Galaxy Digital accelerated its bet on Solana, buying more than $1.2 billion in SOL within a week.

On September 13, Blockchain Analytics platform LookonChain reported that Galaxy had acquired nearly 5 million SOLs for around $1.16 billion over three days. Of that amount, approximately 4.7 million SOLs have been transferred to Coinbase Prime for custody.

Solana Suras 21% after Galaxy Digital wins 5.3 million tokens in a week

A day later, the company added 325,000 SoL worth $78 million, resulting in nearly 5.3 million tokens of purchases.

Galaxy Digital has purchased an additional $325,000 Sol ($78m) over the last five hours. https://t.co/f31rzyksxm pic.twitter.com/mpml4wallc

– lookonchain (@lookonchain) September 14, 2025

Arkham Intelligence Data shows that after these transfers, Galaxy holds around 225,000 Sols (just over $55 million) in its wallet.

This shows that SOL's purchase spree is intended to implement long-term storage and strategies through Coinbase's infrastructure, rather than short-term transactions.

Meanwhile, the purchasing activity coincides with Galaxy's leadership role in the $1.65 billion investment round for the forward industry, along with JumpCrypto and Multicoin Capital. The Forward has established itself as a specialized Solana financial vehicle with ambitions to dominate the space.

In particular, industry speculation suggests that moving forward could be a way for insiders to offload locked Solana tokens. However, executives at Galaxy and Multicoin have dismissed these concerns.

Multicoin's Kyle Samani said none of its affiliates will sell locked tokens to the finance company.

“I can express with 100% certainty that the forward won't buy locked sols from entities or people who belong to Multicoin,” Samani said.

Instead, forward backers framed the initiative as a deliberate driving force to scale Solana's role in the capital market.

For context, Galaxy emphasized that its approach is not a passive accumulation, but an “active alpha generation” strategy.

The company hopes to move forward and leverage Jump's high-performance infrastructure to stake SOLs and lend them to decentralized financial markets. It also plans to deploy capital across Solanana Native Strategy, which is designed to accelerate growth per share.

This strong belief has made Sol's prices better than the general market for the past week.

According to Beincrypto data, token values have risen by more than 21% over the past seven days. This uptrend helped push it into the $246 eight-month high.

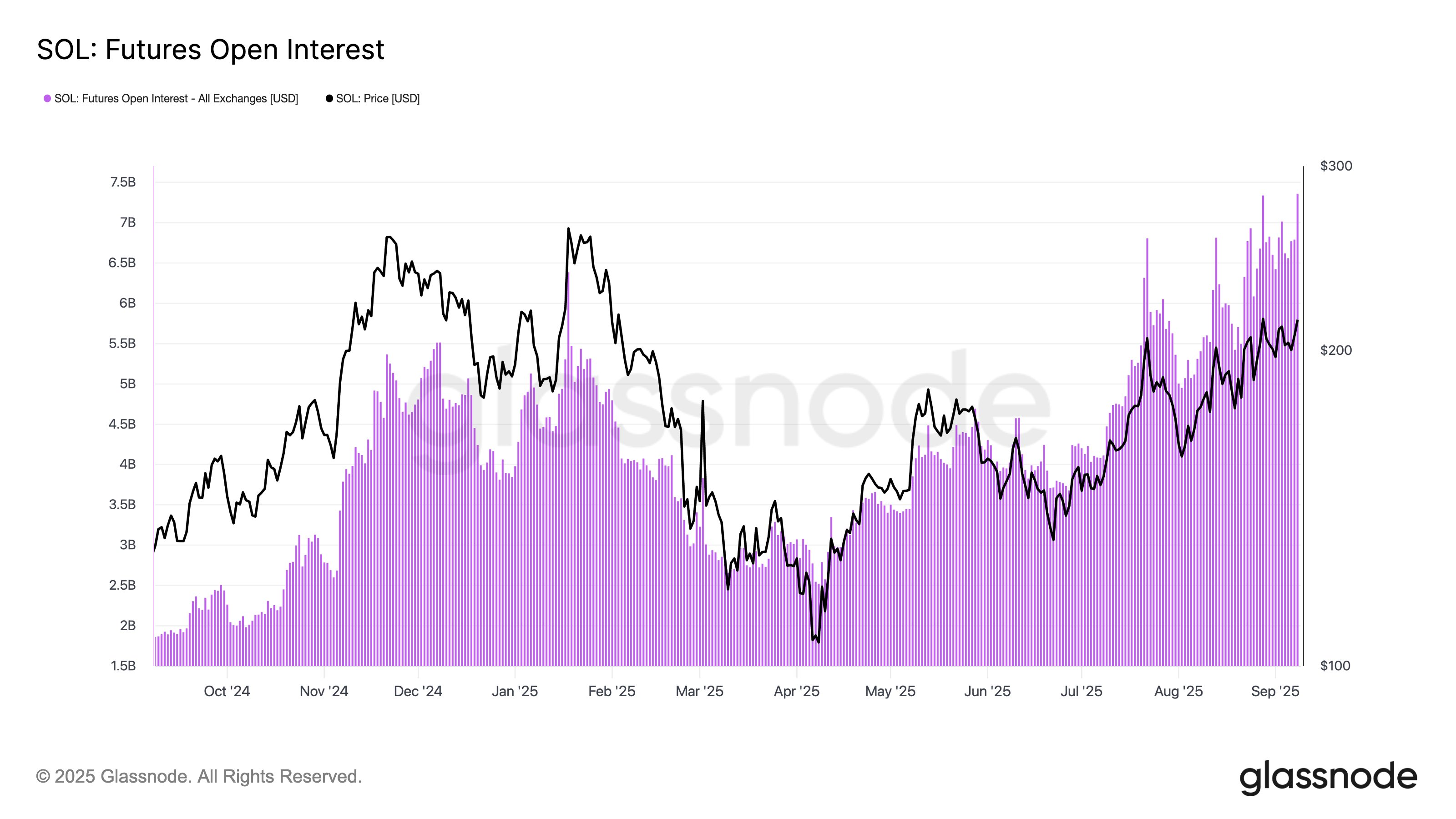

Solana's futures are interesting. Source: GlassNode

Furthermore, price increases coincided with lasting open interest on digital assets exceeding $7 billion for the first time, according to GlassNode data. This suggests that more crypto traders are speculating on the price momentum of Sol in the current market situation.

Solana Price first appeared on Beincrypto as Galaxy Digital increased its $1 billion purchases.