Solana (Sol) had most of its liquidation on the chain after a weekend market slump. Liquidation on the chain was more than 79% higher than centralized exchange activities.

The Solana chain has shown that after handling most of the liquidation during the recent SOL slump, it can carry out high quality financial transactions. Over the weekend, Sol was immersed further from the $200 milestone, sinking to $182.60.

The market slump has wiped out long positions in all assets. Sol was liquidated by $37.4 million in the chain liquidation and an additional $20 million in the centralized exchange. On Monday, liquidation continued, with Sol wiping $29.7 million from the centralized market. Previously as cryptopolitan It has been reportedchain derivative activity has been switched to on-chain trading.

The biggest factor in Sol Derivative Trading is direct access from Phantom Wallet. Other permanent futures markets also show growing interest in SOL.

SOL activities migrate to distributed protocols

Following the latest round of liquidation, the massive exchange Sol Open Interest fell by more than 7%. Binance is the top market for centralized exchanges in Solana.

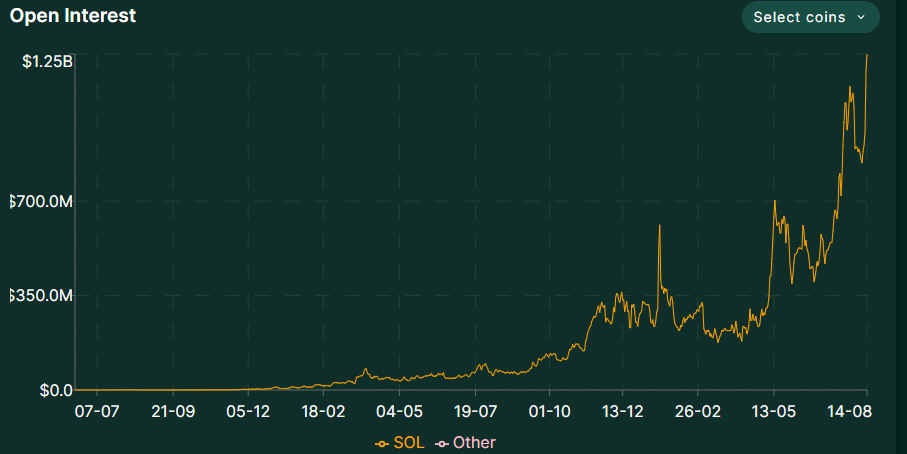

The drift protocol is currently the permanent futures exchange of SOL's largest chain, $11.9 billion The total value is locked. Sol Open Interest has also reached a new peak of high lipids, exceeding $1.2 billion in open positions. Sol is one of the small markets of high lipids, but it was responsive as assets returned to near $200.

Solana's open interest in Solana Hyperquid has expanded to the record as Sol's decentralized activities continued to outweigh the centralized liquidation. |Source: Hyperliquid

Open interest has returned to $49.8 billion as traders began restructuring their long positions. but, Long position It has rebuilt to a low level of $175, but its short position is just above $200.

As a result of the growth of activity in the chain, Jupiter and Jito are back in the top 10 rate producer apps. Solana prices go back between $1 million and $2 million daily, despite only 2.3 million active users each day.

Over the past week, the Solana ecosystem has also seen influx from other chains, but almost half of it input It comes from Ethereum. Solana Stablecoins are over $12 billion and are trapped in decentralized protocols with liquidity exceeding $100 billion.

Kamino Lend is growing aggressively, but Solana Defi is still relatively small 300 million dollars Locked value. Solana's on-chain activity is slowly shifting beyond meme tokens to multiple forms of defi.

The Solan Whale will change to a short position

Following the latest liquidation, the High-Lipid Whale reconstructed Solana's short position. As of August 18, 59 whales had long in Sol, with 70 short-circuiting their assets.

White Whale is one of the well-known traders with bullish Sol outlook. Currently, traders are holding 20x leveraged lengths in SOL, $79 million. The position has an unrealized loss of $1.22 million, with a liquidation price of $154.59.

The white whale was also one of the first to seek rebuilding. Long positionwe look forward to a recovery in the market.

Sol Feelings In general, it is more cautious and bearish for both retail and smart money. Sol was one of the weakest assets in the new week when all the blue tips sunk. However, the expectations of high-risk traders are that Sol breaks in at a “hate rally.”