Ethereum's market capitalization is currently a quarter of Bitcoin. However, new institutional studies show that Altcoin can quickly outperform BTC in total market capitalization. Analysts argue that the Treasury and ETFs could fuel demand cycles and make Ethereum a major digital asset within the next one or two market cycles.

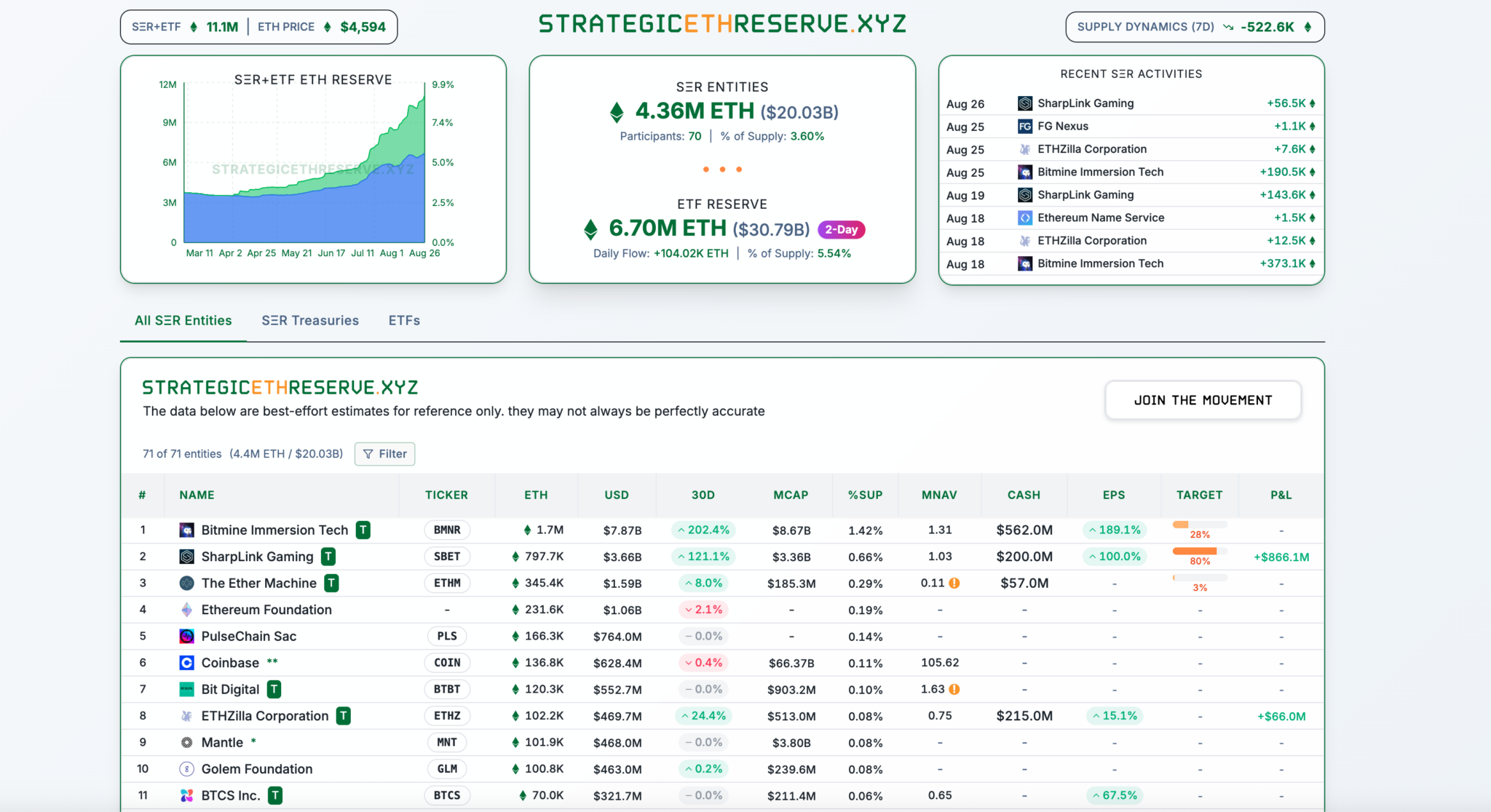

Trend Research, research unit at LD Capital, estimates that the finance company and ETF already hold $2 billion worth of Ethereum, or 3.39% of the total supply. Unlike Bitcoin's static supply model, they not only buy large ETH, but use it as a yielding asset.

Finance companies push ETH beyond supply dynamics

The balance between supply staking and institutional demand has now defined the trajectory of Ethereum.

Since the Pectra upgrade in May 2025, the network has been slowing down daily staking at 57,600 ETH. This predictable trend has already been ingrained by institutional influx.

Ethereum Treasury Holdings | Strategy ETH RESSEL.XYZ

Bitmine has accumulated over 1.5 million ETH since July, spending more than $5.6 billion. Sharplink has added around 740,000 ETH since June.

Both companies continue to expand their allocations, with Bitmine targeting ownership of up to 5% of the supply. According to Trend Research, the purchase reshapes the market dynamics, similar to MicroStrategy's role in Bitcoin.

Ethereum yield and ETF flow

Ethereum offers structural advantages. Unlike Bitcoin, Eth Holdings generates yields through staking and liquidity offerings. Staking averages 1.5-2.15% per year.

The liquidity provisions for Decentralized Financial (DEFI) allow yields to be increased to approximately 5%. This revenue stream allows the Treasury to justify a higher rating through a discounted cash flow model. Trend Research calls this effect the “cash flow premium.”

ETF flows reinforce this trend. From mid-May to mid-August, Ethereum ETF recorded a 14th consecutive week of net inflow, adding $19.2 billion.

BlackRock's ETHA leads at 2.93% of supply. Trend Research says Ethereum ETF continues to oust its $179 billion Bitcoin ETF, with room for growth.

Beincrypto reported that Fundstrat's Tom Lee expects Ethereum to reach $5,500 in the short term and could rise to $10,000-$12,000 at the end of the year. He cites the Treasury accumulation and reduced exchange balances as reasons for his outlook.

Trend research noted that institutional demand for Ethereum now far exceeds the supply of sluggish existence, a factor that could undermine Bitcoin's relative position.

Why Ethereum can surpass Bitcoin

Trend research lists several structural reasons that outweigh Bitcoin in the coming cycle. The first is supply and demand.

Daily staking remains closed at 57,600 ETH, but Treasury companies and ETFs make more purchases, creating lasting net demand that Bitcoin cannot match.

Ethereum Domination | Trend Research

Ministry of Finance, ETFs and Whales

Secondly, the finance company and funds accumulate ETH as preparations. Unlike Bitcoin, Ethereum generates yields through staking and resistance, making it a cash flow asset rather than a rare item.

ETF flows also continue to support Ethereum. Ethereum ETF recorded a 14-week inflow worth $19.2 billion. In contrast, Bitcoin ETF saw the leak. BlackRock's Etha alone holds almost 3% of its supply.

Furthermore, on-chain data shows that the whales are spinning from BTC to ETH. Ethereum's futures trading share increased from 35% in May to 68% in August. Some large owners are outscoring the Ethereum Foundation's balance with hundreds of thousands of ETH.

Technical shows short-term tests

Although the long term cases become stronger, ETH faces short-term volatility. Matrixport's Markus Thielen expects ETH to trade between $4,355 and $4,958, warning that momentum has slowed since the July rally.

Today's #MatrixPort Daily Chart – August 27, 2025

Respect your technology: Ethereum's next big test #MatrixPort #TheReum #Ethereum #CryptOMARKETS #CRYPTOETF #INSTITIONALFLOWS #BTC

– Matrixport's official (@matrixport_en) August 27, 2025

“Respect for technology can be the difference between making money and losing it,” Tieren said.

The chart shows Ethereum has recently bounced its 21-day moving average. However, the decline momentum causes the risk of retesting to below $4,355.

The market direction may depend on whether the finance company and ETF continue to make aggressive purchases.

Beincrypto also reported that Ethereum recently posted one of the biggest exchange spills since July, but that the Taker Buy-Sell ratio temporarily exceeded 1.

Institutions, including BlackRock, have revolved nearly $892 million from Bitcoin to ETH, bolstering their bullish setup.

Ethereum's futures trading share rose from 35% in May to 68% in August, but Bitcoin fell sharply. On-chain activity shows whales selling bitcoin and buying ETH.

In one case, a large owner staked 269,485 ETH, surpassing the holdings of the Ethereum Foundation.

This rotation also shows a shift in investor psychology. Bitcoin is still considered “digital gold,” but ETH is recognized as a stable asset, defi's financial infrastructure.

The recent passage of the US Genius Stubcoin Act reflects this change. With more than half of Stablecoin and real-world asset activities running in Ethereum, assets benefit from policy and technology support.

Macroeconomic conditions also support the Ethereum case. Federal Reserve Chair Jerome Powell signaled the possibility that rate cuts are likely to occur in September at the Jackson Hole symposium. Past cycles suggest that looser policies often support Ethereum's performance over Bitcoin.

Trends research estimates that Ethereum's market capitalization is above $3 trillion in an optimistic scenario, surpassing Bitcoin's current valuation.

Post-studies predict that Ethereum, which overtakes Bitcoin within a cycle of 1-2, was the first to appear in Beincrypto.