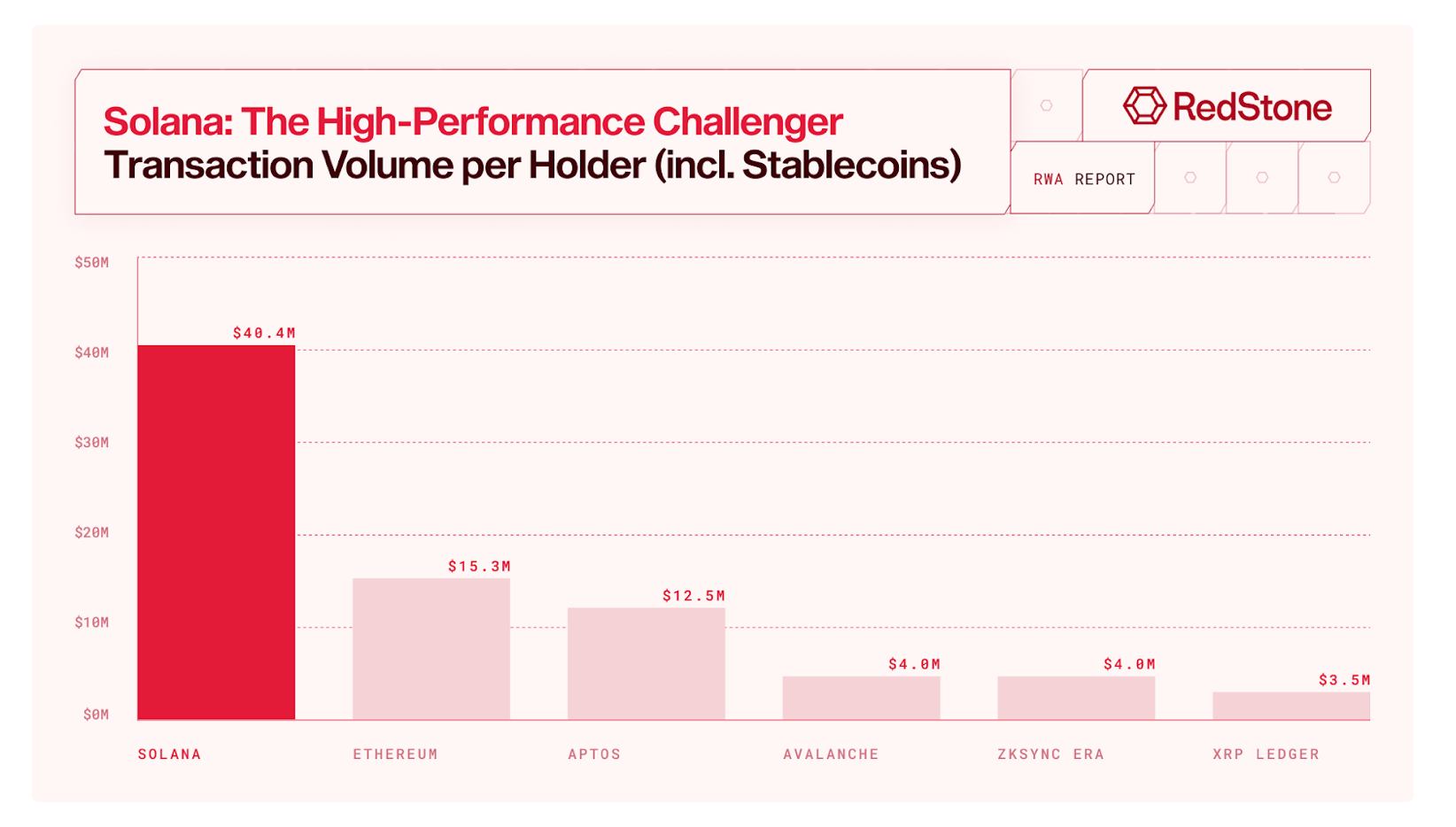

Solana planted a $13.5 billion flag in real-world assets (RWAS) and features Stablecoins in Mix, and Redstone's latest report states it is at the height of the Internet capital market.

Redstone Analysis: Solana's tokenized assets of $13.5 billion, creating an Internet capital market

Modular Oracle Protocol and Decentralized Finance (DEFI) company Redstone explains that Solana's RWA footprint is not a round error. This is a headline with nearly 500% growth year-over-year, fees of less than a tenth of a cent, and a sub-second final support request.

Redstone's new analysis, released Monday, frames the moment clearly. Tokenized finance jumped to over $31 billion by September 2025 from $5 billion in 2022 to over $31 billion, with Solana's share exceeding $13.5 billion, including Stablecoins.

Stablecoins dominates the USDC's stack of Solana, led by USDC, with over $8 billion, far surpassing the USDT's roughly $2 billion supply, while new entrants like Pyusd, FDUSD, AUSD and Eurc have gained market share.

Source: Redstone Report.

Beyond the dollar, the unstable coin RWA has leaned heavily towards the tokenized US Treasury, which accounts for more than 90% of the Solana category, thanks to products like Ondo's USDY and Ousg and BlackRock's Buidl.

The facility is shipped here: Apollo's Ackled and Hamilton Lane scopes arrive via securitization, but Vanek's Vbill and centrifugal reaction funds expand access and turn Solana into a busy on-scene street.

Rails are built for compliance and speed: Token-2022 extension allows KYC gates, forwarding rules and corporate behavior, but keeps 100% uptime over 12 months with instantaneous throughput.

Prices and plumbing matters; Redstone Oracles secures the RWA market with drift facilities and Kamino, bringing Nav-Aware Feed that allows Defi strategies to plug into tokenized funds without waving their fantasy from the mark.

Tradfi Bridges are also formed. Corda in R3 wires its regulated network to Solana's public chain, and banks settle in a deeper liquidity pool where users already trade, whilst maintaining privacy controls.

Takeout is simple. Solana's blend of speed, compliance tools and institutional proof points make it a natural place for tokenized assets to graduate from pilots to production on an internet scale.