The market capitalization of stablecoins on the Solana layer 1 blockchain soared by $900 million in 24 hours on Tuesday.

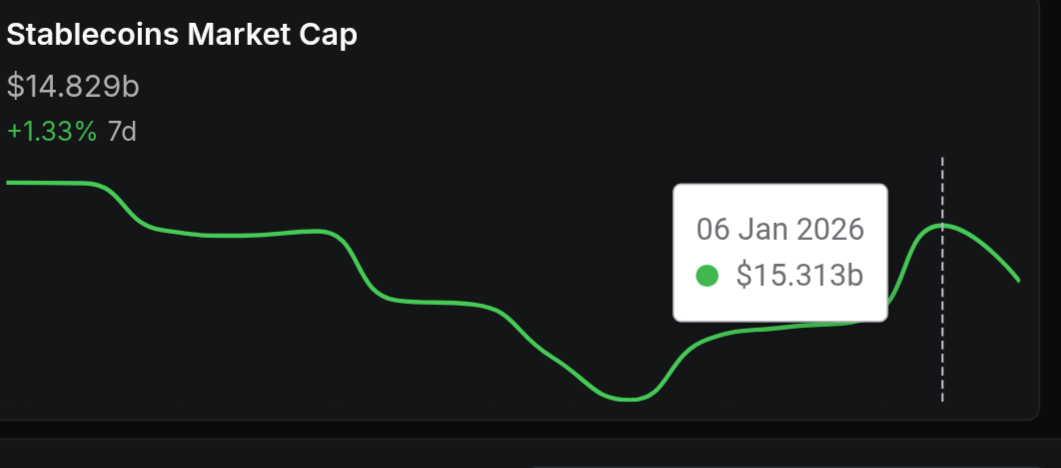

Stablecoins, which are blockchain tokens backed by fiat currencies or debt assets, have soared to a market capitalization of $15.3 billion on the Solana network, according to DeFiLlama.

This dramatic rise came as decentralized finance platform Jupiter launched the JupUSD stablecoin, developed in partnership with synthetic stablecoin issuer Ethena.

The market capitalization of Solanas stablecoin has skyrocketed. sauce: Defilama

Solana’s stablecoin ecosystem is dominated by Circle’s USDC (USDC), a dollar-pegged token that accounts for over 67% of the network’s stablecoin market capitalization.

The proliferation of Solana stablecoins reflects increased investment activity and investor interest as the Solana ecosystem transitions into a hub for internet capital markets, with value and risk transferred entirely through on-chain rails.

Related: Coinbase bets on stablecoins, Base, and 'Everything Exchange' for 2026

As assets move on-chain, stablecoins become important plumbing

According to financial rating agency Moody's Investors Service, stablecoin payment values increased by 87% in 2025.

According to Moody's, stablecoins are critical infrastructure for tokenized real-world assets (RWA), which are physical or traditional assets represented on-chain. Tokenized RWA requires stablecoins for on-chain liquidity and settlement.

Asset tokenization opens up new use cases, such as traditionally illiquid asset classes such as art, real estate, and collectibles being able to be used as collateral to back loans in DeFI applications.

The RWA market is expected to soar to $30 trillion by 2030, according to multiple traditional financial institutions.

Stablecoins are one of the leaders in that growth. The market capitalization of overcollateralized stablecoins (tokens backed 1:1 by fiat deposits and government bonds) is approaching $300 billion, according to RWA.xyz.

Under the GENIUS Act, signed by US President Donald Trump in July 2025, regulated payments stablecoins must be backed 1:1 with high-quality liquid assets, effectively eliminating algorithmic and undercollateralized models.

Algorithmic stablecoins that use software or complex market transactions to maintain a fiat peg are not permitted under GENIUS law.

The GENIUS law also prohibits stablecoin issuers from sharing yield directly with customers, a provision that has sparked debate about the future role of banks.

magazine: Pakistan will deploy Bitcoin reserves to DeFi for yield, says Bilal bin Saqib