The recent market selloff has sent crypto investor sentiment plummeting as market analysts and traders search for a unique reason for the asset's decline and Bitcoin's drop below $100,000.

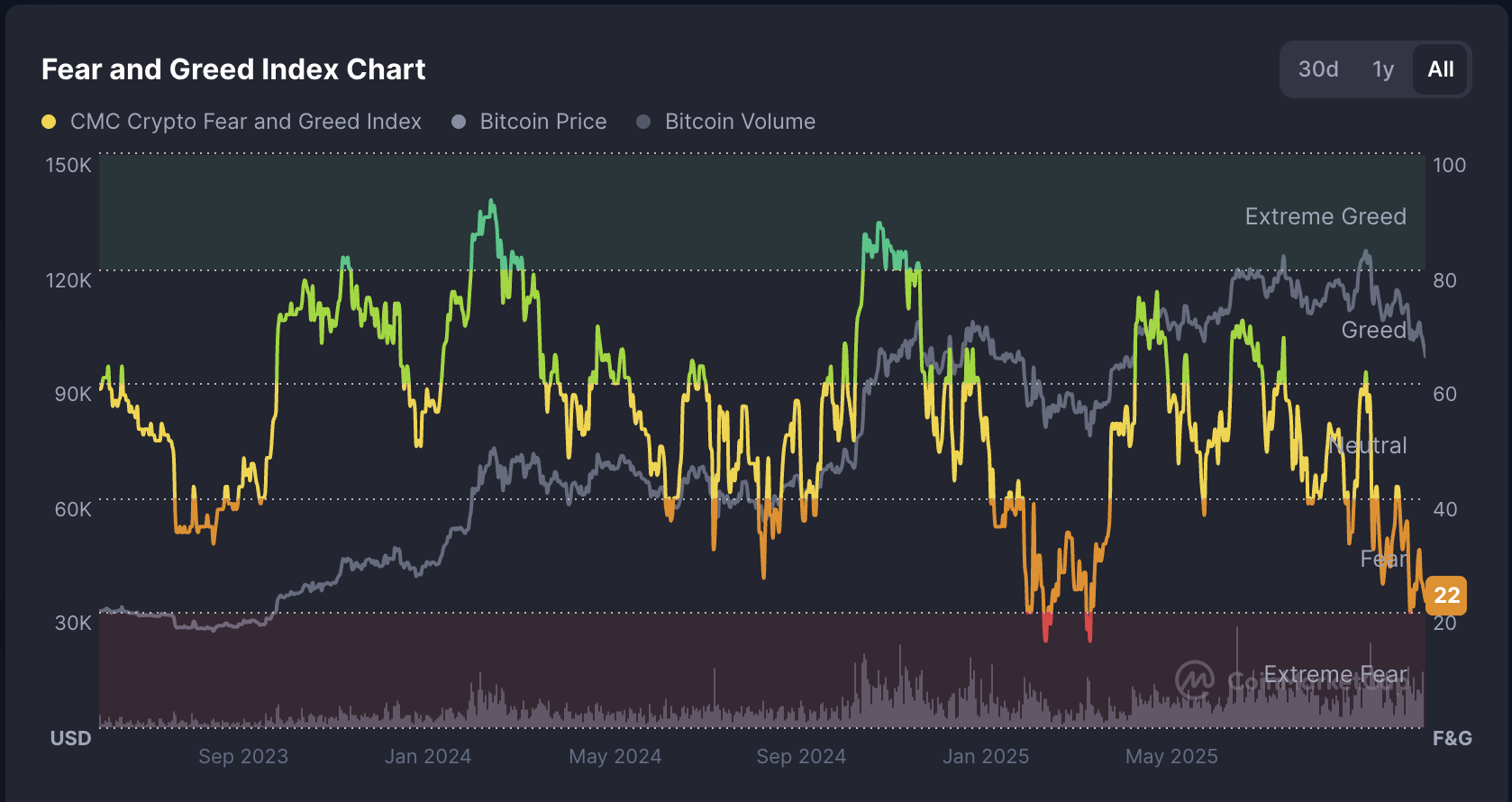

The cryptocurrency “Fear and Greed” index, a measure that tracks investor sentiment, is at 22, indicating investor caution and hovering just above “extreme fear” territory. According to CoinMarketCap, this is the lowest level since March.

“This is the smallest drop of this cycle, 25% vs. 31%, 32%, but it feels like it's significantly worse. Sentiment has cooked up,” said market analyst Nick Pucklin.

The Crypto Fear and Greed Index is 22, indicating investor fear and trending toward “extreme fear.” sauce: coin market cap

More than 70% of Polymarket traders now expect Bitcoin to fall below $90,000, a trend market analysts attribute to aging Bitcoin whales cashing out. Long-term Bitcoin holders released over 400,000 BTC to the market in October.

Market analysts, investors, and traders are debating whether this decline signals the beginning of the next long crypto bear market, or whether cryptocurrencies will hit new all-time highs in 2026 if interest rates continue to fall and liquidity flows into assets.

Related: Sour Crypto Mood Could Accelerate This Month’s Unexpected Rally: Santiment

Crypto market investors are searching for a unique cause for BTC crashing below key support

Bitcoin fell below the key support level, the 365-day moving average, several times in November, and continued its decline on Friday, trading well below the 365-day average.

Bitcoin is trading well below its 365-day moving average. sauce: TradingView

Eric Balciunas, senior exchange-traded fund analyst at Bloomberg, dismissed the idea that mass outflows from Bitcoin ETFs were the main reason for the continued price decline, saying ETF investors remained resilient despite the 20% price shock.

Bartunas said ETFs saw about $1 billion in outflows last month, despite October's historic market crash in which about $19 billion in leveraged bets were wiped from the market within 24 hours, making it the worst crypto liquidation event in history.

Alex Thorne, head of firmwide research at investment firm Galaxy, lowered his 2025 BTC price prediction from $180,000 to $120,000, citing several factors, including investor rotation into competing narratives such as gold and AI.

Thorne also said that leveraged liquidations in the crypto derivatives market are also one of the main reasons for the decline in asset prices.

Cathie Wood, founder of investment firm ARK Invest, said stablecoins have become a store of value for residents of emerging countries and are eating into Bitcoin's market share.

magazine: Bitcoin is “interesting internet money” in times of crisis: Tezos co-founder