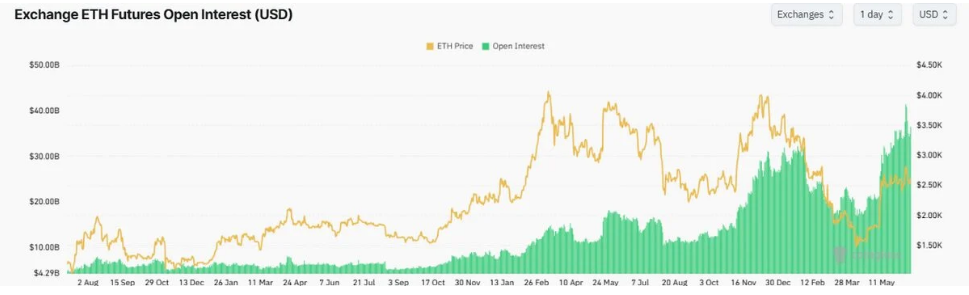

Ethereum (ETH) attracted new attention as open interest on futures rose to an annual increase of $36.56 billion on June 16th. The price bounced over $2,600 and hovered near the main resistance level that has been held for several months. Traders were stacked in new positions and set the stage for big moves in both directions.

Open futures gifts are a hit every year

Open interest in ETH futures jumped sharply over three days, reaching $36.56 billion on Monday, according to Coinglas data. That number is at the highest level since last year. It shows that many traders are using borrowed funds to wager Ethereum on where they go next.

Price exam resistance for multiple years

ETH rose about 4.5% in one session. Based on the technical charts, Larry has pushed ETH to a long-standing descending trendline. Investors have seen the line for over a year.

It's just above the 50-week moving average, but the 200-week average is just below. If the ETH can clear and hold above these levels, it may signal the room you run. However, weak trading volumes can mean that the bull needs more firepower before it is in charge.

ETF flow shows stable support

The US spot fund tied to Ethereum had a small outflow of $2.18 million on the same day, marking its first net withdrawal in 19 days. However, the weekly inflow remains at $52812 million, with over $10 billion in total assets under management in these ETFs.

Institutional support expands ETH reach

Key asset managers are also becoming more creative with Ethereum. Companies such as BlackRock and Fidelity are beginning to deploy tokenized financial products and stable funds that link directly to ETH.

Based on statements from these companies, these latest products are intended to increase access to large institutions that have previously been avoided. They support the notion that Ethereum can fuel debt testing as well as real-world applications.

Before potential ripples, Ethereum drift remains stable

Meanwhile, market statistics show that Ethereum was trading calmly at $2,630 on June 16, showing a 4% increase in the last 24 hours. The futures market is warming up, with volumes rising sharply as large players are pouring into ETH-based contracts.

Speculative positions usually predict choppy actions. Even a modest price movement can cause forced liquidation as the increasing amount moves into leveraged positions. When that happens, the volatility increases. So, today's quiet charts can quickly become jagged once these mammoth bets begin to unravel.

Unsplash featured images, TradingView charts