Financial influencer and author Robert Kiyosaki has once again responded to criticism of Bitcoin (BTC). This time it's from legendary investor Warren Buffett, who believes Bitcoin could face a catastrophic “blow to the top.”

author of rich dad poor dad At X, he acknowledged that Buffett may be right from a traditional Wall Street-oriented perspective, but argued that the criticism ignored the risks associated with traditional financial assets.

“Warren Buffett is dumping Bitcoin… Doesn’t the World Bank know that stocks are crashing, real estate is crashing, and that the world’s “safest” investment, U.S. Treasuries, is currently being “dumped”…? wrote Kiyosaki.

Warren Buffett abandons Bitcoin

Warren Buffett is probably the smartest and probably the wealthiest investor in the world.

He slams Bitcoin, saying it's not an investment… it's speculation… it's gambling.

He claims that Bitcoiners will be wiped out if the top blows out.

And from his worldview…

— Robert Kiyosaki (@theRealKiyosaki) November 17, 2025

“I invest in Bitcoin and Ethereum knowing that there will be booms and busts because neither the Fed nor the US Treasury nor Buffett can produce Bitcoin or cryptocurrencies.” he added.

“Why invest in paper assets when there are real assets?”

Kiyosaki further emphasized that his investment approach stems from a fundamental distrust of U.S. financial institutions, particularly the Federal Reserve, Treasury Department, and Wall Street, and a preference for “real” assets such as gold, silver, and Bitcoin.

He also reiterated his long-standing refusal to invest in exchange-traded funds (ETFs) that feature his favorite investments, calling them “fake,” comparing them to REITs, mutual funds and bonds, and describing them as “fake money” printed by Wall Street.

“I don't live in a paper house or eat paper apples. Why invest in paper assets when there are real assets?” the author added.

Warren Buffett's latest investments

Meanwhile, Warren Buffett's Berkshire Hathaway (NYSE: BRK.B) released its latest quarterly holdings over the weekend, revealing a total value of $308.9 billion.

Apple (NASDAQ: AAPL) remains the conglomerate's cornerstone investment, valued at approximately $64.6 billion and accounting for more than 20% of its portfolio. Bank of America follows with about $29.9 billion, with long-term holdings in American Express (NYSE:AXP) and Coca-Cola (NYSE:KO).

While these holdings are large, the standout figure is its record cash reserves of $381.7 billion as of September 30, its largest cash position in history, up more than 10% from the previous quarter.

The numbers show that Buffett is cautious as the stock market hovers near all-time highs and bond yields continue to rise, meaning that, as Kiyosaki says, Buffett isn't actually looking to gamble.

Indeed, rather than chasing expensive assets, Berkshire appears to be waiting for market stresses to bring out more attractive opportunities before Buffett retires at the end of the year and hands the reins to Greg Abel.

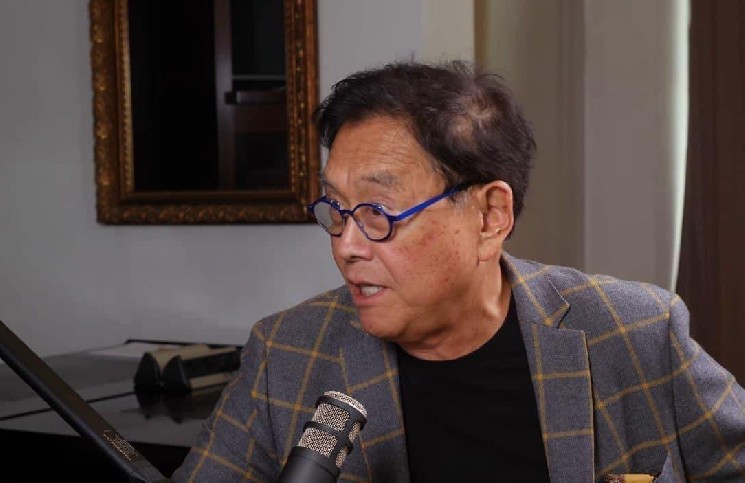

Featured Image via Cavalry using YouTube