Anthony Scaramucci once again praised Solana, telling attendees at the Breakpoint conference that he expects the public blockchain platform to eventually overtake Ethereum in market value.

summary

- Scaramucci joked that he is “not chain monogamous” but still supports multiple networks.

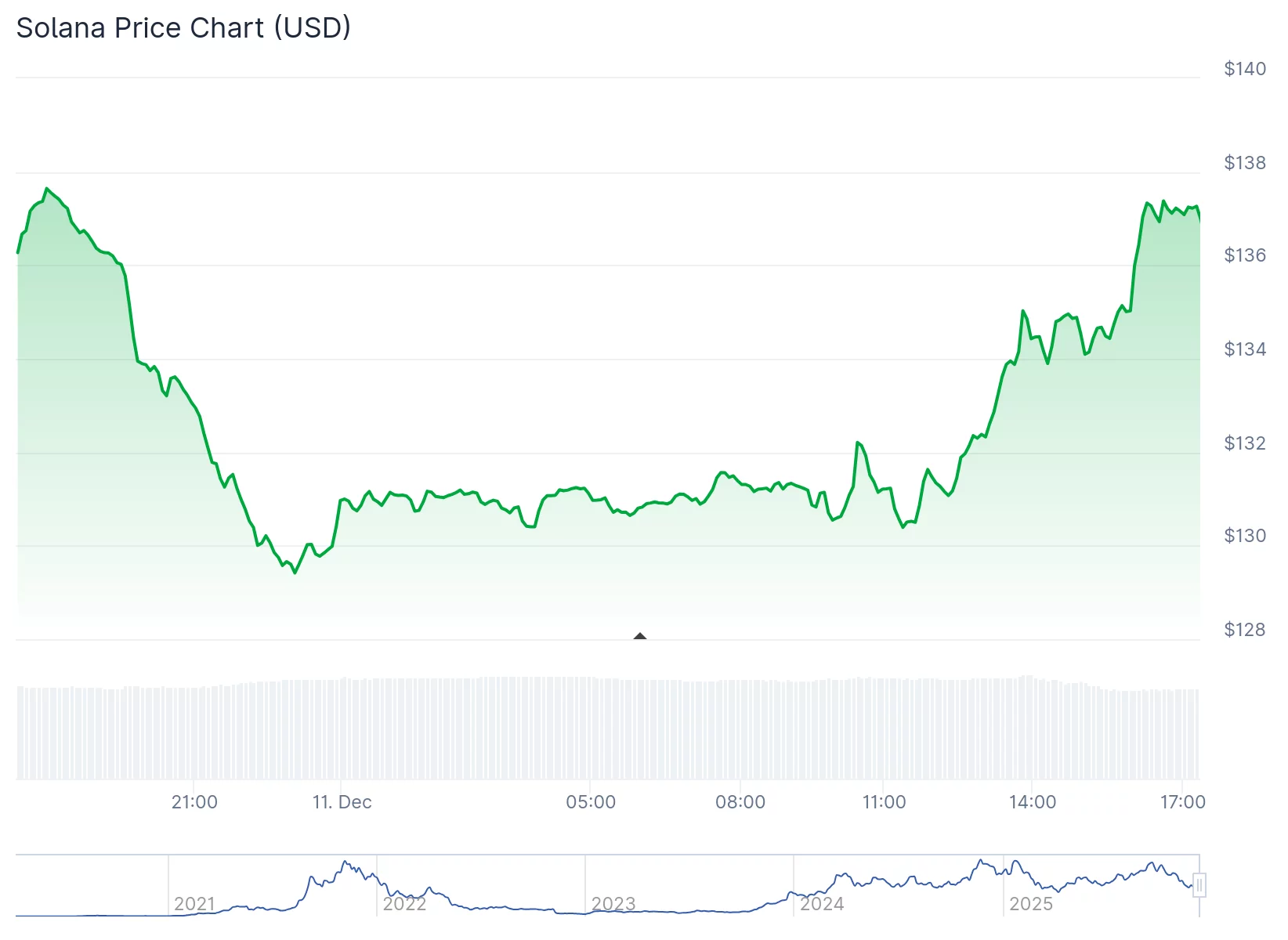

- His remarks come as ETH maintains important support near $3,121 despite heavy outflows, while Solana struggles near $137 amid bearish technical signals pointing to a possible fall to $100.

- Despite price pressures, Solana's ecosystem has boomed with new bridges, tokenized funds, and major corporate consolidation.

“I think it’s going to turn Ethereum upside down,” the SkyBridge Capital founder said, before quickly clarifying that he still loves ETH and Avalanche, and insisting he’s “not chain monogamous.” See below.

🚨 Anthony @Scaramucci shares his thoughts on Solana vs. Ethereum at @SolanaConf:

“I think it's going to turn Ethereum upside down.” pic.twitter.com/Xi0UejTzgN

— CoinDesk (@CoinDesk) December 11, 2025

In other words, it's Ethereum, not you. It's Solana's incredible throughput, growing developer base, and probably the ability to appear very loudly at conferences.

You may also like: Ethereum price rejects the 200MA at $3,400, suggesting a deeper correction is unfolding

why is it important

Scaramucci's comments revived a long-running Layer 1 race that has intensified as Solana's ecosystem continues to expand with new infrastructure, developer tools, and organizational pipelines. However, the price charts painted a less romantic picture for both networks.

Ethereum is trading around $3,200 and remains slightly above the 20-day EMA of $3,121. If buyers emerge, this support zone could set bullish targets at $3,309, $3,382, and $3,453. Despite the $116 million in net outflows reported by Coinglass today, ETH has refused to set new lows and is building a low-high pattern that suggests sellers are running out of steam. However, the Supertrend indicator remains red, warning that Love Story is not yet completely bullish.

Meanwhile, Solana was last seen around $137, down nearly 50% from its September high and languishing near the bottom of the chart. Technical indicators are that the bearish flag pattern and death cross are both flashing red, indicating the possibility of further decline towards $100. A break below $122 could strengthen the decline, but a recovery to $147 will invalidate the bearish setup.

Source: CoinGecko

Basically, Solana has a lot to be proud of.

- A new bridge connecting Solana and the base with a chain link

- Ondo Finance and State Street launch tokenized liquidity fund SWEEP

- Animoca Brands is preparing to list its stock on Solana

- Bhutan deploys first government aid token on network

- Coinbase Announces Trading Access to Complete Suite of Solana Tokens

Even ETFs seem to be getting carried away. Solana-listed products received more than $22 million in inflows this week alone, bringing total inflows to $661 million and total assets to $950 million.

Despite the price weakness, Scaramucci's bullish stance confirms a broader view shared by some crypto investors. Solana and Ethereum can both grow, coexist, and maybe even thrive together — even if Solana ends up getting bragging rights for “the inside out” one day.

read more: Ethereum price rejects the 200MA at $3,400, suggesting a deeper correction is unfolding