Ripple's dollar-pegged stablecoin RLUSD surpassed $1 billion in market capitalization in late November, less than a year after its launch.

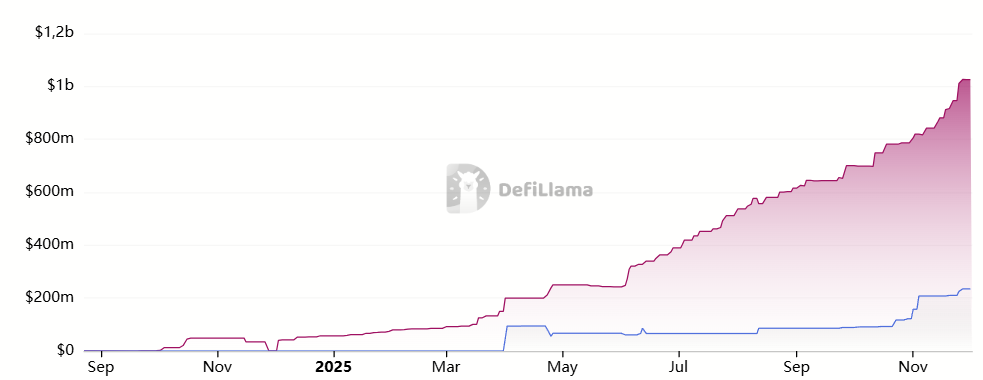

Ethereum (purple) vs. XRPL (blue). Source: Defilama

DefiLlama's on-chain data shows that more than 82% of RLUSD's supply, or about $1.03 billion, is currently on Ethereum, and about $235 million is on the XRP ledger, the blockchain network originally created by Ripple's founders and key executives.

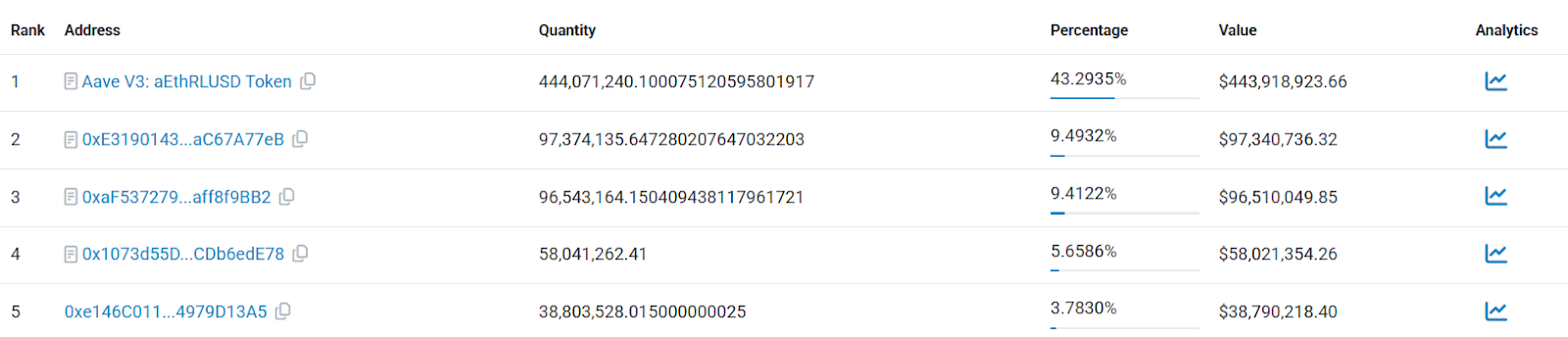

RLUSD supply in Ethereum. Source: Etherscan

According to EtherScan data, more than 40% of RLUSD's Ethereum supply is concentrated in DeFi lending protocol Aave, suggesting that most holders prefer to earn yield passively rather than using it on exchanges. In contrast, stablecoin giants like USDT and USDC are primarily held in Binance-related wallets and have been shown to be used in trading pairs, with Aave holdings coming further down the list.

Despite this latest milestone, RLUSD is still small compared to major USD-pegged stablecoins. Tether’s USDT ranks first in circulating supply with over $184 billion, followed by Circle’s USDC with $77.5 billion. At the time of writing, RLUSD ranks 10th among USD stablecoins in supply with a market capitalization of $1.26 billion, according to CoinGecko.

RLUSD's growth on Ethereum comes months after Ripple acquired stablecoin platform Rail for $200 million. As previously reported by The Defiant, the acquisition will give Ripple access to a variety of tools that power its payments ecosystem, including stablecoin on- and off-ramps, virtual accounts, a network of bank partners, and increased liquidity for RLUSD and XRP, the native asset of the XRP Ledger.