Thompson resurfaced the previous thread from March 18th, asking on-chain investigators to see if the total value of Ondo Finance is locked by the team selling tokens, and redirect the revenue to the protocol to create the illusion of organic users' recruitment.

“Can one of the on-chain investigators see if it is true that a large portion of Ondo's TVL will have the team giving the emergence of organic growth from the sale of $ONDO tokens back to the protocol?” he wrote.

You might like it too: Mantra CEO criticizes 90% OM token crash with forced exchange liquidation

To support his claim, Thompson resurfaced his posts from October 2024, where he criticised the fully diluted ratings of the project despite offering a product (USDY and OUSG), which is a revenue-generating and “BlackRock's Buidl rapper.”

He also pointed out the company's acquisition rate of 0.15%. This was abandoned until 2025. That is, despite its massive TVL, the protocol was not making any profit. He argued that once the fees begin, users are more likely to move their funds to Buidl because they are safer, cheaper and have better yields. Even if Ondo starts charging for fees, he will only make around $975,000 a year. “It's more than 7,000 times FDV/revenue increase in competition and competition over Zero Margin Business without a moat,” he added.

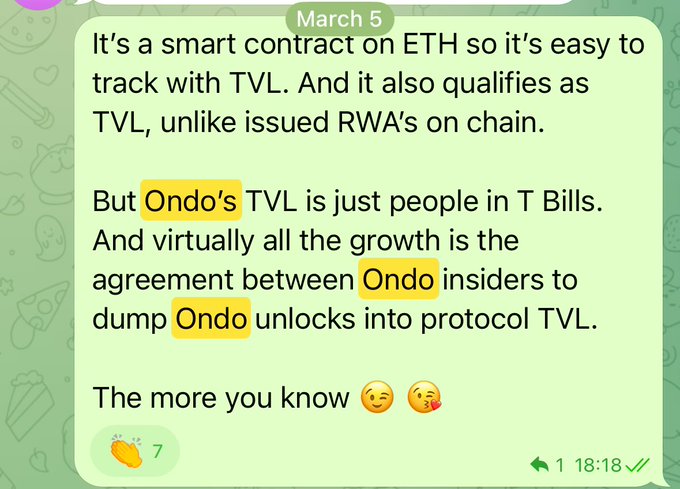

In response, one user @Timibot commented, “I thought this was an Open Secret,” and attached a screenshot of what appeared to be a distribution message from the Telegram group. This message outlines the suspect mechanism behind Ondo's inflated TVL.

Source: @trim_bot

This suggests that TVL funds are authentic, but Ondo Finance's TVL metrics are misleading as much of the capital in Ondo's protocol is not fueling Defi, but instead parked in the tokenized US Treasury bill, a traditional financial product with low risk.

To tie it all together, Ondo Finance could be leveraging TVL's artificial inflation by selling its own Ondo, taking that cash, and reverting it to its own protocol. The funds invested in T-Bill are also part of the reported TVL, but are not actually used for debt activities such as lending, borrowing, or trading. Both of these tactics create misleading photos of the actual adoption of the protocol.

You might like it too: If TVL hits a key milestone, ondo's price could skyrocket 110%