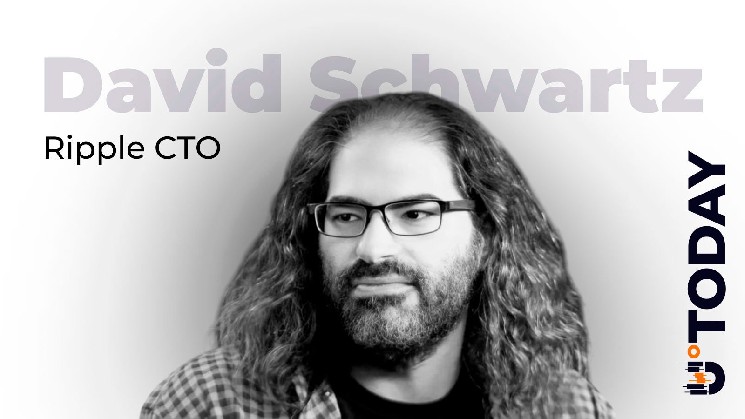

Ripple's chief technology officer, David Schwartz, has once again been brought into public view to reveal what the XRP Ledger actually does, and more importantly, what the XRP Ledger does not do.

The debate began after a $120 million exploit hit a major DeFi protocol balancer, resurfacing criticism that most decentralized platforms rely on complex smart contracts and “intermediaries” to keep their systems afloat. One XRP community member called this a “design flaw” in Ethereum, arguing that XRPL's decade-old architecture was built to avoid exactly that.

Who owns the XRP ledger?

Schwartz didn't just agree. In a detailed thread, Ripple's CTO explained that XRPL validators “do not make money from transactions” and exist only to help nodes agree on one global order of transactions to solve the double-spend problem.

In contrast to Bitcoin and Ethereum, where miners and stakers are rewarded for including transactions in blocks, XRPL validators serve nodes rather than account holders, he explains.

Therefore, currently all XRP Ledger nodes already know which transactions are valid, but validators only decide when each one appears in the ledger.

Simply put, validators synchronize rather than mediate. This structure was intentionally designed this way to remove rent-seeking behavior from the network and ensure that the finality of transactions relies on mathematics rather than incentives or bidding systems that are gamified over time.

In other words, XRPL runs on ordered logic rather than trust or reward loops. Ripple believes this design is still disconnected from all smart contract-driven chains that are trying to solve yesterday's problems.