A major leap into regulated crypto banks is ongoing as Ripple calls for the National Trust Bank Charter to increase Stablecoin's reliability and custody standards.

RIPPLE National Trust Bank deepens regulatory footprint with its RLUSD strategy

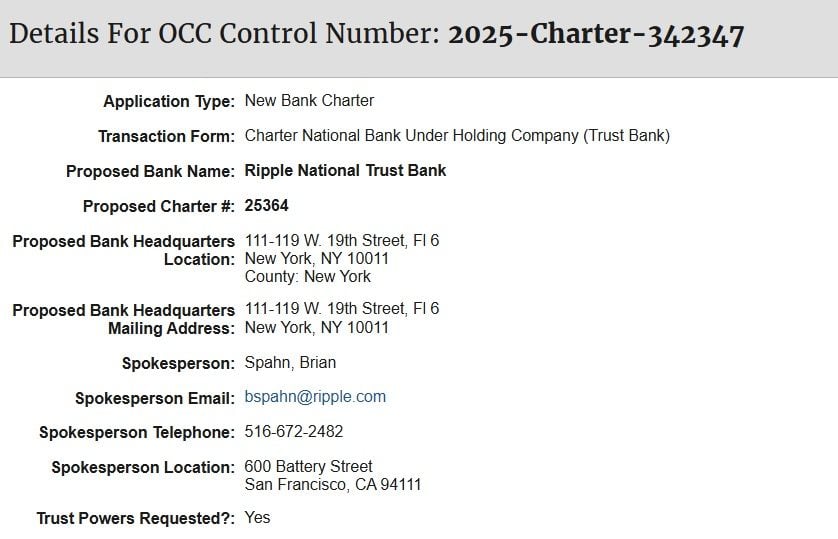

Ripple has advanced its regulatory ambitions with its application to establish the Ripple National Trust Bank, demonstrating a deeper into federal overseen financial infrastructure. The blockchain payments company filed with the US office of the Secretary of the U.S. Currency (OCC) earlier this month to request a National Trust Bank Charter based on Control Number 2025-Charter-342347. The proposed institution (Ripple National Trust Bank) is headquartered at 111-119 W. 19th Avenue on the sixth floor in New York City and is open at charter number 25364.

According to the application, Ripple is requesting trust authority. This allows banks to provide custody and fiduciary services for digital assets under direct federal supervision. Brian Spahn, based in the San Francisco location in Ripple, is listed as a spokesman. The OCC has held a public comment period running until August 1st.

This regulatory step follows Ripple's announcement earlier this month, pursuing a dual licensing model for Stablecoin Ripple USD (RLUSD), combining state oversight by New York Financial Services (NYDFS) with potential federal regulations through the OCC. Brad Garlinghouse said at the time on social media platform X: “Tritually following years of compliance roots, Ripple is applying for a National Bank Charter from the OCC if approved, if it approves a new (and unique!) benchmark for trust in the Stablecoin market.”

Ripple's submission sets federal rules for Stablecoins in anticipation of the Genius Act amid a broader move towards a banking charter by Crypto companies, calling for full support, transparency and compliance with the AML/KYC Act. He passed the Senate and is now waiting for the home to be approved. Standard Custody & Trust Company, a subsidiary of Ripple, has also applied for the Federal Reserve Master Account. Garlinghouse said: “This access allows RLUSD to retain the Fed directly and provide an additional layer of security to RLUSD's future trust.”