Sharpling Gaming, one of the ether's corporate treasury ministries, has approved a $1.5 billion share buyback program.

In an announcement Friday, Sharplink Gaming said it has approved the repurchase of $1.5 billion worth of shares as part of its “disciplined capital market strategy.” So far, no repurchase has been made.

The company's CO-CEO Joseph Chalom said the company would consider buying back if the shares traded below the net asset value of its ether (ETH) holdings. “The program offers the flexibility to act quickly and decisively when those conditions exist in their own right,” Charom added.

Sharplink's strategy focuses on ether accumulation and staking, and increasing the metrics of its stock. The company said repurchases of shares below the net asset value would increase that ratio.

Sharplink games are all in ether

The betting platform moved to an Ethereum-based corporate financial strategy, nominated Ethereum co-founder Josefulvin as chairman in late May. At the time, the company said, “ETH will serve as the company's major Treasury protected asset.”

Related: Joe Lubin from Sharplink wants to buy ETH faster than any other company

In early July, Rubin said the ETH Treasury Department was important in developing the Ethereum ecosystem. He said such companies are “the best business to operate,” but also explained that “as more and more applications are built, it is important to allow the dynamics of ether supply and demand to the right size.”

Related: Sharplink buys $667 million in ether at an almost record price

Despite its close ties with the Ethereum Ecosystem, Sharplink does not hold the largest etheric treasury in the industry. According to strategic ETH reserve data, the spot is held by former Bitmine, a Bitmine company with $6.5 million in etheric holdings at the time of writing.

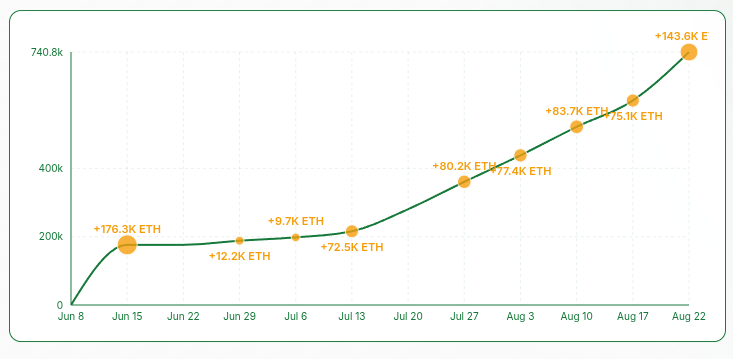

Sharplink Gaming holds 740,800 ether worth $3.14 billion, less than half of Bitmine. Sharplink is now also an unrealized profit of nearly $600 million after Ether's recent price profit.

Sharplink Gaming Ether Holdings chart. sauce: Strategic ETH Reserves

magazine: How Ethereum Finance Companies Can Cause “Defi Summer 2.0”