Bitcoin's BTC$105,247.40 While the short-term outlook may look bleak with prices hovering around $105,000, the U.S. financial picture looks pretty positive.

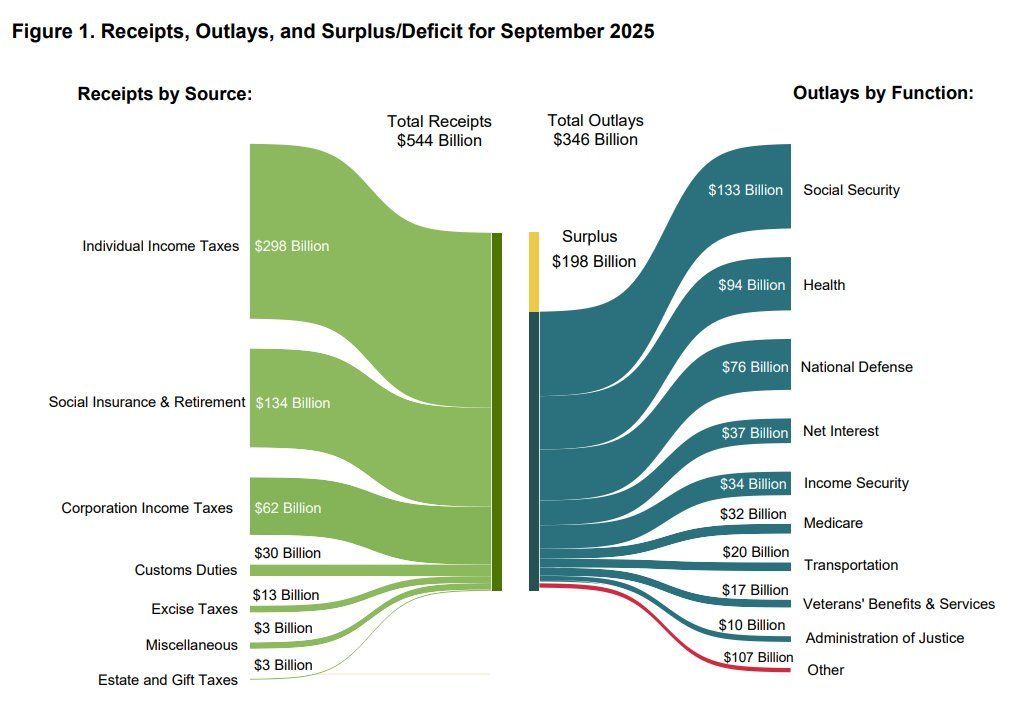

According to CNBC, the U.S. Treasury recorded a surplus of $198 billion in September 2025, the largest surplus ever for that month. As a result of this favorable financial result, the fiscal deficit in fiscal 2025 has been reduced to $1.78 trillion, which is approximately $41 billion (2.2%) lower than in 2024.

Typically, the country records a budget surplus in September due to tax payments, but this time an additional factor contributed: import duties (tariffs) introduced by President Donald Trump in April. Due to the tariffs, revenue in September was $30 billion, almost half of what was expected for the entire fiscal year.

These revenues helped offset record interest payments on the $38 trillion national debt, amounting to more than $1.2 trillion annually. Total net interest payments in September were $37 billion, the fourth-largest federal spending for the month. It was the third largest spending after Social Security ($133 billion), health care ($94 billion), and national defense ($76 billion).

President Trump's higher-than-expected tariff revenue suggests that he is likely to remain committed to his trade war strategy despite potential market volatility. This could mirror the market reaction seen during April's “tariff tantrum” and encourage investors to move away from risky assets and seek safety in alternative assets such as bonds and gold.

A potential worsening of trade tensions could further accelerate inflation, but the Fed expects any price increases to be temporary and is likely to continue lowering interest rates, currently at 4.00% to 4.25%.

According to the CME Fed Watch Tool, the market is pricing in a 50bps rate cut in 2025, with benchmark interest rates ranging from 3.50% to 3.75%. It remains to be seen whether the impending easing will provide relief for risky assets.

Income, Expenses for September 2025 (U.S. Treasury Monthly Financial Report)